News

Eichengreen backs Fund as global lender of last resort

Berkeley economist Barry Eichengreen believes International Monetary Fund should in time take on the mantle of global lender of last resort

ECB attacks Brussels over hedge-fund rules

Concern comes after British authorities warned on rules

Barofsky: US Treasury abdicated responsibility for AIG

Neil Barofsky, the special inspector general for the Troubled Assets Relief Program (Sigtarp), accuses US Treasury of "abdication of responsibility" over AIG retention bonuses

Zim finance minister looks to cut central bank authority

Tendai Biti, Zimbabwe’s finance minister, has tabled a bill that seeks to reduce the powers of the Zimbabwe’s central bank and its governor

Living wills the way forward: Britain’s FSA

Britain’s Financial Services Authority also calls for higher capital and liquidity requirements

Norges Bank reverses emergency collateral rules

Norway’s central bank tightens collateral guidelines with immediate effect, proposes end to acceptance of bank bonds

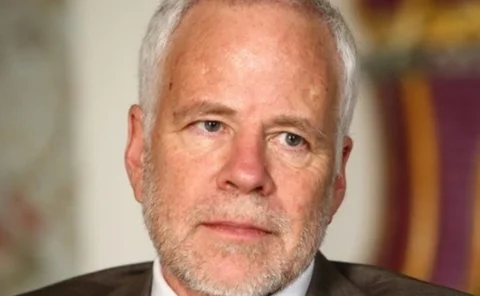

Eichengreen sees dollar safe for now

The euro and the renminbi could both mount a strong challenge to the dollar’s status as the global reserve currency. But, as Berkeley economist Barry Eichengreen tells CentralBanking.com, must overcome some major obstacles before they can do so

Plosser attacks Fed liquidity support

Philadelphia Federal Reserve president says central bank has gone “far beyond” Bagehot’s lender-of-last-resort tenet, should accept nothing but Treasuries

Brazil capital control unlikely to slow real’s rise

Imposition halts currency’s appreciation but analysts sceptical move will help in longer term, investors jittery on Colombian peso

Paulson broke the law for Goldman Sachs, alleges book

Book accuses the former US Treasury Secretary of misconduct over alleged meeting with Goldman officials

Fed names new supervision head

Fed names Patrick Parkinson as Roger Cole’s replacement

King’s speech elicits mixed reaction

Commentators and politicians broadly support Bank governor’s call for break-up of biggest banks, but see no easy fix

King calls for radical reform of banking

Bank of England governor pushes for root-and-branch reform, says Bank will detail macroprudential approach later this week

France’s Noyer likely to win second term

French central bank governor looks set to be given a second term after glowing endorsement from economy minister

Korea considering shifting dollar assets to gold

Korean central bank reportedly interested in diversifying reserves; favours gold over dollar

Canada sees more modest recovery

Bank of Canada downgrades growth forecasts slightly, says slack to remain until September 2011

Ireland names new chief regulator

Bermuda Monetary Authority governor will take up senior post at central bank

NY Fed sets out stall on reverse repos

New York Fed communicates workings of possible strand of exit strategy

Gulf officials call for UAE, Oman to rejoin monetary union

Members of the four states still involved in plans for single currency in the Gulf ask UAE and Oman to come back

Ireland hints at IMF intervention in bid to slash costs

Irish health minister Mary Harney suggests IMF will make drastic cuts if the government cannot rein expenditure in

BoE’s Posen backs governor on smashing up banks

Newest member of the Bank of England’s Monetary Policy Committee sees case for limiting bank size “full stop”

Hungary slashes rates for fourth time since July

Hungary’s central bank cuts base rate to 7%, fears inflation will be substantially below target

Crisis underlines democracy’s flaws: ECB’s Bini Smaghi

Short-termism inherent in democratic government led to the lax supervisory regimes that paved way for banks’ excesses, says ECB board member

Greenspan: too-big-to-fail didn’t exist until crunch

Former Federal Reserve chairman believed government would allow failure until government-sponsored enterprises were taken into conservatorship