Reserves

ECB taken to task over SME finance in Central Banking debate

Participants in latest Central Banking On Air debate accuse central banks of 'unreasonably neglecting' SME funding difficulties; question whether the type of assets central banks hold is important

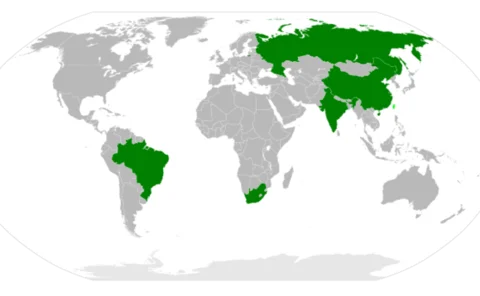

Paper examines roster of RMB bilateral swap partners

BOFIT researchers find the list of countries signing a swap agreement with China is determined by a range of factors - and suggest the agreements are not used as a ‘soft power' political tool

MBS offer portfolio benefits for some central banks, say CBP panellists

Mortgage-backed securities may offer reserve managers a higher yield and diversification benefits for their foreign currency holdings, according to panellists in a new Central Banking On Air debate

RBNZ could ‘scale up’ forex intervention

Reserve Bank of New Zealand governor Graeme Wheeler signals willingness to sell more NZ dollars to combat currency appreciation; house price increases put central bank in policy ‘bind’

Latvian annual report reveals reserves diversification

Bank of Latvia publishes annual report for 2012; reveals 15% increase in foreign reserves and diversification into Canadian and Singapore dollar-denominated assets

Colombian paper trumpets transparent forex intervention

Research says ‘pre-announced and transparent’ interventions had a greater impact on the Colombian exchange rate than more discretionary or ‘dirty’ purchases

UAE central bank annual report shows sharp balance sheet expansion

Annual report for 2012 sees balance sheet growth driven largely by higher foreign exchange purchases; prudential measures implemented to shore up banking system

RBI targeting 'greater internationalisation' of rupee

Reserve Bank of India executive director Padmanabhan says currency is a ‘natural candidate’ for internationalisation; aims for ‘careful and gradual’ progress

IMF paper scrutinises ‘procyclicality’ in reserve management

Over half of central bank reserve managers surveyed by IMF say they would alter practices to reduce procyclicality; paper questions reliance on credit rating agencies

Italians back using gold reserves to lower funding costs

A survey commissioned by the World Gold Council finds that Italians would support the creation of gold-backed bonds; sovereign bond yields fall further as new government is formed

Central bankers back equity investment for reserves

Almost two-thirds of respondents to CentralBanking.com poll believe central banks should invest some of their reserves in equities; most say investment should be kept below 10% of portfolio

SNB's Jordan slams gold referendum

Thomas Jordan says limiting Swiss National Bank's control over gold reserves would be ‘detrimental to Switzerland'; reveals location of holdings in face of public pressure

Australia to shift 5% of foreign reserves to China

Deputy governor Philip Lowe reveals the Reserve Bank of Australia will invest around 5% of its foreign exchange reserves in China; Asian economists divided over significance of move

IMF publishes new reserve management guidelines

New additions encourage portfolio diversification, greater consideration of an investment's impact on the markets and internal credit rating assessments

Bank of Israel director says central banks can 'overdo' liquidity

Andrew Abir identifies difficulty in providing the right amount of liquidity; says the risk of impairing market function was one worth taking

Draghi enters fray to defend Cyprus central bank independence

ECB president warns Cyprus government against violating the central bank’s independence by dismissing its governor; says any gold sales should benefit the central bank ‘first and foremost’

CNB board member issues warning on common bank resolution

Lubomir Lízal says common bank resolution most worrying element of European banking union; renminbi too politicised to use as reserve currency

Central banks weigh use of OTC clearing houses

Survey finds nearly 40% of central banks are considering clearing their OTC derivatives

Accumulating reserves to guard against inflation is 'misplaced'

Researchers at Bofit institute find that using reserves as a ‘bulwark against goods price inflation' is a mistake; say best protection against costly reserves accumulation is flexible exchange rate

Reserve managers expanding into riskier assets, survey finds

Latest Reserve Management Trends reveal central banks are moving into ‘non-traditional' currencies; growing number of reserve managers investing, or considering investing, in equities

Turkish banks face larger bill for holding forex and gold

Central bank increases price of holding gold and foreign exchange for Turkish banks who want to diversify reserve holdings away from Turkish lira

China uses Brics summit to further RMB internationalisation

South Africa and Brazil sign deals with PBoC to 'strengthen economic relations' between Brics nations

Swiss National Bank faces referendum over gold sales

Politicians seek to prevent SNB from selling gold and force the central bank to hold 20% of assets in the precious metal via a public referendum

Fed pays $88bn in profits to US Treasury

Federal Reserve makes large profit on securities holdings in 2012; follows warnings from Ben Bernanke and Fed researchers that remittances are not likely to remain elevated