Gold reserves in central banks – 2020 survey results

This article reports the findings of a joint survey of central banks carried out by Central Banking, with the support of Invesco, in August 2020. Those that took part did so on the condition that neither their names nor those of their central banks would be mentioned.

Executive summary

- The Covid‑19 pandemic has not, in the main, changed the view of central banks on gold, although almost one-quarter of respondents said they view gold as a more attractive asset.

- Central bankers typically expect central bank gold holdings to increase over the next 12 months; no respondent expected a decrease.

- When determining a central bank’s gold holding, the benefits of diversification stand out as the most relevant factor for reserve managers.

- One in three central banks said they maintain a target allocation for gold: this rose to 39% of respondents when only those holding gold were considered.

- Purchases in the global market are by far the most popular means of buying and selling gold, with derivatives second.

- Overseas storage at a central bank is the preferred way to store gold: more than 80% of respondents said they did this.

- Central banks are positively disposed to gold exchange-traded funds (ETFs), but active interest in investing is the preserve of a minority.

- A combination of gold’s quality as a hedge against the US dollar and ETFs’ cost-effectiveness are the main benefits for holding ETFs.

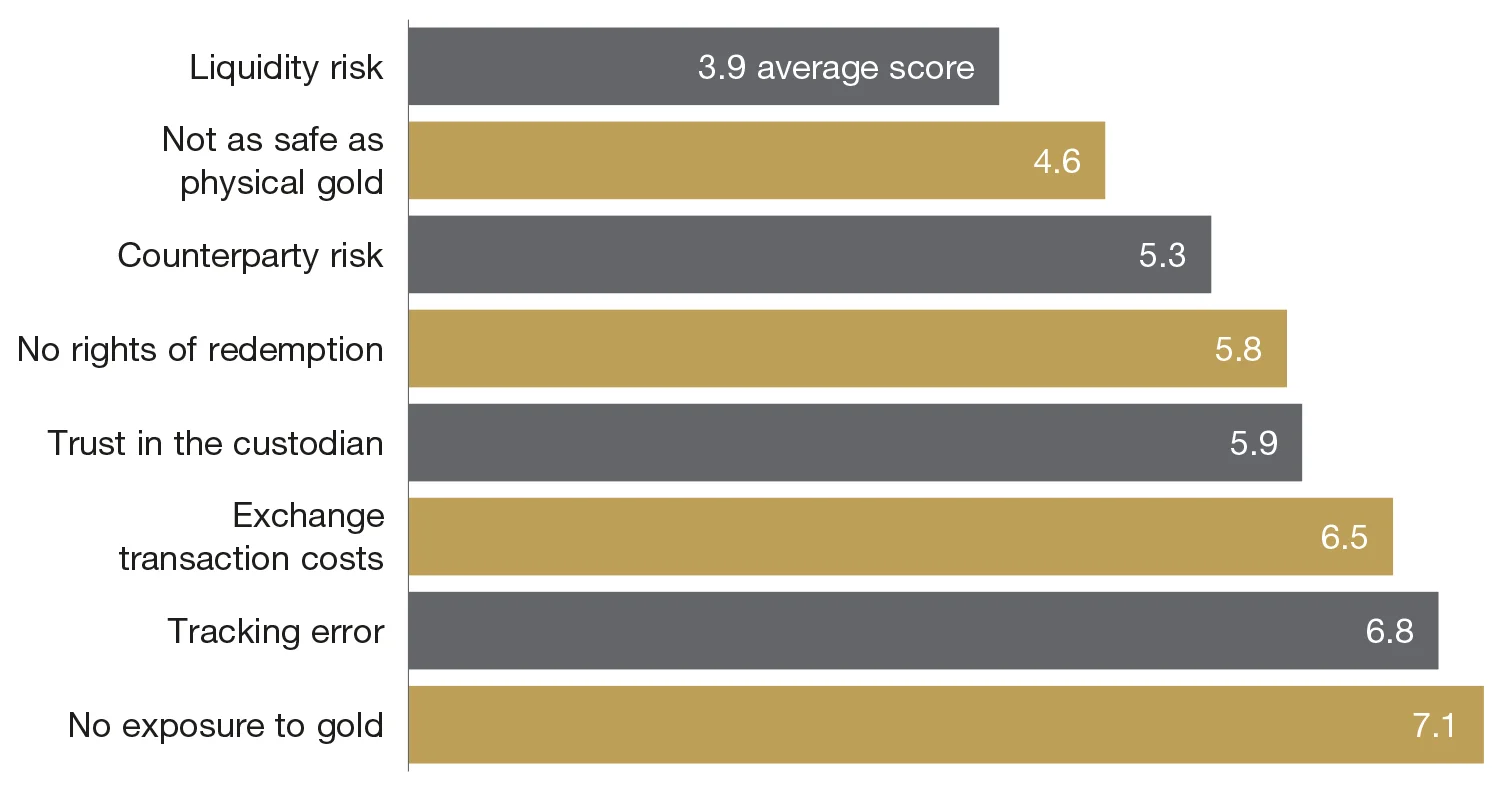

- Liquidity risk is the chief concern associated with holding gold ETFs, although larger holders say safety regarding physical gold is more of an issue.

Profile of respondents

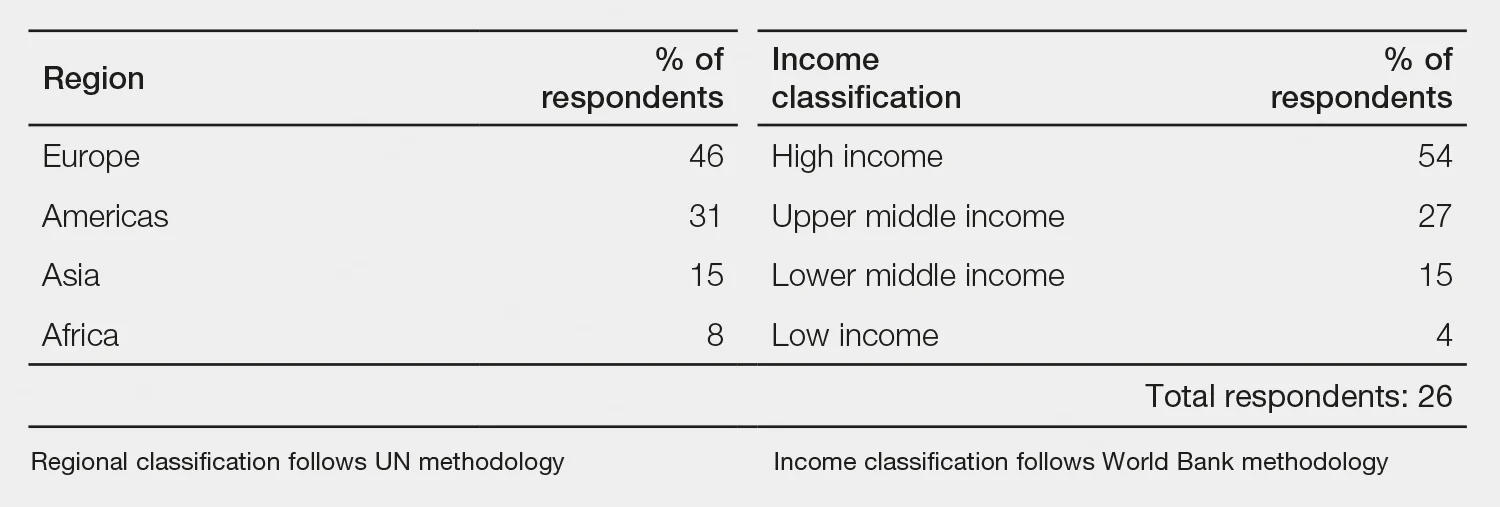

The Gold for Central Banking 2020 survey questionnaire was distributed in August 2020 and had received replies from 26 central banks by the first week of September. The reserve managers that replied did so on condition of anonymity. The 26 central banks are, as a group, responsible for just over $2.6 trillion in reserves as of June 2020.1 The average holding was just over $100 billion. Collectively, the banks are responsible for $344 billion worth of gold, with an average holding of $13 billion. The group included six central banks with no gold reserves. A breakdown of respondents by national income classification and geography is set out below.

1. International Monetary Fund International Financial Statistics, with gold valued at market prices.

Percentages in some tables may not total 100 due to rounding.

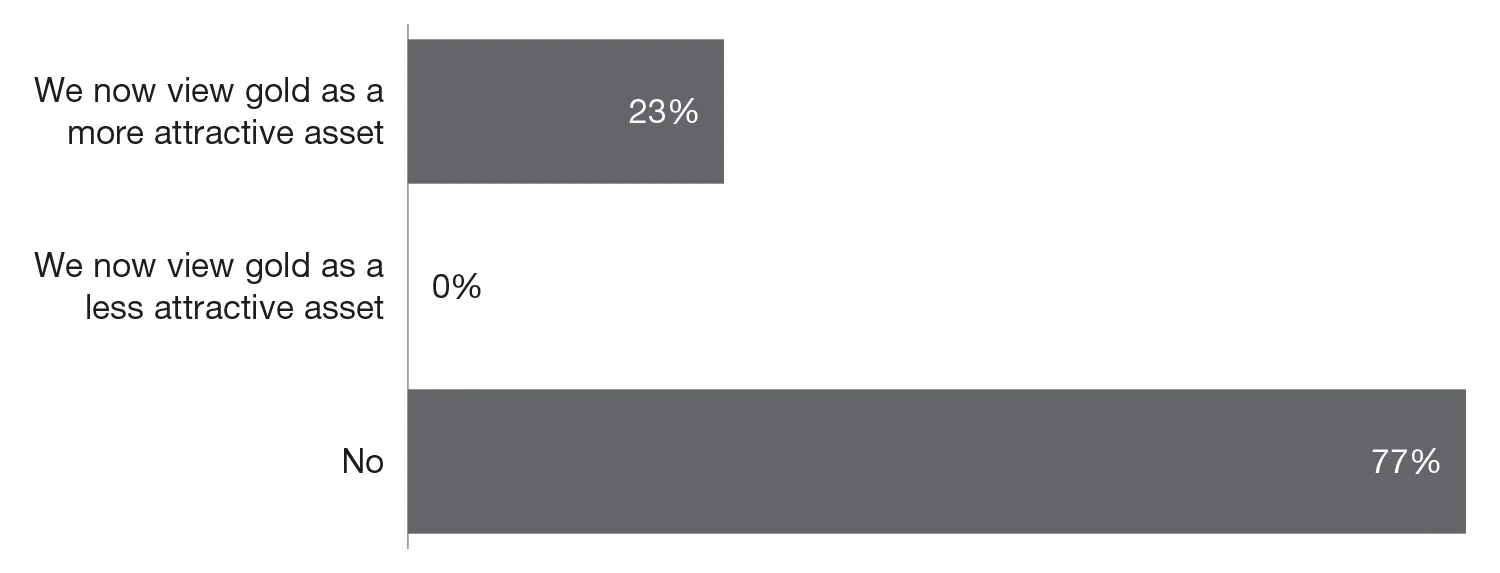

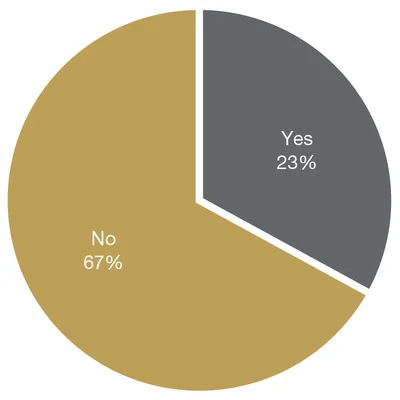

Has your central bank changed its view on gold since the Covid‑19 outbreak?

The Covid‑19 outbreak has not changed how central banks see gold. This was the view of just over three-quarters of respondents, responsible for $2 trillion in reserves. Several respondents from this group noted that gold was an elemental part of their reserve management framework and as such was not impacted by market moves. A reserve manager from Asia explained: “Gold has been an integral part of our reserves regardless of market condition, and it may likely continue to be so.” A respondent from central Europe said their central bank remained committed: “We were very positive on gold in terms of the role it plays in any foreign reserve portfolio, even before Covid‑19, and that has not changed.” Another reserve manager from Europe had seen their view of gold’s strength in a crisis confirmed: “Gold is seen as a safe-haven asset in times of financial and political stress. Current market conditions have no impact on its strategic role in foreign reserves, other than to reaffirm the validity of the initial view.”

A contrarian view was offered by a reserve manager from Africa, whose central bank had yet to be persuaded on the benefits of holding gold: “In our view, gold does not provide a regular income, has high volatility and, with the Covid‑19 outbreak, its price has risen substantially, making it unattractive to buy for

our portfolio.”

Six respondents did however say their central bank’s view had changed. The reserve holdings of this group ranged from $3 billion to more than $300 billion and they were mostly drawn from middle-income countries. In comments, two reserve managers, from Africa and Europe respectively, noted that an increase in the price of gold had strengthened its safe-haven status.

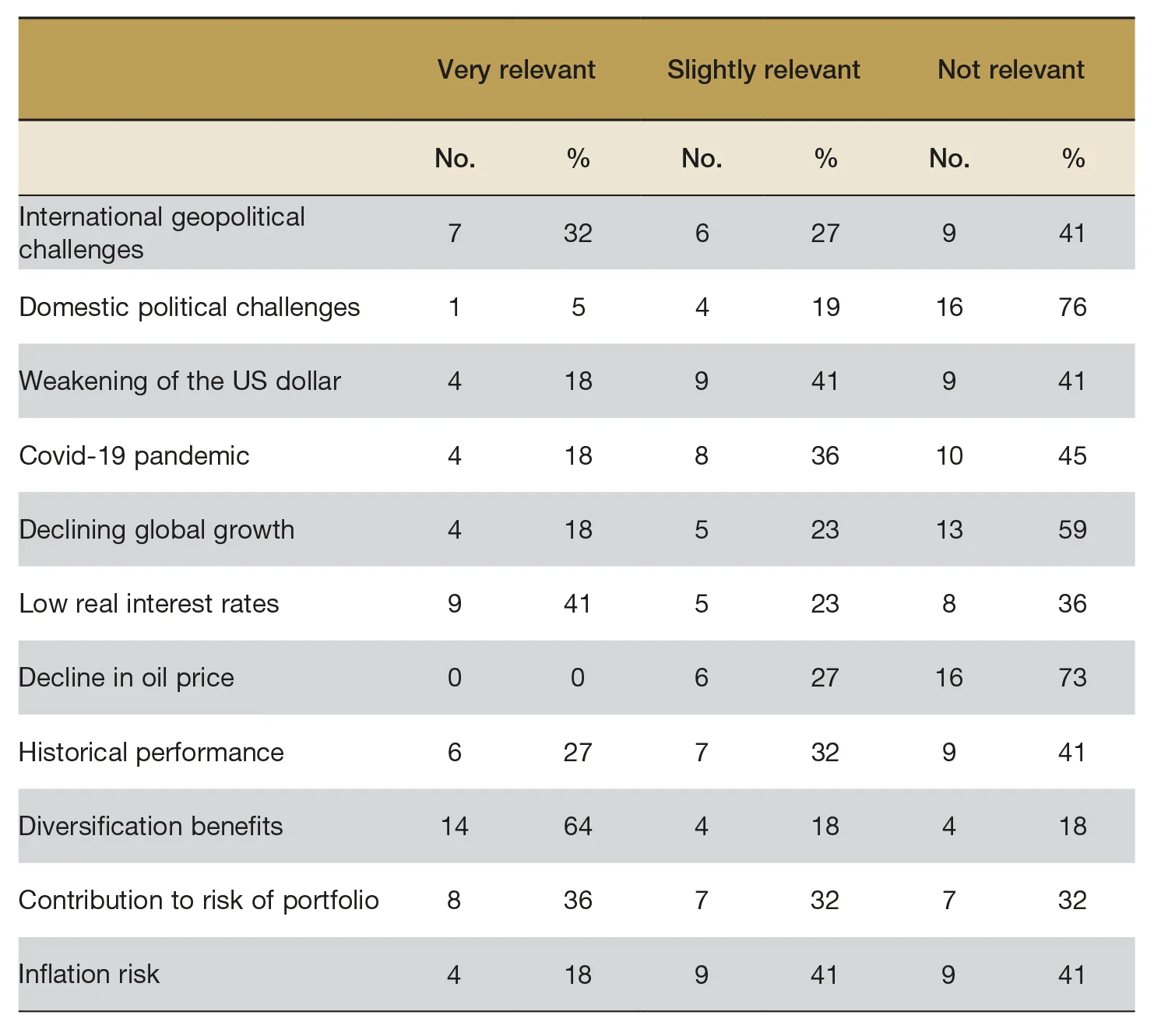

What issues are most relevant in determining your institution’s gold holdings?

The benefits from diversification stand out as the most relevant factor for reserve managers in determining their institution’s holdings of gold. Just under two-thirds of respondents – a group of central banks responsible for $1.9 trillion, and with an average holding of $134 billion – said this was “very relevant”. This group, which included several large holders, was dominated by central banks from middle-income countries. It included over half the respondents from the Americas.

Low real interest rates also figure prominently in decision-making: just over 40% said this was very relevant. This group was also dominated by central banks from middle-income countries, and there was significant overlap with views on diversification benefits: all but one of the nine also said diversification benefits were very relevant. The nine were smaller reserve holders, however, holding $85 billion on average. Eight respondents reported that gold’s contribution to the risk of a portfolio was very relevant for their central bank, a group that contained several very large holders and was responsible for $1.4 billion. All eight also said that diversification benefits were very relevant.

A similar pattern was observed when looking at the central banks with gold holdings. Of the 18 that answered this question, 61% placed diversification benefits first, followed by low real interest rates (50%) and then contribution to portfolio risk (39%).

Viewing the results through the prism of national income classification revealed a variation in views, however. Diversification benefits scored highest for reserve managers from high- and middle-income countries. Immediately below this, those from high-income countries placed more emphasis on the contribution to the risk of the portfolio, but for middle-income countries, low real interest rates matter more.

Just over half of respondents said “historical performance” was relevant, and several mentioned legacy or legal requirements in their comments. “Decline in oil prices” and “domestic political challenges” were not, however, seen as relevant for this group, and there was only marginal support for “weakening of the US dollar”, “Covid-19 pandemic”, “declining global growth” and “inflation risk”.

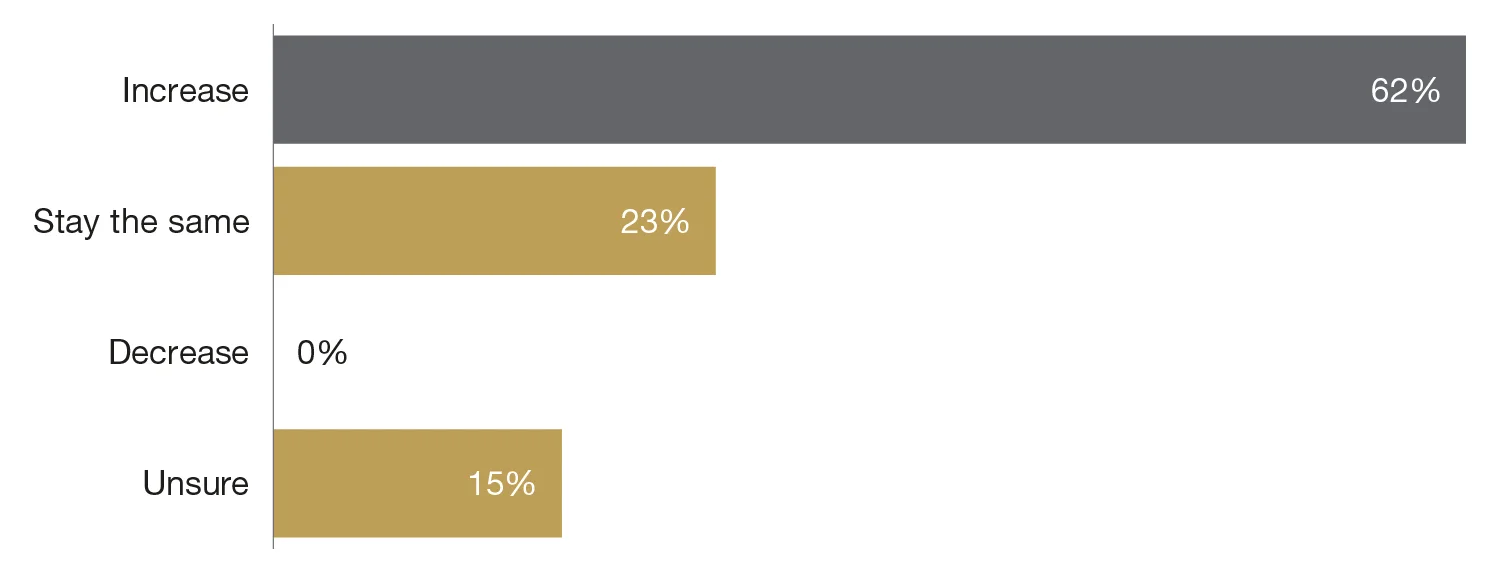

How will global central bank gold reserves change over the next 12 months?

There is little prospect of central banks reducing their gold holdings over the next 12 months, with expectations centred on stock increasing or remaining flat. Just over 60% of respondents – a group of central banks responsible for $1.7 trillion in reserves – said they expect gold holdings to increase over the next 12 months. The percentage was slightly higher among gold holders at 70%. The group of 16 was dominated by central banks from high-income countries (10), with the remainder from lower middle-income (4) and upper middle-income countries (2).

A reserve manager from Europe, whose central bank has significant gold reserves, explained what they saw as the two driving forces behind this: “The growing demand from emerging-market central banks reflecting current geopolitical, political and economic conditions, as well as structural changes in the global economy, will probably last in the future.” Six reserve managers, of which two-thirds were from upper middle-income countries, said they thought holdings would remain the same. Indeed, among upper middle-income countries, this was the majority view: only one in three among this group expect gold holdings to increase. In contrast, all four reserve managers from lower middle-income countries expect central banks to hold more gold in 12 months’ time. Three of the four reserve managers who were “unsure” were from high-income countries.

Does your central bank have a target allocation for gold?

Maintaining a target allocation for gold is a minority activity among central banks, though somewhat higher among gold holders. One-third of respondents – responsible for $680 billion – said they had a target allocation for gold. All but one of these eight central banks were gold holders. However, narrowing the sample to holders of gold only increases the percentage to 39%.

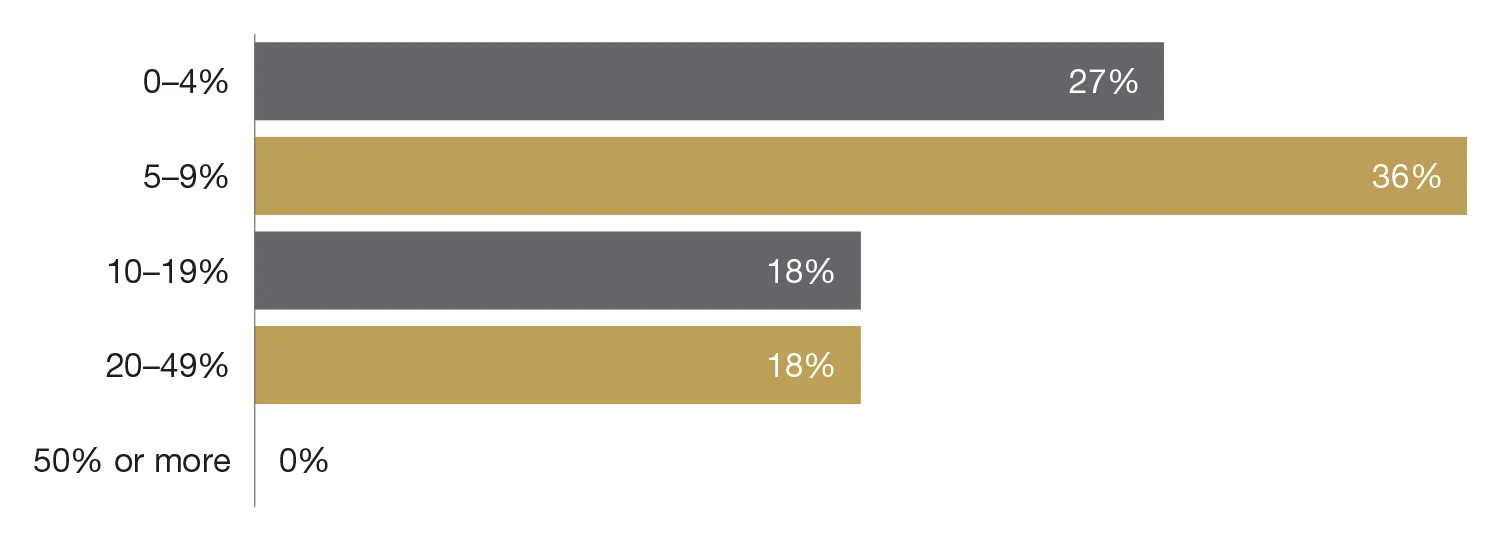

The practice was most common among central banks in middle-income countries, almost half of which said they had a target allocation, with one respondent from a central bank in Asia commenting that they were in “the process [of having] a certain target allocation”. In contrast, this was the case in only two of the 12 high-income countries. A large holder from Europe qualified their answer: “[We have] no target allocation. Percentage is derived from value of gold holdings in relation to value of currency reserves.” Most central banks with a target allocation target less than 10% – a figure in line with historical percentage holdings for official sector assets.

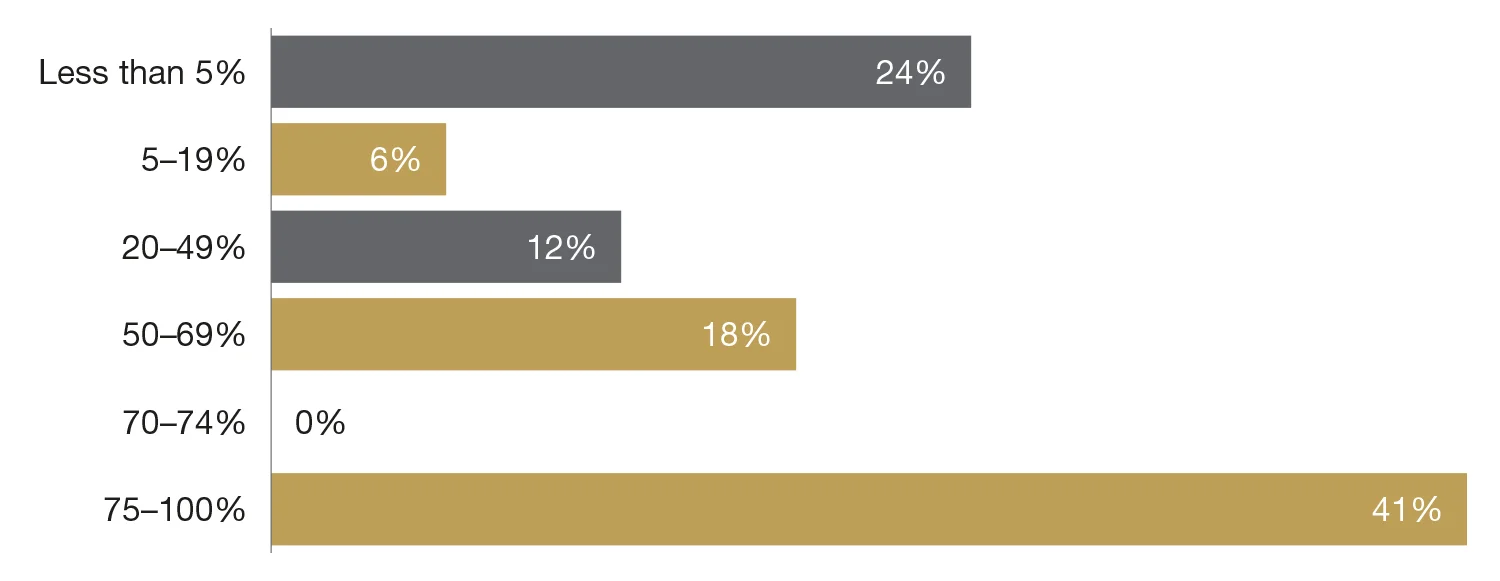

If yes, what percentage of your total reserves portfolio do you allocate for gold?

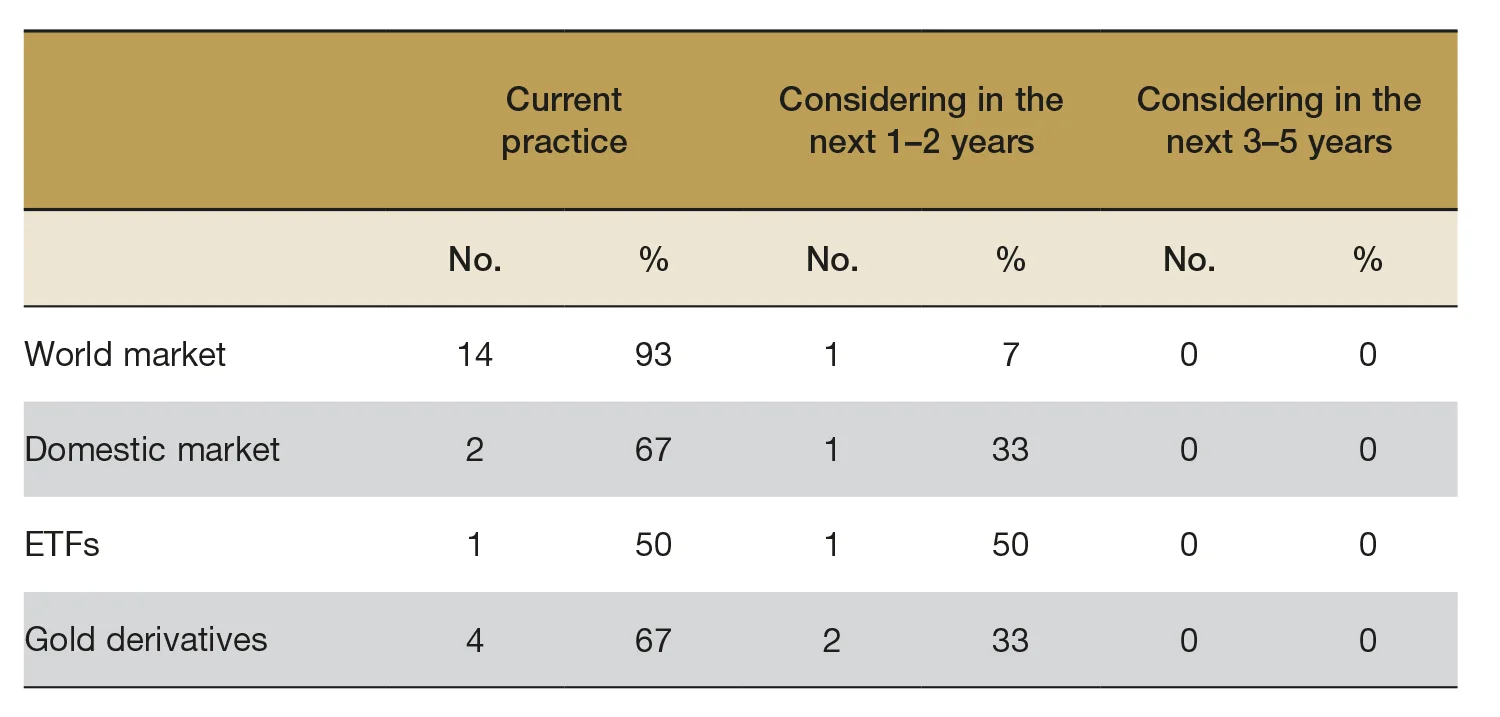

How does your central bank buy and sell gold?

Transacting in the global market is by far the most prevalent means of buying and selling gold. The 14 central banks that said they used the world market were split almost evenly between high-income and middle-income groups. The group contained several large holders and were responsible for a combined $2 trillion in reserves. The average holding of gold among this group was just under $10 billion. Of these, five made use of an additional channel, with derivatives the most popular, and a large holder from the Americas reporting it was considering this. Overall, four respondents said they used derivatives: three of these were very large holders and all four used derivatives with at least one more channel. There was little support for ETFs: the one central bank that said it used this product also used global markets and derivatives.

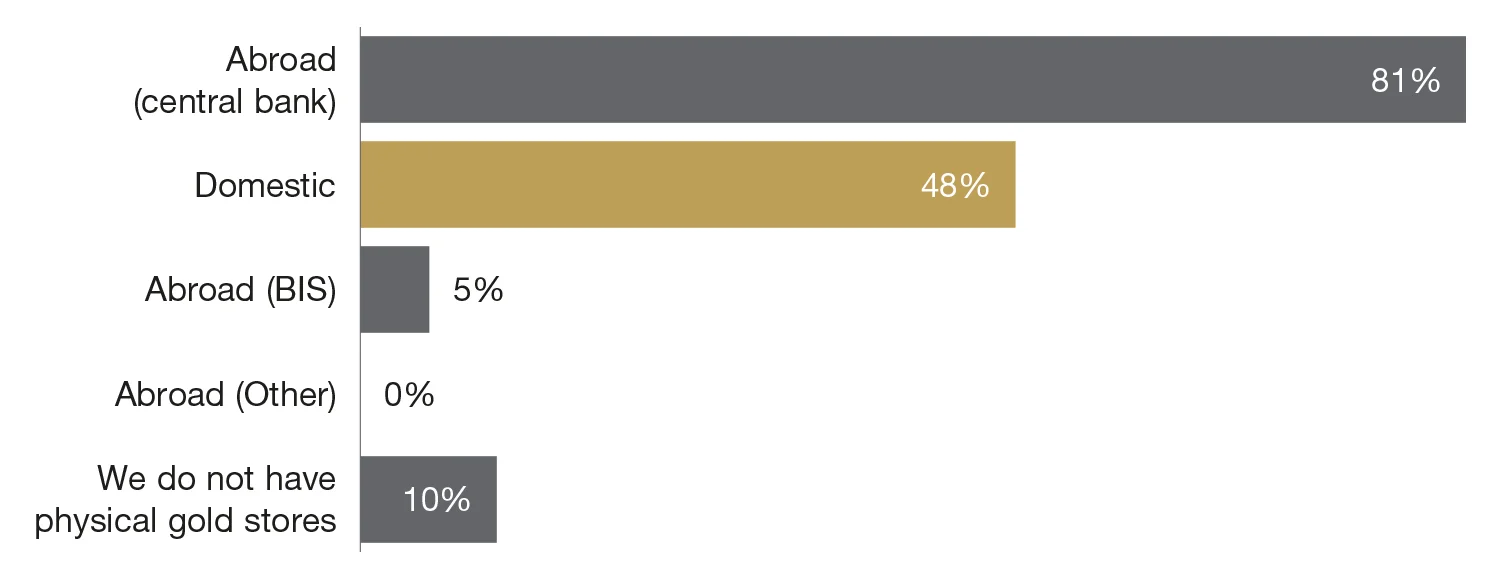

Where does your institution store its physical gold holdings?

Overseas storage at a central bank is the preferred way to store gold for most central banks: more than 80% of respondents said they did this. Of this group, half also said they stored gold domestically. The 17 central banks were responsible for $2.3 trillion and $340 billion in gold and as a group were dominated by high-income countries. Only two central banks exclusively store gold domestically: one from Europe and one from Africa.

How much of your total gold holdings are held abroad?

Seven central banks said they stored more than three-quarters of their holdings abroad. The percentage held overseas dropped where central banks had more than one option for storing. These seven were also smaller holders, with an average of $1.4 billion in gold, though two were overall very large reserve holders. By contrast, the central banks that combine domestic and overseas holding are on average much larger holders ($42 billion). The percentages held abroad ranged from the smallest of less than 5% in one Asian and one European central bank to 75–100% in another Asian central bank.

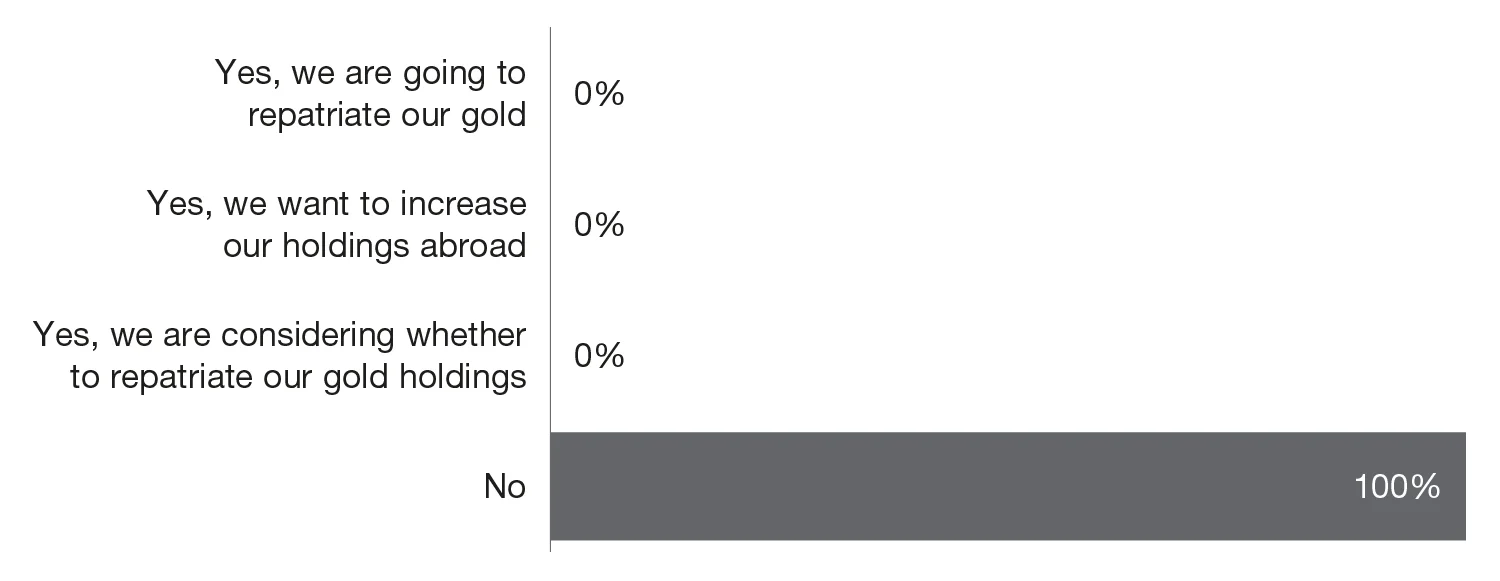

Respondents were unanimous in there not being any bearing of the Bank of England (BoE) versus Venezuela government court decision on their decision to hold gold, but three did offer comments. An Asian central banker underscored its lack of influence: “Our decision to review our gold storage policies is independent of the BoE and Venezuela government matter.” Another, from Europe, noted their decision was based on broader considerations: “Potential global geopolitical tensions were one of the premises when deciding on repatriation of part of gold holding to domestic vaults, not any particular case.”

In an extended comment, one reserve manager – after noting their bank had had a “similar experience” – added that “backtesting would prove that gold abroad is not a risk-free asset and that it will always depend on which side the holder stands. And it is very important to consider this because […] gold is supposed to be used during crises and international political tensions.”

Has the outcome of the recent BoE versus Venezuela government court decision impacted your decision to store gold?

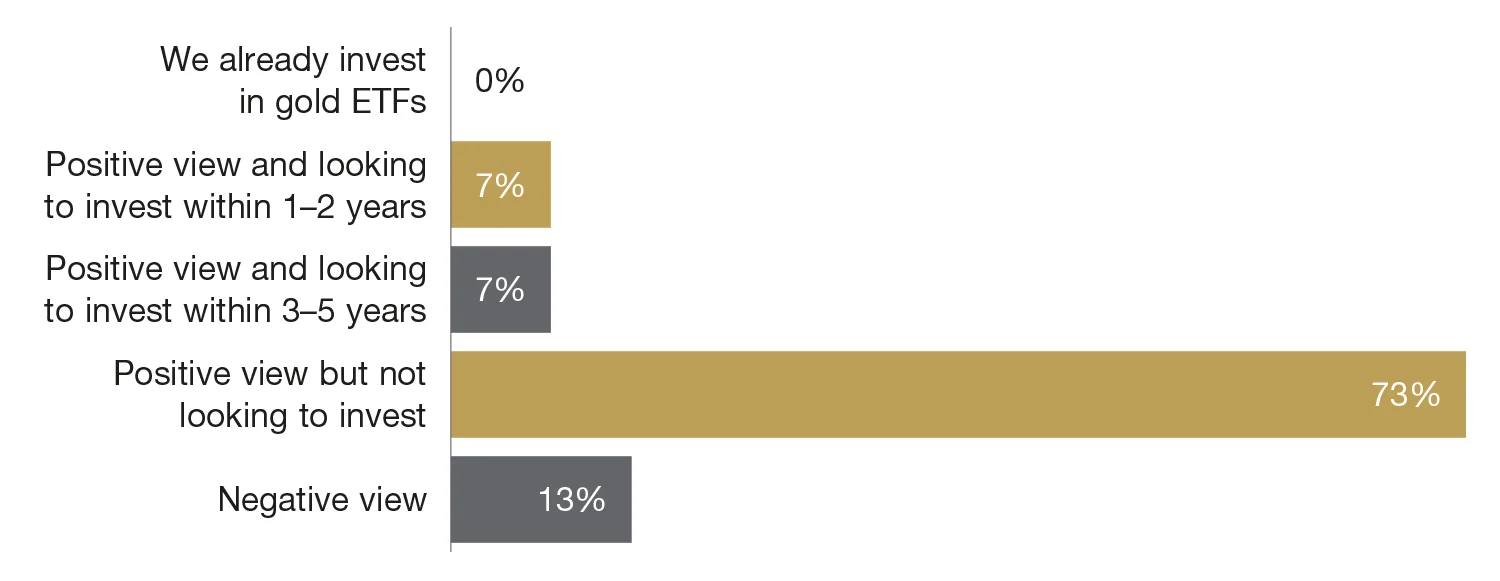

Which best represents your institution’s view on gold ETFs?

Central banks are positively disposed to gold ETFs, but active interest in investing is the preserve of a minority. Eleven central banks – responsible for $615 billion in reserves – had a positive view but were not looking to invest. These were, on average, smaller reserve holders than the survey average and, indeed, smaller gold holders than the sample. One reserve manager from Europe explained their thinking: “Our opinion is that ‘paper’ gold is not as safe as physical.” One central bank from the Americas said it was considering moving into this product in the next one to two years, and one from Asia was looking at it over a three- to five-year horizon. The two central banks with a negative view were both large holders from Europe.

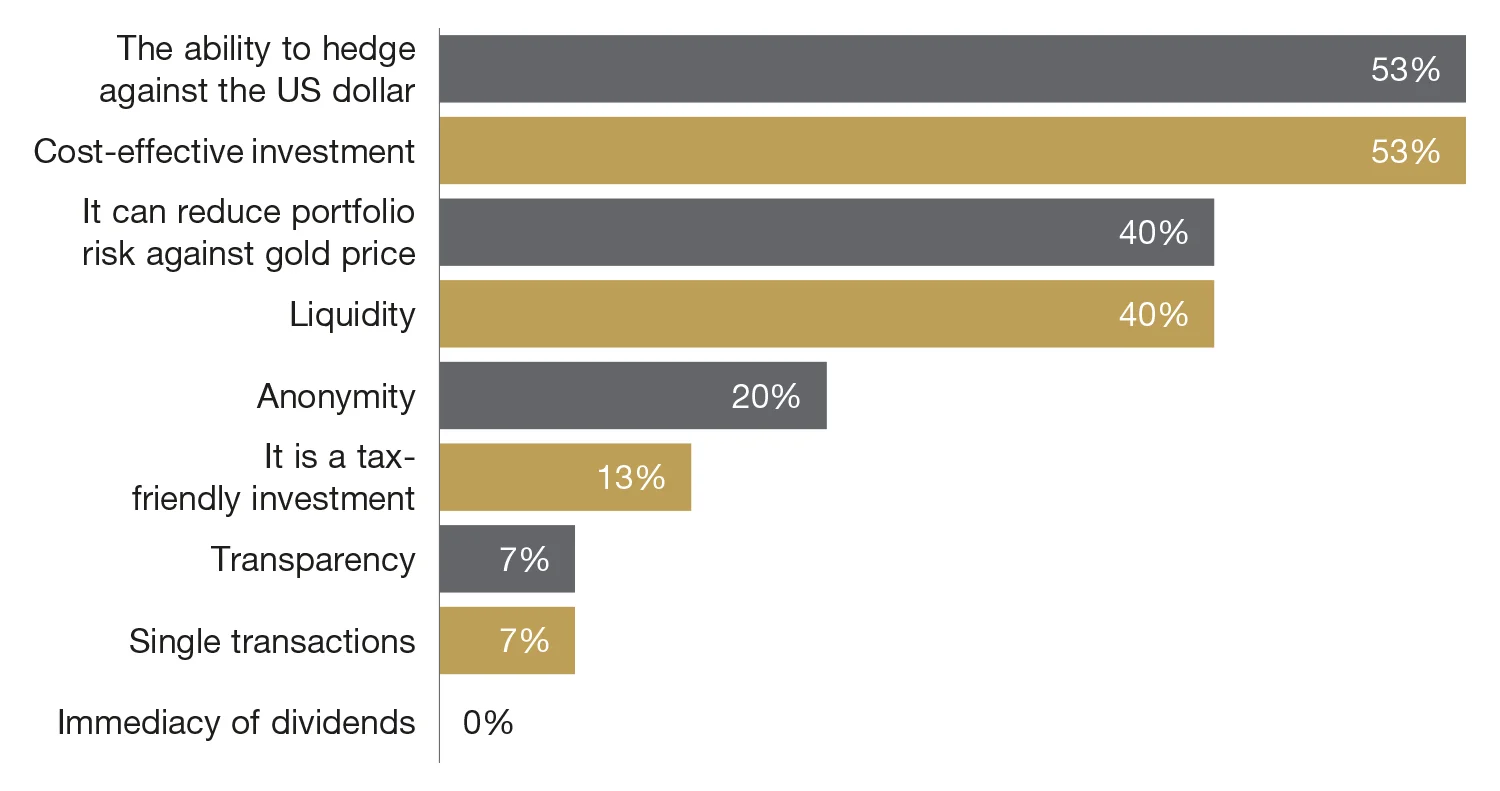

What are the main benefits for central banks that hold ETFs?

A combination of gold’s quality as a hedge against the US dollar and cost-effectiveness are considered the main benefits for holding ETFs. Over half the survey respondents selected these two options, and three-quarters of the sample of 15 chose at least one of them. This group of 12 was responsible on average for reserves with $46 billion and gold worth $19 billion. It is notable that those mentioning the hedge against the dollar tended to be smaller holders on average of both reserves and gold than those that viewed cost-effectiveness as a main benefit. Liquidity, cited by six respondents, was typically a benefit for larger holders: three of these six were responsible for reserves worth more than $100 billion. In contrast, all but one of the six that saw reduction of the risk against the gold price as a benefit were responsible for less than $10 billion. Among those that said their institution had a positive view on gold ETFs, there was marginally more support for the hedge against the US dollar than cost-effectiveness, but the pattern broadly followed that in the previous table (What are the main benefits for central banks that hold ETFs?).

What is the greatest concern for your central bank regarding holding gold ETFs?

Liquidity risk is the chief concern associated with holding gold ETFs: over half of respondents ranked this either first or second. These six were on average smaller holders, at $15 billion in reserves and $270 million in gold, than the survey average. The second greatest concern was that gold was not as safe as physical gold, and, indeed more respondents (five) ranked this first than did liquidity risk (three). These five were on average much larger holders – three held reserves worth more than $100 billion – and were all from Europe. Counterparty risk was third overall and ranked first or second by five respondents. Four of these five were middle-income countries and, as a group, tended to be smaller holders – on average responsible for $30 billion in reserves and $7.5 billion in gold. No single central bank saw the lack of rights of redemption as the primary concern, with only two ranking it second.

There was some variation across geography and income groups. Central banks in Europe were unanimous in their concern that ETFs were not as safe as gold: all five European respondents ranked this first, with trust in the custodian the second greatest concern. In contrast, respondents from Asia were more concerned about counterparty risk and as concerned about liquidity risk as they were safety. Large holders, with more than $10 billion, were most concerned about safety compared to physical gold, whereas for smaller holders liquidity was the main concern.

This feature forms part of the Central Banking focus report, Gold for central banking 2020

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com