Kazakhstan’s long path to inflation targeting

After a slow start, IT implementation is starting to mature, says technical assistance veteran

Kazakhstan declared its independence from the Soviet Union on December 16, 1991, and the Soviet Union was formally dissolved 10 days later. For almost two years after, Kazakhstan and the other newly independent former Soviet republics continued to use the Soviet, then the Russian, ruble in a poorly co-ordinated and increasingly untenable arrangement, under which the newly independent central banks of the 15 former republics issued their own ‘ruble' credits while circulating the ruble banknotes supplied by Russia. Most of these countries – eventually all of them – quickly introduced their own currencies and with this the need to establish the policies to guide their supply.1

The Kazakhstan tenge was introduced on November 15, 1993, and for about one month it could be exchanged for Soviet and Russian rubles at a rate of one tenge to 500 rubles. While designing its new currency and plans for introducing it, the National Bank of Kazakhstan (NBK) began to adapt its internal organisational structure and procedures for its new role of managing its own currency in a market economy.2 As a branch of the Soviet Central Bank (Gosbank), the NBK was experienced with managing banknotes, but its accounting systems required a redesign for a market economy, as did the organisation and operation of its payments-processing system. Its capacity to regulate commercial banks and lay the legal foundations for privately owned commercial bank and privately issued financial instruments had to be built from scratch, as did the management of its foreign exchange (forex) reserves.

More broadly, the NBK needed to facilitate the development of private financial markets (forex, money, and credit and securities markets, etc), and the private institutions that issue and deal with such instruments. These are the channels through which its monetary policy would influence economic activity and prices, and resources would be allocated in a market economy. Developing such markets takes many years, if not decades, but the design and use of the NBK's policy instruments play an important role in such development, about which more will be said later.

Fortunately, the authorities were able to draw upon the experience and best practice of well-established market economies when establishing the legal and regulatory framework for the financial sector. The process of evolving from central bank allocation of credit through the state banks to the private-market allocation of credit to its most profitable uses began in 1992, by gradually replacing allocated central bank credit with auctions of credit to the highest bank bidders.

The Law on the National Bank of the Republic of Kazakhstan was adopted in April 1993 and mandated the NBK to seek a stable value for its currency, the tenge. Although the NBK discussed its options intensively for the regulation of its new currency,3 like most small- to medium-sized countries, it initially focused its policy on stabilising the exchange rate of the tenge to the US dollar. The IMF classified the NBK's monetary policy as being a soft or managed peg, which it controlled by intervening in Kazakhstan's forex market. Until the establishment of an oil fund in 2000 – the National Fund of the Republic of Kazakhstan (NFRK) – the NBK's forex market interventions to prevent an appreciation of the tenge in the face of oil export revenues were often sterilised (ie the increases in the supply of tenge from NKB purchases of dollars were reversed by sales by the NBK of government securities or its own notes).4

During the early transition years (1992–99), Kazakhstan's GDP contracted by 4.5% per year on average. From 2000–07, the NBK's market reforms and developments plus the coming online of substantial amounts of oil resulted in GDP growth of 10% per year on average. Kazakhstan's external trade balance turned from a deficit of 5% of GDP on average per year in the first eight years of independence into a surplus of 11% on average over the next eight years. Its GDP per capita increased from $1,000 per year in 1999 to $6,800 in 2007.5

Kazakhstan's banking sector grew rapidly during this second period. Bank credit grew by around 70% per year on average. Half of this growth was financed by foreign borrowing, rather than by domestic deposit growth, resulting in the underdevelopment of domestic financial intermediation. In addition, oil export volumes began to rise rapidly in this second period, boosted by the CPC crude oil-export pipeline coming into operation in September 2001. The NBK avoided the unwanted real exchange rate appreciation of the tenge from these two sources of foreign currency inflows with sterilised intervention and the build-up of the NFRK's assets.

The National Bank of Kazakhstan

The National Bank of Kazakhstan

These developments led the NKB to re-evaluate its managed-peg exchange rate approach to monetary policy. With the rapidly increasing production and export of oil, Kazakhstan's balance of payments because increasingly sensitive to the international price of oil, and the potential monetary impact of such swings became increasingly difficult to sterilise when maintaining an exchange rate peg. While shifting the exchange rate peg from the US dollar to the price of oil – as has been suggested by some for oil exporters – would stabilise the balance of payments of oil price swings, it would shift the adjustment and volatility of such swings to import prices and the volume of imports, and thus domestic prices and inflation. Absorbing such swings in Kazakhstan's balance of payments via the NFRK became a more important and very helpful policy tool.

The NBK realised that if it allowed greater scope to the market for determining exchange rates – or even floated them freely – to gain control over domestic monetary policy, it would need an alternative anchor for its policies. Inflation targeting was rapidly becoming the regime of choice among countries that floated their exchange rates.

A September 14, 2004, press release from the NBK stated: "In 2003, the National Bank adopted a new monetary policy framework and price stability has become the primary objective. The NBK announced its plans to introduce inflation-targeting regime by 2007."6

In light of this new framework, the NBK's legal mandate to stabilise the value of its currency was amended and clarified, "ensuring stability of prices in the Republic of Kazakhstan shall be recognised as the main purpose of the NBK".7

The target of 2007 for implementing the new regime proved overly ambitious. Experience suggests there are five 'initial conditions' in support of an inflation-targeting framework:

- Clearly defined legal mandate to pursue an inflation objective, as well as autonomy and accountability of the central bank to meeting this objective.

- The inflation target is not subordinated to other objectives.

- General macroeconomic stability, including lack of fiscal dominance.

- A developed and stable financial system.

- Adequate tools to implement monetary policy in support of the inflation target.8

The city of Almaty, where the NBK is headquartered

The city of Almaty, where the NBK is headquartered

At that time, the NBK enjoyed legal and de facto policy independence, with an amendment to the central bank law on July 10, 2003, strengthening its inflation mandate. The development of appropriate rules for the NFRK and a prudent fiscal policy protected the NBK from fiscal dominance. However, financial markets had a way to go to become reliable and stable transmitters of monetary policy, and to permit the free floating of exchange rates, required for an inflation target. Also, the NBK's policy instruments were not well designed to facilitate financial market development.

In addition, the NBK had a lot of work to do to develop its analytical and decision-making framework, and capacity for effectively implementing an inflation forecast target. In short, the first three conditions were satisfied, but the last two required work.

Preparations for inflation targeting

Inflation forecast targeting is the most sophisticated and challenging monetary policy regime to implement. As a result of lags in the effects of monetary policy on income and prices, an inflation-targeting regime requires the central bank to forecast expected inflation one or two years in the future, given known and expected developments in exogenous factors such as oil prices and fiscal outlays when combined with the impact of monetary policy decisions.

The primary operational target used by inflation-targeting central banks is a short-term interbank interest rate. A reduction in the policy interest rate target relative to its real equilibrium rate, for example, should increase bank lending through the credit channel of policy transmission, increase investment via the direct interest rate channel (assuming other market rates move in the same direction) and increase consumption via the real balance effect of an increase in the rate of monetary growth. To the extent that cross-border capital flows are sensitive to domestic and international interest rate differentials, a reduction in the policy rate will also depreciate the exchange rate and increase the demand for exports. All things being equal, a lower interest rate 'operational' target should produce a higher inflation rate, and vice versa.

If the public has confidence in the central bank’s forecasting and policy-setting ability, as well as its commitment to the chosen inflation target, the public’s inflation expectations will coincide with the policy target, and will be reflected in market pricing and wage decisions

Today's policy interest rate target should be chosen with the expectation of hitting the inflation target in one to two years. The rate chosen should be communicated to the public, along with the reasons for the level chosen, with as much clarity as possible. If the public has confidence in the central bank's forecasting and policy-setting ability, as well as its commitment to the chosen inflation target, the public's inflation expectations will coincide with the policy target, and will be reflected in market pricing and wage decisions, thus further supporting the achievement of the target without negative impacts on income and employment.

The NBK and the Kazakh government have more broadly set about building the necessary framework and capacities to shift to an inflation forecast-targeting regime. Detailed action plans were developed. The elements required are:

- The process for establishing a government-wide inflation target for use in budget planning and monetary policy.

- The development of the economic analysis of inflation factors needed for setting operational policy targets (short- and medium-term model-assisted forecasts).

- The development of the decision-making process within the NBK.

- The establishment of the instruments for implementing policy.

- The vehicles for communicating policy to the public.9

Setting the inflation target

Kazakhstan appears to have a well-developed process for setting its inflation targets. The inflation forecast for the upcoming year – the basis for the government's budgets – is established through a government-wide consultation process with key input from the NBK. The executive board of the NBK sets its medium-term target in consultation with the rest of the government. The NBK needs to ensure its model forecasts for this government-wide exercise are consistent with those it uses to assist its Monetary Policy Technical Committee (MPTC) in setting its base interest rate target for the overnight interbank lending rate (TONIA).

Choosing and setting the operational target

All inflation forecast targeting central banks target a short-term market interest rate to achieve their future inflation target. All things being equal, such as the unobservable equilibrium real interest rate, a lower policy interest rate results in faster growth in money supply and bank credit, greater investment and exchange rate depreciation, all of which increase aggregate demand and thus inflation.

The NBK's operational instrument – its so-called base rate – is the overnight interbank loan rate (TONIA). The MPTC should set its target for this rate at the level its forecasts indicate will result in inflation in one to two years, equal to its inflation target. With the announcement in 2004 of its intention to implement an inflation-targeting regime by 2007, the NBK began to develop the capacities needed. These consisted of: a) the analysis of economic developments and models to assist in forecasting them and the chosen base rate target's probable impact on future inflation; b) the process of presenting such analysis to, and discussing it with, the MPTC in order to set the base rate target; c) the adoption and use of policy instruments for achieving the base rate target adopted; and d) communicating the policies adopted to the public. A report to the NBK in August 4, 2005, by David Kemme and myself, presented these requirements in more detail.

Forecasting and policy analysis system (FPAS)

Forecasts of economic developments and the impact of alternative base rates on future inflation inform, but do not dictate, the MPTC's decisions on the NBK's base rate targets. With its decision to adopt inflation forecast targeting, the NBK began to receive technical assistance in the forecasting and decision-making capabilities it would need, and to strengthen its FPAS staff.

In our initial report in 2005, we recommended staff develop a quarterly forecasting model and peripheral models to augment this model, and provide additional input into the policymaking process. We noted that the NBK Research and Statistics Department had developed a model of monetary transmission mechanisms that could form the starting point for a quarterly forecasting model. The quarterly forecasting exercise provides the benchmark – a common understanding of the economic processes involved – around which policymakers consider possible alternative scenarios and form recommendations. We recommended that staff develop a small gap model for this purpose, as well as peripheral models for specific policy questions – inflationary expectations and exchange rate forecasting, in particular – or for inputs into the core model, which are also important elements of framing internal policy discussions.

Progress was very slow for several reasons. Budgetary limits imposed on the NBK by the government prevented it from expanding qualified staff in this area as rapidly or to the level needed; neither have the hired staff been able to devote sufficient time to this critical work. Furthermore, the forecasting team lacked members with deep macroeconomic understanding of the processes being modelled, and both management and staff were uncomfortable with the interaction and forecast discussions that were required.

The pace of developing the FPAS was accelerated in 2014, with the addition of some highly qualified staff and technical assistance was intensified.10 But the number of new hires remained inadequate. Moreover, the team still lacked people with good monetary and macroeconomic backgrounds. Even with sufficient staff resources, which the NBK lacked, developing and refining the forecasting models needed to help guide monetary policy choices is an ongoing process of refinement and adaptation to changing conditions, which requires the team's full-time attention. In 2014, we estimated two years would be needed if the central bank had sufficient staff devoted full-time to the task. While I do not have access to the current output of the FPAS, the most recent Inflation Report discussed below indicates considerable progress has been made.

Decision-making process

The FPAS forecasts and analysis are of little value if not communicated and discussed directly with the MPTC. Also, the forecast team needs the benefit of feedback, with suggested alternative scenarios, from the committee. Thus an explicit schedule of interactions between the two bodies is very important.11 12 The interaction that is needed between the FPAS team and the policymakers (MPTC) has not been the traditional approach to decision-making in the NBK (or other former Soviet Union central banks). Thus, establishing the new approach has proven slow, and the first face-to-face presentation by the FPAS team to the MPTC did not occur until the third quarter of 2015.

Since that first meeting, however, the process of the FPAS and MPTC interacting as part of a well-defined schedule of forecast updates has been embraced more fully, and the pace of progress has accelerated significantly.

Money market development

The NBK needs to hit its base rate targets in a way that promotes the deepening of money markets, so the base rate is transmitted to market interest rates more generally. For this reason, funds should not be injected or withdrawn at the target rate via a standing facility, but rather auctioned in amounts expected to result in the target rate. So actual market rates will vary around the target.

The NBK has a variety of instruments by which it influences tenge liquidity, and thus market interest rates and the base rate (TONIA) in particular. These consist of: its forex market interventions, given the operation of the NFRK and the government's use of forex from this fund; its open-market operations, selling and buying its own notes and the government's treasury notes; and its passive standing facilities. In 2015, the design of these instruments was reformed to take into account the need to promote the development of better bank and company liquidity management by deepening markets for efficient money market instruments. This is an important part of integrating the base rate into the structure of financial market rates more generally, so monetary policy is transmitted to other market interest rates and inflation.

Progress in this area has been slow until the last two years for several reasons. With the introduction of the tenge and the gradual elimination of the NBK's centrally directed credit, banks began to develop more market-based approaches to the management of their liquidity. However, the bank's instruments for managing market liquidity were overly complex and administered in a manner that tended to perpetuate the previous central credit allocation approach, thus undermining market development with a level playing field.

As part of its preparations for an inflation forecast targeting regime, the NBK undertook the rationalisation of existing instruments into traditional central bank tools of short-term liquidity management. The maturity of deposits with the central bank was reduced to one week, and of short-term notes to one month. Lending to banks was consolidated into one facility (refinance facility) with a one-week maturity at an official policy rate. Open-market operations would rely on short-term note issues (suspending repurchase, or repo, transactions), undertaken with fixed quantities rather than at fixed interest rates.

In shifting from providing liquidity at a fixed interest rate to offering to buy or sell fixed or targeted quantities at market rates, in order to facilitate and encourage bank development of liquidity management capabilities, the NBK had not developed very reliable liquidity forecasts and was thus unable to determine the appropriate size of its open-market operations with much accuracy.

After first establishing a base rate target of 12% in September 2015, the NBK had difficulty hitting it. The target was raised to 16% in October, as the central bank resisted market sales of tenge for dollars to finance capital flight, but it failed to raise interest rates to those levels. In the face of growing capital flight, actual overnight interbank rates were allowed to spike at over 300% in late December 2015, before dropping below 20% in January 2016, as pressure on the exchange rate and capital flight eased. On February 1, the base rate target was set at 17% and the NBK's standing facilities to lend or accept deposits were pegged to its base rate target, with a spread of two percentage points either side of the target. On May 5, the base rate was reduced to 15% and the spread on the standing facilities was narrowed to 1% on either side of the target. Following the November 14 reduction in the target to 12%, the actual rate has varied over the full range of its corridor of one percentage point either side of the target, suggesting the NBK is still refining its ability to hit its target. As actual inflation moved within its target range, the NBK reduced its base rate target to 11% on February 21, 2017.

These standing facilities should be open in unlimited quantities to any bank satisfying their terms and conditions, and constitute safety nets to ensure banks that market rates will remain within this corridor around the base rate target. Since establishing a plus/minus 1 percentage point corridor around the base rate target, the overnight market rate has remained within the target corridor and the volume of interbank lending has increased significantly, reflecting a deepening of this market. However, the NBK has only gradually refined the use of its open-market operations (repos/reverse repos, NBK note issues, etc) sufficiently to keep market rates near the centre of the base rate target corridor so that the standing facilities would be rarely used.

The NBK's reserve requirement's reserve averaging feature has also contributed to the improvement of market liquidity management, and adjustments in its treatment of tenge versus foreign currency deposits have removed an incentive for dollarisation, which has fallen over the year. The ratio of foreign currency to total bank deposits rose from 37% at the end of 2013 to 69% at the end of 2015, and fell back to 43% by the end of December 2016.13

Kazakhstan's heavy reliance on commodity exports, especially oil, means its net export revenue and thus exchange rate are potentially heavily influenced by oil prices. The NFRK was created partly to cushion the potential impact of fluctuations of oil revenue on the money supply and/or exchange rate. It is structured so that it has a countercyclical impact. However, the rules governing flows into and out of the fund should be reviewed by the NBK to evaluate whether they might play an even more positive stabilising role.

The NBK has rationalised the design of its policy instruments, along with its treatment of tenge and foreign currency deposits, and steadily improved its management of market liquidity and thus its ability to hit its monetary policy base rate target

In summary, the NBK has rationalised the design of its policy instruments, along with its treatment of tenge and foreign currency deposits, and steadily improved its management of market liquidity and thus its ability to hit its monetary policy base rate target. In response, the money market seems to be deepening – the volume of overnight-to-one-week auto repos on the Kazakhstan Stock Exchange (Kase) doubled in 2015 over 2014 and doubled again in 2016 over 2015 – and dollarisation is retreating. So the key question is whether the transmission of policy through the base rate to other market rates is strengthening.

One concern is the investment rules of the consolidated national pension fund and other government agencies investing in financial assets may be perpetuating market segmentation, and thus thwarting an integrated market rate structure. As a check on the impact of monetary policy on financial markets and ultimately on inflation, the NBK should also monitor the behaviour of a monetary aggregate such as M1 or M2.

Communication of policy

The NBK provides considerable data and analysis to the public through several regular publications, including a monthly Statistical Bulletin. Of primary importance for monetary policy are its annual Monetary Policy Guidelines and quarterly Inflation Report. These are supplemented by press releases on the occasion of adjustments in monetary policy. These, and other data, are available on the central bank's website, which it continues to improve.

On December 8, 2001, the NBK approved the first three-year Monetary Policy Guidelines (2002–04), explaining the upcoming transition to full-blown inflation-forecast targeting. These reports review performance over the year just ending and set out the central bank's objectives for the upcoming three years. The report, which has gradually improved over the succeeding years, provides a good explanation of the NBK's monetary policy intentions, as is required by an inflation-targeting regime.

As explained in the opening paragraph of the report approved on December 24, 2007: "According to established practice, the National Bank of the Republic of Kazakhstan annually develops the main directions of monetary policy for the next three years, which sets targets for inflation, as well as measures of monetary policy to achieve them. The definition of strategic policies for the medium term increases the predictability of the policy of the National Bank of the Republic of Kazakhstan and reduced the degree of uncertainty for financial market participants in the direction of its development."

However, the horizon was reduced to two years as a result of the international financial disruptions emanating from the US that year. In 2008, a one-year forward horizon was adopted, and has been maintained since. The NBK should restore at least a two-year horizon.

In mid-2005, the NBK published its first Inflation Report, covering the fourth quarter of 2004. Such reports are the primary document by which inflation-targeting central banks explain their policy intentions and review outcomes. Initially, the reports were largely descriptive of the behaviour of the economy, and of monetary and financial variables important for monetary policy. The quality of presentation and introduction of limited analysis have steadily improved. However, the report continues to fall short of what is needed for a successful inflation forecast-targeting regime.

The Inflation Report for the third quarter of 2016 introduced an analytical section, discussing staff's inflation forecasts, including a fan chart of expected future inflation. Model forecasts contain confidence intervals for the probability of the forecast variable falling within the indicated range of the point forecast. A fan chart is a useful presentation of such results. Although this inflation report is the most recent available, it was published with a much shorter time lag after the period reported on and has added more information on the forecasts upon which monetary policy is based, however, it remains deficient in several respects.

The report assumes an oil price of $40 per barrel and is meant to help guide monetary policy decisions (the target for the base rate). In addition to the assumed price of oil (and its impact on the tenge exchange rate), the forecast presented in the report assumes the value of other important "exogenous" variables, such as the stance of fiscal policy, the growth rates of major trading partners and the assumed policy base rate. These assumed values are not reported. It is impossible to interpret an inflation forecast without knowing the policy stance (base rate) assumed when it was generated. The report should also add data on exchange rate developments and financial exchange market interventions by the NBK.

The Monetary Policy Guidelines for the Republic of Kazakhstan for 2016 provides a good account of the domestic and international economic situation at the end of 2015, and the factors to be considered when determining monetary policy in 2016.

It states: "Important factors that will be taken into account in establishing the base rate are: the rate of actual and forecasted inflation and inflation expectations; [the] pattern of the domestic demand; economic growth rates; expectations regarding the exchange rate of the tenge; and the extent of deposit dollarisation."

But, as noted above for the Inflation Report for the third quarter of 2016, it fails to indicate the values for any of these factors – other than the assumed price of oil – upon which the inflation forecast was based.

In addition, the review of the actual outcome for the previous year should include a comparison of the outcome with the earlier base line forecast for the same period, as well as with an inflation forecast using the actual values of the exogenous variable (such as the actual price of oil). An explanation of the forecast errors, and how monetary policy reacted to them, will strengthen both the MPTC and the public's understanding of policy formulation in relation to the inflation target.

The press releases at the time of changes in the monetary policy base rate target provide important and useful information on the intent of monetary policy. The recent release of February 20, 2017, sets a good standard for such communications. On November 15, 2016, the NBK introduced a new press release with its latest inflation forecast and, as with the base rate target press release, the new release sets a high standard, both in terms of timeliness and content. However, the forecast fan chart should identify the confidence intervals for each colour range and the base line assumption for the base rate should be stated.

The transition

While preparing to implement its inflation forecast-targeting regime, the NBK retained its managed exchange rate regime. However, over the six years from 2002 to the end of 2008, the tenge appreciated significantly from 155 to 120 tenge per US dollar. This, along with the plunge in oil prices ($154 to $47 per barrel of West Texas Intermediate between June 2008 and January 2009), the sharp depreciation of the Russian ruble, and the global financial turmoil emanating from the US, necessitated the depreciation of the tenge back to its earlier 150 range, where it remained for the next five years.

The global financial crisis sharply curtailed foreign capital inflows. Domestic credit growth stopped almost completely, precipitating a domestic financial crisis, and exposing weaknesses in the banking sector and its supervision. As a result, growth in real output in Kazakhstan dropped to about 1% in 2009, although high growth rates resumed quickly in 2010, along with the recovery of oil prices until another sharp fall in world oil prices in mid-2013 (from more than $100 to $30 per barrel within six months) precipitated another depreciation of the tenge (from 155 at the beginning of February, 2014 to 182 tenge/US dollar in mid-February 2014).

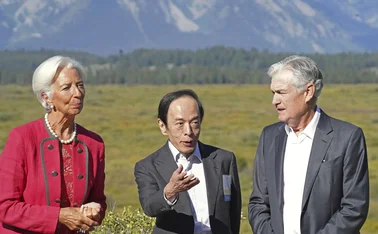

The NBK has various instruments it uses to influence tenge liquidity

The NBK has various instruments it uses to influence tenge liquidity

The tenge/US dollar rate remained very close to this new February 2014 rate until August 20, 2015, when the NBK announced the fully fledged launch of its inflation-targeting regime with market-determined, freely floating exchange rates. On August 21, the rate depreciated dramatically from 188 to 255 in one day. After modestly retrenching, the depreciation proceeded at a more modest pace until it peaked at 384 tenge/dollar on January 22, 2016. For the rest of the year, the rate averaged around 340 tenge/US dollar, but varied between 328 and 354. It depreciated further very modestly in the first two months of 2017. Reductions in earlier bank forex exposures (net open positions) have enabled the sector to weather these wide exchange rate swings without significant losses. NBK's supervision of banks needs to carefully monitor these exposures.

Exchange rate pegs or targets can be prone to speculative attacks when markets anticipate the need for an exchange rate adjustment. Large changes in oil prices, as occurred in mid-2013, generally produce such expectations. Adjustments in pegged rates are generally abrupt and often result in temporary overshooting of the rate.

Adjustments in freely floating exchange rates to changes in fundamentals tend to be more orderly, with little or no loss of the central bank's forex reserves.

In any event, an inflation-targeting regime requires floating exchange rates, with central bank intervention in the forex market only for the purpose of moderating excessive volatility. In the uncertain environment of late 2015 and some capital flight pressure, the announced launch of the NBK's inflation-targeting regime and free floating of exchange rates on August 20 was motivated partly to allow full exchange rate adjustment to the changed fundamentals, thereby eliminating expectations of further adjustments, and to bring greater certainty to the market with regard to future monetary policy.

The tenge's free float over the past year should – and seems to – have led to a gradual deepening of the forex market such that rates should be relatively stable until or unless the economic environment changes (such as oil-price changes) in ways that call for exchange rate adjustments. NBK's interventions in the forex market in 2016 were significantly reduced, and were zero from September 2016 through January 2017 (the latest available), indicating a deepening of the market. The NFRK is the government's primary instrument for dealing with the macroeconomic and monetary policy impact of oil-price changes, and the rules governing its operation should be carefully reviewed in this light.

The way ahead

The NBK has been developing its capacity to implement an inflation forecast targeting regime for more than a decade. Headway was severely limited by the lack of budgetary support, and the global financial crisis emanating from the US in late 2007 and 2008 also interrupted the process. Progress has accelerated significantly over the last several years though, especially since the launch of inflation forecast targeting in August 2015.

The NBK's Monetary Policy of the Republic Of Kazakhstan to 2020 provides a sound blueprint for continuing and completing the adoption of inflation forecast targeting.

The goals set out should be completed. The most challenging needs are to continue strengthening the FPAS and financial markets, and thus the relationship between the base rate and other market interest rates (and inflation).

Strengthening the FPAS requires:

- Additional highly qualified full-time staff, and continuous testing and improvement of econometric and forecasting models.

- Regular dialogue between the FPAS and the MPTC (and future monetary policy committee) over policy options and decisions.

Strengthening the interest rate and credit channels for transmitting monetary policy requires:

- Refining the NBK's management of market liquidity and therefore its control of short-term market interest rates.

- Understanding and removing sources of financial market segmentation in inefficiencies.

Strengthening the role of the NFRK in absorbing oil-price shocks requires the review and adjustment of its rules for adding and withdrawing forex to and from the fund. Aside from the rules governing the National Fund, impressive progress has been made in all of these areas over the past two years (2015–16). The NBK's inflation target is currently 6–8%, and the actual rate from a year earlier through January 2016 was 7.9% and trending down.

Warren Coats worked for the International Monetary Fund for 26 years, where he led technical assistance missions to the central banks of post-conflict countries, such as Bosnia and Herzegovina, Croatia, Kosovo and Serbia, as well as to other countries, including Bangladesh, Bulgaria, China, Czech Republic, Egypt, Hungary, Israel, Kazakhstan, Kyrgyzstan, Macedonia, Moldova, Nigeria, Slovakia, Slovenia, Turkey, and the West Bank and Gaza Strip. He was USAid BearingPoint senior monetary policy adviser to the Central Bank of Iraq between 2004 and 2008, and an IMF consultant on monetary policy to the Bank of Afghanistan from 2002–13 and the Central Bank of Kenya from 2009–10. He has also served on the board of directors of the Cayman Islands Monetary Authority. The author's involvement with the National Bank of Kazakhstan (NBK) spans almost a quarter of a century. He led six IMF technical assistance missions to the NBK in 1992 and 1993, and provided inflation-targeting assistance to the bank with USAid/BearingPoint in 2005–06, the Asian Development Bank (2007–08) and Economic Consulting (2014–15).

1. Odling-Smee, John and Gonzalo Pastor, The IMF and the Ruble Area, 1991–93, IMF Working Paper WP/01/101, (Washington, DC, International Monetary Fund, 2001).

2. The author led six technical assistance missions from the IMF to the NBK between March 1992 and March 1994, which included technical experts on all major areas of central banking provided by the central banks of Austria, Belgium, Canada, England, France, Italy, Japan, Netherlands and the US. These missions continued under other leaders for several more years.

3. Husain, Aasim M, To Peg or Not to Peg: A Template for Assessing the Nobler, IMF Working Paper WP/06/54, (Washington, DC, International Monetary Fund, 2006).

4. An excellent summary of this history and of the NBK’s plans for implementing inflation targeting over the next few years are presented in Monetary Policy of the Republic of Kazakhstan to 2020, approved by the board of the NBK on June 17, 2015 (Almaty, National Bank of Kazakhstan, 2015).

5. Conrad, Jürgen, Three dimensions of the banking crisis in Kazakhstan (Manila, Asian Development Bank, 2008).

6. Overview of monetary policy of the National Bank of Kazakhstan, Press Release No 20 (Almaty, National Bank of Kazakhstan, September 14, 2004).

7. Article 7: The Main Purpose and Objectives of the National Bank of Kazakhstan, Law No. 2155 of March 30, 1995, of the Republic Of Kazakhstan, as amended on July 10, 2003.

8. Lybek, Tonny, Ingvild Svendsen and Turgut Kışınbay, Kazakhstan: Implementing Inflation Targeting: Next Steps (Unpublished; Washington, DC, International Monetary Fund, 2004).

9. The NBK has received advice and assistance in developing the above capacities from several sources. The author, working with econometrician David Kemme, has been advising the NBK on the implementation of inflation targeting since 2005. Their work was supported by USAid in 2005–06, by the Asian Development Bank from 2007–08, by USAid Project for Economic Reforms to Enhance Competitiveness in 2009, and by the NBK from 2014–15.

10. In addition to adding Karel Musil to our team, assistance was provided by staff from the Czech National Bank.

11. Laxton, Douglas, David Rose, and Alasdair Scott, Developing a Structured Forecasting and Policy Analysis System to support Inflation-Forecast Targeting (IFT), IMF Working Paper WP/09/65, (Washington, DC, International Monetary Fund, 2009).

12. Coats, Warren, Douglas Laxton and David Rose, The Czech National Bank’s Forecasting and Policy Analysis System (Prague, Czech National Bank, 2003).

13. Naceur, Sami Ben, Amr Hosny and Gregory Hadjian, How to De-Dollarize Financial Systems in the Caucasus and Central Asia?, IMF Working Paper WP/15/203 (Washington, DC, International Monetary Fund, 2015).

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test