International

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions

Nordic central banks sign currency swap agreement

Norwegian, Swedish and Danish central banks conclude bilateral swap deals

Argentine peso falls after central bank changes regime

Spread with unofficial exchange rate widens further

The eurozone’s eastern conundrum

Bulgaria and Croatia expect a net positive effect as they take final steps to join the euro, while the Czech Republic, Hungary and Poland remain reluctant

Structural changes may increase dollar funding strains – IMF paper

Some emerging markets still face “significant funding pressure”, researchers find

Crises enliven ‘totalitarian temptations’

The coronavirus pandemic will embolden governments and bodies such as the International Monetary Fund to grasp for more power, writes Steve Hanke

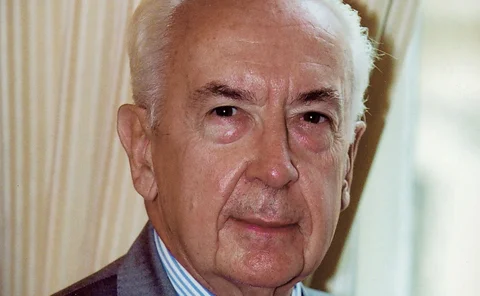

Major economies already engaging in ‘currency wars’ – former IMF chief

De Larosière floats new commodity-based exchange rate regime; says “trust” is key to avoiding “beggar-thy-neighbour” policies

Fed cuts rates 100bp as central banks launch joint action

US central bank unveils unprecedented coronavirus response package as global swap lines are bolstered through co-ordinated action

Major central banks ready to respond to coronavirus

Fed, ECB and Bank of Japan say they are willing to act; central bank events disrupted

Higher oil prices dampened impact of Fed spillovers in Gulf – IMF paper

Changes in Fed rates likely to have minimal impact on GCC growth with current oil prices, researchers say

Risk of hitting ZLB in the future reduces inflation today – Fed paper

Policy-makers could use “risk-adjusted policy rule” to offset risk of undershooting, researchers say

BIS’s Borio warns interacting financial cycles destabilise global system

Domestic and global cycles interact and amplify one another, BIS official says

IMF paper tracks Asian authorities’ responses to volatile capital flows

Monetary policy typically responds to several variables in pursuit of greater stability, analysis finds

Fed paper looks at US spillovers to foreign government debt yields

Fed has “economically large” impact on some dollar-denominated bond yields, researchers find

King calls for radical shake-up to escape ‘low-growth trap’

Central bank models fail to appreciate demand-side secular stagnation; IMF could help to drive country-specific policies to reallocate resources

‘Hegemonic digital currency’ could help fix global system – Carney

Using CBDC to facilitate online sales could bring about more rapid change, governor says

Tackling ‘dead-end’ monetary policy

A shift to lower inflation targets would help central banks escape forever-loose monetary policy, writes former IMF chief Jacques de Larosière

EMEs can resist spillovers with prudential policy – BoE paper

Some prudential policies work better than others, researchers find

Expectations and term premia both drive spillovers – BIS paper

Different components have greater impacts in advanced and emerging economies, authors find

Seven threats from big tech’s libra

Can central banks avoid a ‘big tech’ monetary meltdown?

BoE paper: ‘tails’ matter when studying global financial cycle

Authors look to the tails of the distribution to understand exchange rate risk in the global cycle

A key message from Jackson Hole: policy must globalise

Setting policy in isolation is becoming untenable and spillovers must be considered more, remarks suggest

Carney: digital currency could help fix global monetary system

A “synthetic hegemonic currency” could end the destabilising dominance of the dollar, BoE chief says

Agustín Carstens on fixing the global monetary system

The BIS chief speaks about how to strengthen the global safety net, vulnerabilities in emerging markets and the challenges and opportunities posed by fintech