Kenyan banks forced to reveal hidden loan fees

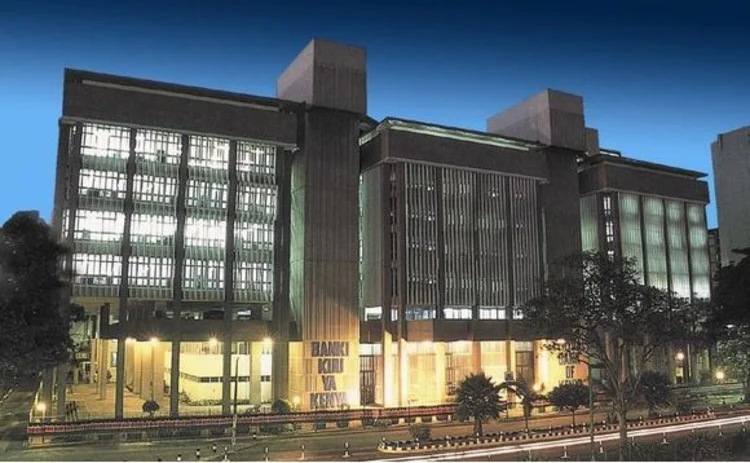

Kenya’s central bank begins effort to repeal interest rate cap

Banks in Kenya will be forced to disclose any extra fees attached to loans from September 1, as the country’s central bank looks to lay the ground for the removal of interest rate caps.

“[The] CBK now mandates all commercial banks to upload their respective internal and external fees for all products on the cost-of-credit website to enable customers make rational financial decisions,” the central bank announced, as part of a new banking sector charter.

In May 2017, the central bank and Kenya’s

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com