The growing role of China in an interconnected world

Chinese structural reforms will help global growth in the years ahead

The past seven years have represented the most treacherous economic recovery since the Great Depression. In 2015, global economic activity remained subdued; although emerging market and developing countries still accounted for more than 70% of global growth, the US economy slowed in the fourth quarter of 2015 to a 1% increase in GDP, and 2.4% for the year as a whole. Europe and Japan are still not out of the woods, where quantitative easing and negative interest rates are still on the policy agenda. Some economists are discussing the possibility of 'secular stagnation' and the International Monetary Fund has issued warnings on prolonged period of low growth and high unemployment as the world's 'new normal'.1 Three main factors underlie the global outlook: first, the gradual slowdown and structural changes in China; second, dramatic decline in the prices of oil and other commodities; and third, a gradual tightening in monetary policy in the US, which has resulted in capital outflows from developing countries into the north American superpower.

In early January this year, the world received a wakeup call in the form of stock market turmoil and currency depreciations, often attributed to concerns about a Chinese hard landing. The events in January demonstrated the world is increasingly more interconnected and the Chinese economy is playing a more important role than before. China's fundamentals remain quite strong, as shown below. Given its large economic size, with annual GDP of $11 trillion, second only to the US, its economic growth, even though slowing to 6.9% in 2015, accounts for a significant amount of global growth. In the first quarter of 2016, China's GDP grew at an annual rate of 6.7%, with other indicators such as transport and electricity consumption strongly supporting this data. China's strong growth has built confidence in the global economy.

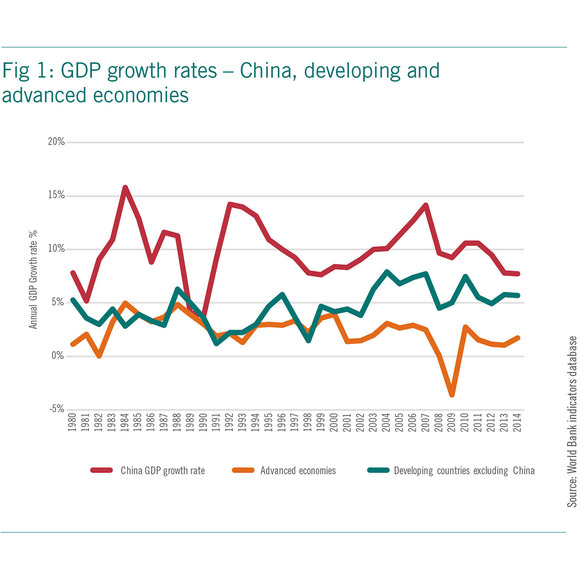

Figure 1 shows China's GDP growth rates compared with those of the developing countries and industrial countries. It shows a wide divergence – indicating a three-speed global economy, with China outperforming developed and other developing countries during the past 20 years. While China's secondary industry (manufacturing) growth slowed to 6.0% in 2015 from 7.3% in 2014, tertiary industry (services) expanded by 8.3% last year, up from 7.8%.

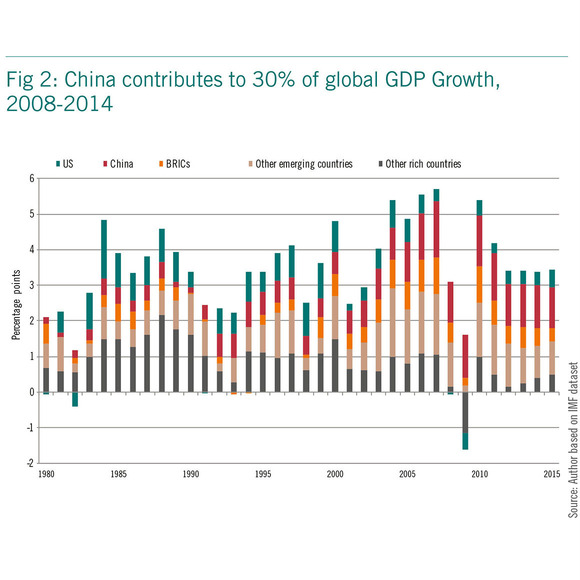

In Figure 2, using GDP in purchasing power parity terms as the weight, it can also be seen that China's GDP growth has accounted for an average 30% of global GDP growth since the 2008 financial crisis. As a result, during the global financial crisis, the Chinese economy served as the strongest pillar without which the global recession would have been a global depression. Even now, with the Chinese economy gradually slowing, due to its large size the incremental nominal GDP of more than $700 billion per annum adds another 'Switzerland' each year to the world economy.

The IFF China Report 2015 stated that Chinese leaders were already determined to implement "accelerated and deeper structural reforms to the economy". Since then, significant progress has been made in China's structural transformation, whether it is in consumption, services and export structure, or innovation and green financing. There is also more reform on the way, as outlined in China's plan for the next five years – the Thirteenth Five Year Plan. The aim during the next five years is to achieve more balanced, innovation- and consumption-driven, inclusive and sustainable development. A particular focus for China's reform and investment strategies includes – but is not limited to – its One Belt, One Road strategy, which will have an impact that will be felt around the world.

The IFF China Report 2015 stated that Chinese leaders were already determined to implement "accelerated and deeper structural reforms to the economy". Since then, significant progress has been made in China's structural transformation, whether it is in consumption, services and export structure, or innovation and green financing. There is also more reform on the way, as outlined in China's plan for the next five years – the Thirteenth Five Year Plan. The aim during the next five years is to achieve more balanced, innovation- and consumption-driven, inclusive and sustainable development. A particular focus for China's reform and investment strategies includes – but is not limited to – its One Belt, One Road strategy, which will have an impact that will be felt around the world.

Rationales for structural transformation

History since the industrial revolution has shown that structural transformation is critical to economic development. However, mainstream economics has paid little attention to structural transformation and industrialisation during the past two decades. Insufficient amounts of resources have been invested in economic and industrial infrastructure, especially in many developing countries. As a result, many countries have suffered from deindustrialisation. Africa, for example, has seen its share of manufacturing in GDP terms stagnating for 40 years. Only a few developing economies that industrialised and grew dynamically after World War Two – most of them in east Asia – followed an export-oriented development strategy.

In the interconnected world, structural transformation is even more critical and difficult because goods and services are relatively freely traded across borders, yet 'factor endowments' such as physical, human and natural capital (eg land), face barriers or are either completely immobile across borders or facing barriers. Many developing countries have attempted to catch up with industrial countries but failed; some appear trapped in the position of natural resource and primary product exporters, unable to diversity their economies. During the last half a century, only 28 countries were able to close the income gap with industrial countries by 10% or more. Among these 28 countries, only 12 were non- European and non-resource-based countries.2

Industrialisation and its upgrading were recognised as one of the main engines of economic growth, especially in the early stages of development. The manufacturing sector, in particular, offers new possibilities for the production of tradable goods, including technology. Manufacturing plays a crucial role in employment generation. In 2013, there were more than 500 million jobs in manufacturing, allowing for greater inclusiveness and gender equality, according to the United Nations Industrial Development Organization's Industrial Development Report 2013.

New structural economics, which attempts to combine structural economics and neoclassical economics and is promoted by economists such as former World Bank chief economist Justin Yifu Lin, starts with the observation that the nature of modern economic development is a process of continuous structural change in technologies, industries and hard and soft infrastructure. This makes the continuous increase in labour productivity and per capita income in an economy possible. The optimal industrial structure in an economy at a specific time is endogenous to its comparative advantage, which in turn is determined by the economy's given endowment structure at that time.

History in the making

Yu Hongjun explains why the One Belt, One Road initiative is a historic opportunity to integrate the interests of various nations and build new international relations.

Compared with the initial regional co-operation between China and its surrounding nations in the past, which was extensive but low quality and small scale, the One Belt, One Road initiative adopts a far more advanced concept of partnership. This builds on the experience China has drawn from the past, and the stock of capital and talent it has accumulated.

China has built eight road ports and two railway ports connecting central Asia with a surge of goods exchanges, personnel exchanges and capital flows. The trade volume between China and central Asia has reached $45 billion. The China-Kazakhstan oil pipeline, China’s first transnational oil pipeline, has transported 80 million tons of crude oil to China; and the Turkmenistan-China gas pipeline transports natural gas to coastal areas in southeast China, meeting the region’s huge demand. These efforts serve as a demonstration in facilitating interconnectivity between China and central Asia. Through such broad, high-level and multi-dimensional co-operation, China has obtained a better understanding of regional co-operation and thus proposed the strategic vision of the Belt and Road initiative.

Promoting ‘south-south’ co-operation

There are many mechanisms and platforms for ‘south-south’ co-operation. But the imbalanced development among such different countries and regions has hindered efforts. In addition to the China-Africa Co-operation Forum and the China-Latin America Co-operation Forum, China has recently launched the China-Pacific Island Countries Economic Development and Co-operation Forum. Based on such platforms and partnership frameworks, the Belt and Road initiative not only mobilises more than 60 countries along the path, but can also incorporate countries far away in the South Pacific; Latin America; north, west and east Africa. Furthermore, the many enthusiastic responses to the establishment of the Asian Infrastructure Investment Bank were beyond China’s expectation. So, the Belt and Road initiative will promote and reform south-south co-operation.

Innovative efforts in international relations

Although China has been highlighting the importance of building a more impartial and reasonable international political and economic order since the 1970s, unreasonable, unfair and unhealthy components still exist. Therefore, building a new, fair and reasonable order is a common issue faced by all countries.

China has proposed some new concepts and visions through its diplomatic practices in recent years. It has proposed a partnership network with global coverage and a new type of international relations. This requires shared development, prosperity and progress. Through creating common interests and missions, the Belt and Road initiative integrates the interests of various nations and builds new international relations along the path.

As the international community has higher expectations of China, the country will shoulder more responsibilities. Promoting and implementing the Belt and Road initiative is a historic opportunity and China should grasp this moment to play its part in global affairs and take its rightful place in the international community as a major developing country and as one of the world’s oldest civilizations. It should fulfill new missions and responsibilities in the progress of humankind.

Yu Hongjun is an IFF Advisory Committee member, member of CPPCC Sub-committee of Foreign Affairs, and vice-minister of the International Department of the CPC Central Committee.

Economic development is therefore a dynamic process marked with externalities and requiring co-ordination. While the market is a necessary basic mechanism for effective resource allocation at each given stage of development, governments must also play a proactive, enabling role to facilitate an economy to move from one stage to another. Policy-makers must intervene to allow markets to function properly. They can do so by: (i) providing information about new industries that are consistent with the new comparative advantage determined by change in the economy's endowment structure; (ii) co-ordinating investments in related industries and the required improvements in infrastructure; (iii) subsidising activities with externalities in the process of industrial upgrading and structural change; and (iv) catalysing the development of new industries by incubation or by attracting foreign direct investment to overcome the deficits in social capital and other intangible constraints.3

Because the optimal industrial structure at any given time is endogenous to the existing factor endowments, a country trying to move up the ladder of technological development must first change its endowment structure. With savings and capital accumulation, the economy's factor endowment structure evolves, pushing its industrial structure to deviate from the original structure determined by its previous level. If the economy follows its comparative advantage in the development of its industries, its industries will have the lowest possible factor costs of production and thus be most competitive in domestic and world markets. As a result, they will gain the largest possible market share and generate potentially the largest surplus. Capital investment will also have the largest possible return.

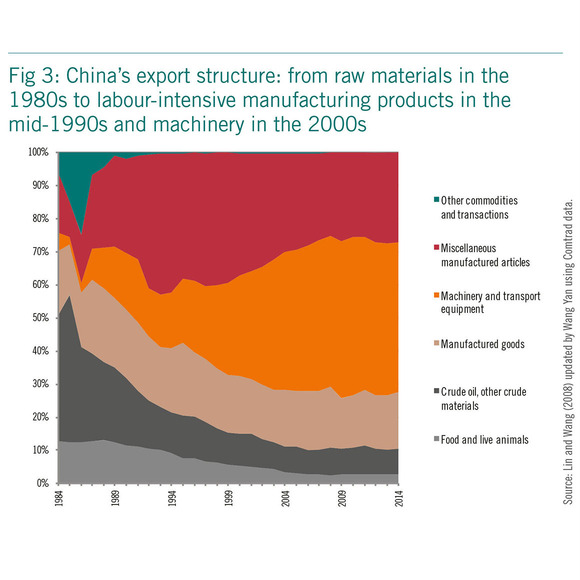

Structural transformation is not new – China has achieved a dramatic structural transformation during the past 37 years of opening and reforms. As mentioned in section three of the IFF China Report 2015, when China started its economic transformation in 1978, it was an agrarian economy with per capita income of $154. China was also an exporter of primary products – as late as 1984, 50% of China's exports were concentrated in crude materials including crude oil, coal, food and animals, and other agricultural products (Figure 3).

China's structural transformation and 'moving up' the value chain involved an industrial upgrade in 1986, when exports of textiles and clothing exceeded crude oil. The second upgrade happened in 1995, when China's export of machinery and electronics exceeded textiles and clothing. The third upgrade happened after China's accession to the World Trade Organization (WTO) in 2001, when high and new tech exports grew rapidly and the level of product sophistication increased. Central and local government conducted regulatory reforms to improve the investment climate. Some exporters have become integral parts of the global supply chains of multinationals in automobiles, computers, cell phones, and airplane parts. China has grown to be the 'world's workshop'.

During the transition process, China adopted a pragmatic, gradual, dual-track approach. China's industrial upgrading is continuing at an accelerated speed. Secondary industry, or manufacturing, grew at a slowing rate of 6% in 2015 but service sector growth hit 8.3% in 2015. Now, services account for more than 50% of GDP. In addition, household consumption has also risen strongly, accounting for 66.4% of GDP, increasing 15.4% during the previous year. In particular, the middle-class has grown to be more 109 million people, outnumbering that of the US at 92 million. Their consumption is expanding rapidly and become more selective; demand for high quality and safe products is growing fast.

China's rapid upgrading of its services export

In the IFF China Report 2015, it was stated that China has committed to continue to liberalise its trade policy and the composition of its trade in services has been changing This trend continued in 2015. Last year, China formally accepted the WTO's trade facilitation agreement and became the sixteenth member to accept this protocol, demonstrating its commitment to support the multilateral organisation's agenda.

‘New normal’ obstacles and trends

Zhang Yansheng looks at five obstacles China must overcome in its transition from old normal to new normal.

China is embarking on a major transition. Many practices and procedures adopted in the past 35 years will have to change as the country moves from the ‘old normal’ to the ‘new normal’. It must contend with numerous difficulties, deal with increased risks and avoid imbalanced economic growth. At the same time, new opportunities will emerge. The coming years will be a critical period for the country.

Five obstacles to transition

- China will need to move up the value chain. There is a key distinction that separates business models in east Asia – on one hand, there is original equipment manufacturing (OEM), known as the small-country model; and on the other, there is original brand manufacturing (OBM), adopted by developed countries such as Japan and the Republic of Korea. China must abandon OEM and adopt OBM.

- The country must find a new niche in the international division of production. India has 400 million young people aged 15 to 35. They will put an end to China’s low-cost advantage when they begin to play a part in economic globalisation as India’s infrastructure improves, its manufacturing sector becomes more productive and its investment environment develops. Upgrading China’s manufacturing industry requires technology, talent, brand, capital, experience and capacity – things the country still lacks.

- China has to achieve the transition from copying and imitation to innovation, especially technological innovation. This requires transformative changes in education, the environment and individuals.

- China must abandon the mentality of “crossing a river by groping the stones along the way”, in favour of normative practices based on the rule of law. This transition will be harder now than 35 years ago.

- The economic model relying on exports and attracting investment will not endure. In the Fifth Plenary Session of the 18th CPC Central Committee it was proposed that, to be deeply integrated into the world economy, China has to build a new, open economy on a higher level.

While it will take time to reach the ‘new normal’, five trends are already emerging that are likely to persist as the transition continues.

Five emerging trends

- The ratio of R&D expenditure to GDP is constantly rising. From 1.75% in 2010, it increased to 1.98% in 2012 and is expected to exceed 2.1% in 2015 (including more than 4% in Shenzhen). Of the R&D expenditure, 76.6% is contributed by enterprises, which shows they are starting to attach importance to investment in R&D, innovation, consulting and human resources.

- China is increasing the amount of value-add in its output. In the services sector, the ratio of value-add to GDP is constantly rising. It rose from 44.6% in 2012 to 51.4% in the first half of 2015.

- The contribution of consumption to economic growth is on the rise, accounting for 58.2% of growth in the first three quarters of 2015.

- China is experiencing a new type of urbanisation. The percentage of China’s population living in urban areas is 55% – and it is expected to reach 70%. Hence, the country is entering a period of accelerated development.

- Income disparities between urban and rural areas, among residents and across regions within China, are narrowing rapidly. The ratio of urban income to rural income fell from 3.33x in 2009 to 2.84x in the first half of 2015, and the Gini coefficient is also falling. To narrow the gap across regions, China should prioritise the development of its western regions.

Zhang Yansheng is an IFF Academic Committee member and secretary general of the Academic Committee, National Development and Reform Commission.

Although the share of low-end service export such as travel has fallen significantly, the share of high-end, knowledge-intensive services has risen significantly. These high-end services include:

- Financial services (micro-enterprise development, scientific innovation, green economy, cross-border operations of enterprises, new service formats such as online trading, as well as innovative financial products and services models) exports rose from 1% of total service exports in 2005 to 4% in 2014.

- High-tech services (information services, software development, information systems integration services, internet value-added services, information security services and digital content services) rose from 3% in 2005 to 8% in 2014.

- Business services (accounting, auditing, taxation, engineering, consulting, standards certification and accreditation, credit evaluation, brokerage, management consulting, market research and other professional services) rose from 22% in 2005 to 29% in 2014.

- Construction services exports rose significantly from 3% in 2005 to 6% to 2014, doubling the share in this sector and demonstrating China's comparative advantage in this sector.

- Transport services remained roughly the same share from 17% to 16%, while the share for goods-related services, especially logistics services have declined significantly from around 20% in 2005 to 9% in 2014. This is due to the weak global demand for trade in goods. Again, this indicates that export of goods is no longer a powerful engine of growth, as we had shown in our 2015 report.

Dual economy: successful vs failing parts

The experiences of developing countries – including China – during the past few decades indicate that both the pace and the quality of growth are critical for achieving welfare improvements. China has achieved the fastest poverty reduction in the world: more than 660 million people have lifted themselves above the international poverty line of income exceeding $1.25 per person per day. In 2015, personal per capita disposable income increased by 7.4% in real terms, overtaking the economy's growth rate. In rural areas, greater alleviation efforts have reduced the number of people living in poverty by 14.42 million last year and more than 100 million in the past five years in total. However, while fast economic growth is essential to poverty reduction, some growth patterns are more effective than others in reducing poverty, improving wellbeing, promoting equity and stimulating innovation.4 That is why improving the quality of growth has been placed so high on the policy agenda.

The IFF China Report 2015 highlighted that China's unique central-local governance system has facilitated many institutional innovations, such as special economic zones and a central-local revenue sharing system that have motivated local governments, state-owned enterprises, private companies and households to pursue growth through a trial-and-error approach. As a result,"35 years of high growth have created a dual economy, with both successful and failing parts”, the report stated. During the past year, the structural imbalances of the dual economy in China have become more apparent. They can be summarised as structural, financial and systemic.

The fundamental goal of the ‘supply-side reforms’ is to raise the social productive level and to implement the people-centred development theory

Xi Jinping, president of the People’s Republic of China

It has been long recognised that the institutional barriers discouraging rural-urban migration (hukou) are major impediments for poverty reduction, and contribute to inequalities in health, education and employment opportunities, as well as mounting social problems of ‘left-home children’ and dismantled families. The fragmentation of social insurance systems is also a major impediment for labour market mobility, economic efficiency and social fairness. It is also a major barrier for urbanisation and the integration of urban and rural migrant populations.

Institutional barriers between rural and urban dwelling are now largely dismantled, after many years of gradual reforms. All major cities have established a scoring system to gradually integrate rural migrant workers into the urban system, providing them with residential rights, social insurance and rights for their children to be educated in the cities. Pension systems are also being unified. Based on reforms unveiled in early 2015, insurance for workers in government agencies and public institutions will now be paid by both workers and the organisations, instead of just by the organisations or from central finance as in the past. The aim is to build a system for government and public institutions that is similar to the one employed by the private sector, facilitating a more free flow of staff between private and public agencies. In January 2016, urban residents’ basic medical insurance integrated with new rural cooperative medical system, and a unified urban and rural residents’ basic medical insurance system was established. Under the new medical insurance scheme, residents can purchase insurance according to the unified policy and enjoy treatment, no longer restricted by the identity of urban or rural residents.

The State Council has also cut red tape by streamlining a number of regulations and reduced the number of licenses that need to be issued and approvals granted. According to the newly delivered Report on the Work of the Government,5 last year alone saw the delegation of power or cancellation of the requirement for government review for 311 items. In the past three years, the State Council has delegated the power or cancelled the requirement for government review for 618 items in total, about 40% of the original items, of which 491 items are completely cancelled. A lot of cancelled items are directly related to the operation of enterprises, benefiting a wide range of projects, thus greatly stimulating the economic and social development.

In the past two years, the State Council has cancelled 258 non-administrative review items, accounting for 57% of the original. The rest of the non-administrative review items are adjusted to either administrative review items or internal government approval items. The State Council has put a complete stop to the practice of non-administrative review, after reducing the number by 57% in the past couple of years. The number of items that require government approval for new businesses prior to registration was cut by 85% and the system of a separate business license, organisation code certificate and taxation registration certificate was replaced by a unified business license with a unified social credit code.

In May 2015, 49 non-licensing examinations and approvals items were cancelled after the motion of sharply decreasing the non-licensing examinations and approvals items in the earlier stage. Last year, the State Council cancelled the requirement for verification or approval for 123 professional qualifications and in 2016, 62 certifications were further cancelled to reduce obstacles to the employment of young people. Professional qualifications will not become the employment threshold. By changing management ideas and simplifying procedures, China can encourage talented people to show themselves, enhance labour and working qualities in various industries, and promote public entrepreneurship and innovation.

There are, however, a number of areas where further institutional reforms are needed, most importantly in finance (see section two) and in state-owned enterprises.

Supply-side policy reforms

Most economists agree that after seven years of expansionary monetary policy by central banks around the world, including zero interest rates and multiple rounds of quantitative easing, Keynesian economic policies focusing on aggregate demand have reached their limit. As a result, some Chinese economists have turned their focus to supply-side economic policies. Other economists believe both demand-side and supply-side factors must get attention.7 For example, at the twelth meeting of the Central Leading Group on Financial and Economic Affairs held on January 26, 2016, President Xi Jinping emphasised: “The fundamental goal of the ‘supply-side reforms’ is to raise the social productive level and to implement the people-centred development theory. We should moderately expand the total market size and at the same time reduce overcapacity, reduce inventory, reduce leverage, lower administrative burdens, lower production and transaction costs and strengthen where there is deficiency. High quality supply in the production field should be strengthened, reducing ineffective supply and expanding effective supply. The adaptability and flexibility of the supply structure and the total factor productivity should be improved, so that the supply system can better adapt to the demand structure.”

Prime Minister Li affirmed at the Thirteenth Five-Year Plan’s preparation forum, which gathered experts at home and abroad, that: “China has been promoting the structural reform these years, without strong stimulation, which is a very tough process. In the future, we would improve both supply side and demand side, and accelerate the structural reform.”

Global economic development and China’s prospects

Zhu Guangyao’s view on how China plans to maintain its growth momentum against a complex international backdrop.

Last year, we saw the global economy endure its most severe and complex situation since the global financial crisis of 2008, as demonstrated by the following observations:

Challenging landscape

First, the global economic growth rate fell. The International Monetary Fund (IMF) cut the rate four times in a row last year, from 3.8% to 3.1%, suggesting the global economy remains perilously close to another recession.

Second, global trade growth declined. The World Trade Organization (WTO) revised it down from 3.1% to 2.8%, nearly half the average of 5.2% during the past 20 years. The fact that 2015 saw trade expand more slowly in developing countries than developed countries – 2.4% compared to 3%, according to the WTO – is particularly alarming.

Third, global interest rates reached their lowest level since World War Two. The European Central Bank, the Bank of Japan and the Swiss National Bank have all implemented negative interest rates. Nevertheless, since liquidity expansion does not appear to support the real economy, small and medium-sized enterprises are still facing financing difficulties.

Fourth, monetary policies in advanced economies are further diverging. The US Federal Reserve has started to raise interest rates while the central banks of the eurozone and Japan have continued to expand their quantitative easing policies. China should monitor how the major advanced economies develop monetary policies, and the impact of their severe divergences on the world’s economy and financial markets.

Fifth, commodity prices kept falling. This trend looks poised to continue and will influence both importers and exporters in 2016. Sixth, emerging economies that underpinned international economic growth following the global financial crisis of 2008 are struggling – particularly Russia and Brazil. According to IMF data, Russia’s economy shrank by 3.4% and Brazil’ s by 3% in 2015. These challenges must be addressed as soon as possible.

Last but not least, geopolitical risk has increased, putting downward pressure on financial markets.

Against this international backdrop and facing the arduous task of domestic structural reform, China maintains its growth momentum while pushing ahead with reforms. China’s economy grew by 6.9% in 2015 and continued to contribute about 30% of global growth.

China’s integration to the world economy

The Thirteenth Five-Year Plan explicitly emphasises a growth strategy with a philosophy of innovative, co-ordinated, green, open and shared development. President Xi Jinping has also indicated that China’s annual growth rate should not be less than 6.5% in the next five years, underpinned by inclusiveness and sustainability. And China’s 2010 GDP and per capita personal income will be doubled by 2020. For the first time, the Belt and Road initiative is included in the Five-Year Plan explicitly, combined with a domestic economic development plan, showing China’s blueprint for future development both domestically and internationally.

President Xi Jinping has emphasised the openness, diversity and win-win nature of the Belt and Road initiative, which welcomes all countries to join the effort by various forms of co-operation, with the same goal of common development. The Belt and Road initiative is not a private route for any particular country but rather an avenue for all joining hands. On this basis, China will  strengthen its co-operation with all countries to achieve common development.

strengthen its co-operation with all countries to achieve common development.

Zhu Guangyao (pictured) is China’s deputy minister of finance.

The supply-side structural reforms appear to include, but are not limited to, the following elements:

- Reducing the tax burden for enterprises, especially for SMEs and for new ventures. This is what the government has been doing for quite some time with the reform to "replace the Business Tax with a value-added tax" will be expanded on August 1, 2016 in service sectors. Premier Li said: "We will ensure all sectors face a reduced burden." A total of 85% of China's tax revenue has been collected from enterprises and their tax burden needs to be reduced. According to a recent paper by Sheng Songcheng, China's corporate tax rate is high compared with international level. And the corporate tax rate grows faster than income, meaning the tax burden continues to increase, especially for SMEs. Measures such as cutting corporate tax, increasing subsidies or more effective implementation of structural tax cuts can be adopted to reduce the tax burden of SMEs as well as strengthening the microeconomic vitality of Chinese economy. Sheng proposes a reduction in indirect taxes and an increase in direct taxes, reducing taxes on goods and services while expanding income tax, and increasing corporate subsidies and tax concessions based on national development strategy.8

- Reducing excess capacity and eliminating outdated and polluting industries – by closing down some steel plants and coal mines. About 500,000 steel workers are set to be laid off because their steel mills will be closed to reduce overcapacity in the steel sector. Across many provinces, hundreds of small and medium-sized coal mines have been closed down. A document issued by The Bureau of Energy in 2015 stated that 1,052 coal mines with backward technology will be closed. Heilongjiang Province has already closed 233 coal mines and Guizhou Province closed 200. Nuer Baikeli, head of the Bureau of Energy, mentioned that in 2016 more than 1,000 outdated coal mines will be closed and in the following three years from 2016, the Bureau will suspend the approval of new coal mining projects. During the past three years, China has cut production capacity of more than 90 million tonnes of steel and iron, 230 million tonnes of cement, in excess of 76 million weight cases of plate glass, and more than one million tonnes of electrolytic aluminum. With active structural adjustment, high-tech industries and equipment manufacturing grew faster than other industries and energy consumption per unit of GDP fell by 5.6% last year – and 18.2% in the past five years.9

- Deleveraging via debt restructuring. Deleveraging will be achieved through closing down some debt-ridden state enterprises in dirty and polluting industries and sectors with overcapacity. In addition to the four largest asset management companies (AMC) for debt restructuring, some provincial governments have established their own AMCs and some localities have used the internet to sell 'poisonous assets' at a discount.

- Enterprise restructuring by allowing some 'zombie enterprises' to go bankrupt, encouraging mergers and acquisitions and mixed ownership reforms. However, the concrete measures and procedures are yet to be made clear. According to Zhen Fang Sheng: "The key to restructuring zombies to have capital restructuring, which relies on the entrepreneurs who are willing to conduct it. Implementing the Bankruptcy Law is the best way for capital reallocation."

- Improving product quality to meet consumer demand for high quality products and safe food. There is a 'quality premium' or 'brand premium' opportunity to be seized.

Learning and innovation

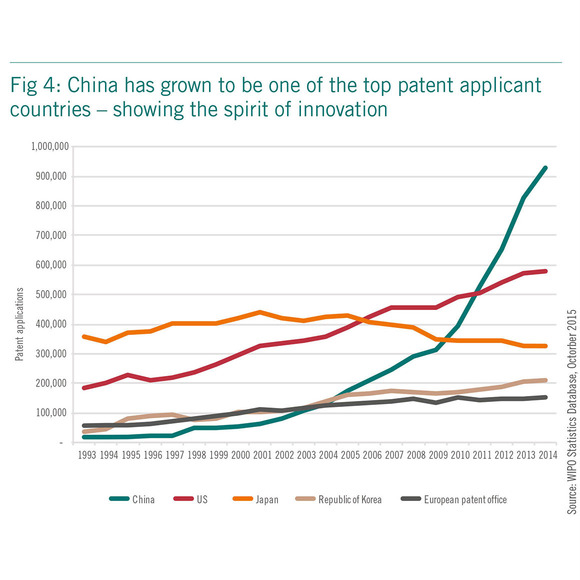

China's past success was in part due to learning and utilising the 'advantage of backwardness'. This has reached its limit. China must rely on its own ingenuity and innovation in the future. Can this be achieved? According to Premier Li, last year: "Business startups and innovations by the general public flourished, with the number of newly registered businesses rising by 21.6% in 2015, or an average of 12,000 new businesses per day. New driving forces played a major role in keeping employment stable and pushing ahead industry upgrading, and are now driving profound economic and social change in China."10 A recent report by McKinsey Global Institute in 2015 assessed China's capacity for innovation and indicates it can adjust – China spent more than $200 billion on research and development in 2014, the second-largest in absolute terms (and above 2% of GDP). Its universities graduate more than 1.2 million engineers each year – more than the next five countries combined. China also leads in patent application, with more than 730,000 in 2013, according to a McKinsey study.11 This can be seen in Figure 4.

Indeed, major headway was made in the development of 3G nuclear power technology, China's self-developed C919 large jetliner rolled off the assembly line and Tu Youyou was awarded the Nobel Prize for Physiology or Medicine. In addition, R&D spending has increased dramatically and some private sector enterprises such as Huawei, ZTE and others are already successful in terms of innovation. However, when looking at the actual impact of innovation – as measured by the success of companies in global markets – the picture is mixed:

Indeed, major headway was made in the development of 3G nuclear power technology, China's self-developed C919 large jetliner rolled off the assembly line and Tu Youyou was awarded the Nobel Prize for Physiology or Medicine. In addition, R&D spending has increased dramatically and some private sector enterprises such as Huawei, ZTE and others are already successful in terms of innovation. However, when looking at the actual impact of innovation – as measured by the success of companies in global markets – the picture is mixed:

- In industries where innovation requires original inventions or engineering. breakthroughs, such as branded pharmaceuticals and automobiles, China has a small share of global markets.

- In industries where innovation is about meeting unmet consumer demand or driving efficiencies in manufacturing – appliances and solar panels, for example - China is doing very well.

The McKinsey research, based on an impact-driven view of innovation, concludes that China does have the potential to become a global innovation leader. China has made the necessary investment in R&D and education to improve its performance in science- and engineering-based industries; one example is China's success in high speed rail and telecommunication equipment.

To be successful in innovation in the next decade, China needs to:

- Implement the right policies to support entrepreneurism.

- Encourage market-based competition in more industries.

- Make China more attractive to top science talents.

Green finance for sustainable development

China continues to face severe challenges of air and water pollution, heavy metal pollution in soil and acute water shortages. The root cause of the escalating environmental crisis is the combination of a rapid expansion in energy-intensive heavy industries with predominantly coal-based energy use, inadequate policies and institutional measures and weak enforcement of environmental regulation.

To tackle these severe challenges, the government has adopted clear objectives, stating it "intends to achieve the peaking of CO2 emissions around 2030 and to make best efforts to peak early and intends to increase the share of non-fossil fuels in primary energy consumption to around 20% by 2030". A number of environmental regulations have been enacted and enforced more rigorously.

Significant progress has been achieved in the past five years, especially in structural transformation that is environmentally friendly. For example, services and green industry have been growing more rapidly, with domestic consumption now accounting for more than 50% of GDP. More than half of the population now resides in urban areas. In parcular, "energy consumption per unit of GDP has dropped by 18.2%, and the emissions of major pollutants have been cut by over 12%", according to the State Council (March 2016).

In addition, the PBoC has established China's 'green financing system', establishing it as a guiding principle in all lending strategies and lending principles. The PBoC report studied measures to: reduce the cost of green investment by establishing green banks, green bonds and green funds; increase the cost of polluting projects by establishing green ratings; and to bolster social responsibility by setting up a public non-profit information system, monitoring environmental cost. Concretely, the PBoC's recommendations included:

- Building a green finance system that allows green banks to fully leverage their expertise, scale and risk management in green credit and green investment.

- Promoting the development of green industry funds through public-private partnership arrangements, thereby inviting private capital to make amplified equity investment in green sectors.

- Requesting institutions such as the Silk Road Fund, the AIIB and the New Development Bank to adopt or reference the 'equator principles' and establish a system for environmental risk management with metrics no lower than those set by the World Bank and the Asian Development Bank. Environmental information should be promoted to the fullest extent, overseas green investment promoted, and China should present the image of an environmentally and socially responsible country.

- An additional set of 10 recommendations cover fiscal and financial policies. The Ministry of Finance, the PBC, CBRC, CSRC and other government agencies will collaborate and take leading roles in implementing them.12

With the recently approved Thirteenth Five-Year Plan by the National People's Congress, there is confidence and optimism that China's structural transformation will continue. Even though there will be a few bumps in the process, the direction of reforms is clear and actionable.

1. Summers 2014.

2. Justin Yifu Lin 2012a. The Quest for Prosperity: How Developing Economies can Take Off, Princeton University Press, Princeton, New Jersey.

3. Lin, Justin Yifu. 2012b. New Structural Economics: A Framework for Rethinking Development and Policy, World Bank, Washington, DC.

4. López, Ramon E, Vinod Thomas and Wang Yan (2008). Fiscal Policies for the Quality of

Growth, IEG Working paper 2008/6, The World Bank.

5. State Council, March 2016.

6. State Council March 2016.

7. Xiao, Geng. 2015. Project Syndicate papers, Studies on Fu Shan.

8. Sheng, 2016.

9. State Council, March 2016.

10. State Council March 2016.

11. McKinsey Global Institute, 2015. The China Effect on Global Innovation. McKinsey &

Company.

12 Green Finance Working Group, PBoC, Establishing China’s Green Financial System, China Financial Publishing House, 2015.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com