Chinese outward direct investment: overtaking other EMEs

Outward investment was expected to surpass inward investment in 2014 for the first time

China has entered the stage that western developed economies and Japan reached during the 1970s and that other Asian newly industrialised economies found themselves in during the 1990s. As labour-intensive industries matured, wages increased and firms moved into more technologically sophisticated industries.

For example, the share of manufacturing employment in the US fell from 17% in the 1980s to 9% in 2004, and in Japan from 18% to 12% during the same period. When labour-intensive industries in the high-wage countries shut down, their jobs relocated to other lower-wage economies, such as those in east Asia.

Now China's labour costs are rising rapidly, while the structure of its industries, exports and employment is changing. Many Chinese economists argue that the country has already absorbed its surplus labour and has approached the ‘Lewisian turning point'.

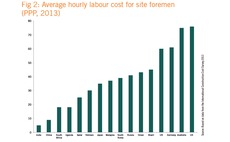

Recent data indicates that China's labour costs rose rapidly from $150 a month in 2005 to $500 in 2012, and over $600 a month in coastal regions in 2013, growing at the rate of 15% a year (in addition to currency appreciation of nearly 3% annually in recent years).

The real wage level could approach $1,000 a month within a decade or about the level of some of the higher middle-income countries (eg Turkey and Brazil) and $2,000 a month by 2030, or the level of South Korea and Taiwan today. More Chinese enterprises are facing the pressure of seeking low-cost locations - they have no choice but to move west or ‘go global'.

The ‘going global' strategy was initially proposed by former president Jiang Zemin as early as 2000. By 2013, approximately 153,000 domestic investors had established 254,000 companies in 184 countries around the world, with accumulated outward foreign direct investment (OFDI) reaching $0.66 trillion, according to the Ministry of Commerce (Mofcom).

It is expected that in 2014, outward investment will reach $116 billion, surpassing inward investment for the first time.

In December 2014, premier Li Keqiang called for the enhancement of financial support for going global in a regular meeting of the State Council. The measures included speeding up the approval process and facilitating finance channels.1

For instance, the China Development Bank (CDB) has supported the going global strategy for many years, with about 80% of its foreign loans aimed at going global projects. For example, the China-Africa Development Fund (CADFund), which is under the umbrella of the CDB, was involved in more than 70 projects in Africa across around 30 different countries by the end of 2013.2 However, this is insufficient.

China has an estimated 100 million workers employed in manufacturing, most of them in labour-intensive sectors, compared with 9.7 million in Japan in 1960 and 2.3 million in South Korea in 1980, when these countries were at a similar state of development.

The reallocation of Chinese manufacturing to more sophisticated, higher value-added products and tasks will open up great opportunities for labour-abundant, lower-income countries to produce the labour-intensive light-manufacturing goods that China leaves behind (Lin 2012d, Chandra, Lin and Wang 2013).

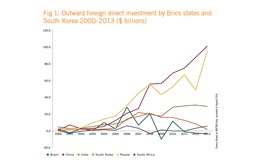

China has also taken the lead among the Brics countries (Brazil, Russia, India, China and South Africa) in OFDI, with the net amount rising to more than $101 billion in 2013 (UNCTAD 2014). Roughly 60% of OFDI from developing countries went into other developing countries, mostly in the form of ‘greenfield' investments that typically can open the door for the South-South relocation of various industries from China and other emerging economies (see figure 1).  While there is widespread suspicion of China's outward investment motivations and criticism of its record of following international standards, a number of studies have found that China's OFDI has contributed to the generation of employment in both developing and industrial nations. See box: Development Results in Four Months: Huajian in the Oriental Industrial Park, Ethiopia below for more details (Shen 2013, Weisbrod and Whalley 2011).

While there is widespread suspicion of China's outward investment motivations and criticism of its record of following international standards, a number of studies have found that China's OFDI has contributed to the generation of employment in both developing and industrial nations. See box: Development Results in Four Months: Huajian in the Oriental Industrial Park, Ethiopia below for more details (Shen 2013, Weisbrod and Whalley 2011).

According to Mofcom statistics, total gross OFDI in 2013 reached a peak of $107.8 billion, but only $3.13 billion (or nearly 3% of the total) went to Africa and 45% of China's total OFDI was attributable to private-sector participants.

"Private Chinese firms have become aggressive in Africa in recent years, with their accumulated project numbers increasing from 52 in 2005 to 1,217 by 2013, representing 53% of all Chinese OFDI projects currently in the continent," said Xiaofang Shen in Private Chinese Investment in Africa: Myths and Realities, published in 2015. "There is a stark contrast between private and government investment in terms of sectors. The former is overwhelmingly concentrated in manufacturing and services, with the latter in construction and mining."

However, these official statistics may understate the level of actual private investment in Africa. Another study by Shen in 2013 found that:

- Based on host government data, Chinese government statistics have significantly underestimated the size of China's OFDI, to the order of 3 to 1.

- The government plays a lesser role in OFDI: the private sector - usually small to medium-sized enterprises - is responsible for 55% of Chinese FDI in Africa.

- Manufacturing accounts for the bulk of private Chinese investment. Based on host country data, Chinese private investment is heavily concentrated in labour-intensive manufacturing activities, accounting for 44% of the total number of projects in six countries (Ethiopia, Ghana, Liberia, Nigeria, Rwanda and Zambia), followed by service industries.

- Chinese investment produces jobs, which African leaders appreciate, although they are concerned about "technology transfer" and "language and cultural barriers".

- Chinese firms come to Africa because their domestic market is saturated and African labour costs less than Chinese labour.

- Operating in Africa is expensive due to infrastructure gaps and security issues.

Box: China's comparative advantage in renewable energy: Hydropower

China is currently the world's largest producer of renewable energy, and hydroelectricity is its dominant clean energy source. Currently, over 281.5 gigawatts (GW) of hydroelectric power is installed domestically. But just 6% of China's electricity comes from hydroelectric sources. The government has signalled its intentions to increase hydroelectric capacity to 290GW by 2015 (KPMG "Infrastructure in China: Sustaining Quality Growth" January 2014).

In 2013 alone, China's pure hydro installed capacity increased by 28.8GW to reach 260GW, with a further 1.2GW of pumped storage commissioned to reach a total of 21.5GW. China now has more installed pure hydropower capacity than the next three countries combined (Brazil, the US and Canada). The total 2013 investment in hydropower of 124.6 billion yuan ($20.1 billion) was roughly the same level as for the previous year (IHA 2013).

It can be further argued that China has a demonstrated comparative advantage (DCA) in exporting construction services in the hydropower sector, including design, engineering and implementation, based on the following evidence:

- existing domestic capacity of hydropower, built by Chinese companies;

- lower cost of labour and foremen (see figure 2);

- ability to bring fi nanciers to these projects;

- and large-scale hydropower projects that have been implemented in Africa and the rest of the world.

Justin Lin and Yan Wang

Box: Development Results in Four Months: Huajian in the Oriental Industrial Park, Ethiopia

African countries can also achieve rapid growth if their governments can facilitate the development of private enterprise in areas of comparative advantage and grasp the opportunities of labour-intensive sectors relocating out of China.

They can bolster their limited resources and capacity by building up industrial parks/special economic zones to overcome the constraints of poor infrastructure and business conditions.

The quick success of the Huajian shoe factory in Ethiopia provides a convincing example of such an approach.

The wage rate of the footwear industry in Ethiopia is one-tenth to one-eighth of that in China, while labour productivity is about 70% of that in China, so Ethiopia can be highly competitive in the footwear industry.

The late Ethiopian prime minister Meles Zenawi came to Shenzhen to invite Chinese shoe manufacturers to invest in Ethiopia in August 2011.

The chairman of the Huajian Group, Zhang Huarong, visited Addis Ababa in October in 2011, and subsequently established a shoe factory in the Oriental Industrial Park near the Ethiopian capital in January 2012, hiring 550 Ethiopian employees and expanding to 2,000 by December 2012.

Within one year, Huajian had more than doubled Ethiopia's shoe exports. Huajian's employment reached 3,500 by December 2013, and is projected to employ 30,000 people by 2016.

Without the joint effort in establishing the Oriental Industrial Park supported by China's South-South development co-operation (SSDC), it is highly unlikely that Huajian could have achieved so much in four months.

Justin Lin and Wang Yan

1 www.gov.cn/zhengce/2014-12/25/content_2796264.htm

2 http://big5.xinhuanet.com/gate/big5/news.xinhuanet.com/english/africa/2013-12/03/c_125796229.htm

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com