Trade structure: from raw materials to machinery and services

The country has prospered by adopting a ‘learning by doing’ attitude

China has come a long way over the past 30 years, albeit from a low base. As late as 1984, 50% of the country's exports were in crude oil, coal, food, animals and other base materials. Today, following 36 years of reform and opening up, the Chinese economy is becoming fully integrated into the global economy: China has become the world's largest trading nation (excluding intra-EU trade). Both exports and imports of goods have expanded rapidly, with exports totalling $2.21 trillion, and imports amounting to $1.95 trillion in 2013 (see WTO 2014).

According to official statistics released on January 13, 2015, China's total trade volume was $4.3 trillion in 2014, with $0.58 trillion in service trade and $0.38 trillion in net exports. China is now ranked number one in terms of the trade in goods, accounting for approximately 12.2% of the world's goods trade (WTO 2014).

Behind the headline numbers are some remarkable shifts in the country's economic system. When China started its economic transformation in 1978, it was an agrarian economy with agriculture accounting for 71% of total employment. Its per-head income was $154 in 1978 - less than one-third of the average in sub-Saharan African countries.

Like many developing nations today, China was an exporter of primary products. Thanks in part to its unique reform approach of "crossing the river by touching the stones at the bottom", spearheaded by the late leader Deng Xiaoping, Chinese principals and workers have "learned by doing", experimenting with various institutions and practices such as special economic zones (SEZs), household responsibility systems, township and village enterprises and fiscal decentralisation - Chinese style.

The "learning-and-experimenting" approach allowed the economy to grow rapidly for 35 years without any of the large disruptions witnessed in Russian and other east European transition economies.

China has been taking advantage of its relative backwardness by learning and imitating - and, increasingly, by innovating. Its industrial upgrading, or "moving up" the value chain, took at least three steps:

- The first industrial upgrade happened in 1986, when exports of textiles and clothing exceeded crude oil. Incentives were provided to foreign direct investments coming to SEZs. This signified China's transition from exporting resource-intensive products to producing labour-intensive textile and clothing, consistent with China's comparative advantage.

- The second upgrade happened in 1995, when China's export of machinery and electronics exceeded textiles and clothing. This indicated that China started the transition from exporting traditional labour-intensive exports to "assembling" non-traditional labour-intensive products. The dominant approach was still as a low-end original equipment manufacturer (OEM).

- ?The third upgrade happened after China's accession to the World Trade Organization (WTO) in 2001, when high-tech and new-tech exports grew rapidly, and the level of product sophistication increased. Central and local governments conducted regulatory reforms to improve the investment climate. Some exporters have become an integral part of the global supply chains of multinationals in automobiles, computers, mobile phones and aircraft parts.

In recent years, because of efforts by the Chinese government to liberalise the economy and sign several free trade agreements (FTAs), the structure of exports has continued to move up the value chain.

In 2013, manufactured products remained the dominant component of China's exports, accounting for 94% of the total. Among manufactured products, office machines, telecoms equipment, textiles and clothing continued to be the country's main exports. Intra-industry trade is of growing importance, as measured by manufactured imports accounting for 58% of imports in 2013. This indicates that China is very much an important part of the global supply chain, engaging in the "supply chain trade" or "import for export" model (Baldwin 2013).

Since joining the WTO in 2001, China has negotiated and concluded 13 FTAs with more than 20 states and regions. FTAs in force include those with Chile, Costa Rica, New Zealand, Pakistan, Peru and Singapore. China has recently signed FTAs with Australia, Iceland, South Korea and Switzerland, but they are not yet in force. Currently, FTAs are under negotiation with the Gulf Cooperation Council (GCC) countries, Japan and Norway. Supplementary agreements were added to the initial Closer Economic Partnership Arrangement (CEPA) with Hong Kong, China and Macao. Unilateral preferences are granted to the least developed countries (LDCs) (WTO 2014, p. 10).

Trade in goods

In the trade in goods sector, China has continued to liberalise its tariff regime and to facilitate trade by a series of reforms, including the introduction of paperless customs clearance procedures. China's average applied most favoured nation (MFN) tariff rate in 2013 was 9.4%, almost unchanged since 2011 and 2009 when the average stood at 9.5%. The applied tariff continued to be higher for agricultural products, at 14.8%, showing a slight decline from the average for 2009 and 2011. The average tariff on non-agricultural products has remained unchanged since 2009 at 8.6%. Import licensing, restrictions and prohibitions are maintained on grounds of state security, human health, environmental protection and to comply with international commitments.

Trade in services

Imports of services became more important as a component of total imports, while travel gained considerable market share, accounting for 39.1% of total imports. Transportation is another important item among services imports, accounting for 28.7% of the total.

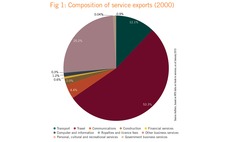

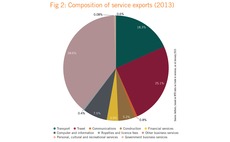

In terms of services exports, the structure has changed dramatically in the period from 2000-2013. Figures 1 and 2 show that the export share of other business services has increased from 25% in 2000 to nearly 39% in 2013.

China's export of financial and insurance services increased its share of the total, in parallel with the gradual relaxation of China's capital control for outward investment and other outflows. The share of computer and information services have also risen significantly, although travel and communication lost some of their share in 2013.

China's export of financial and insurance services increased its share of the total, in parallel with the gradual relaxation of China's capital control for outward investment and other outflows. The share of computer and information services have also risen significantly, although travel and communication lost some of their share in 2013.

The share of construction services expanded from 2% to over 5%, which is related to the construction sector gaining global competitiveness. A joint paper (Lin and Wang 2015) has shown that through "learning by doing", China has gained a comparative advantage in construction, especially in building large hydroelectric power-generation projects, with increased experience, design and engineer capacity, as well as the relative inexpensive cost of site managers and foremen.

The share of construction services expanded from 2% to over 5%, which is related to the construction sector gaining global competitiveness. A joint paper (Lin and Wang 2015) has shown that through "learning by doing", China has gained a comparative advantage in construction, especially in building large hydroelectric power-generation projects, with increased experience, design and engineer capacity, as well as the relative inexpensive cost of site managers and foremen.

The labour cost of Chinese foremen, at $9 per hour, is nearly one-eighth of that of the US ($76 per hour) and European Union countries. Even if Chinese companies pay their overseas workers three times the domestic rate (that is, $27 per hour), that would still be only 36% of the cost for a US foreman. This is one of the reasons why China has gained global competitiveness in providing infrastructure investment and construction projects (see ‘China's comparative advantage in renewable energy: hydropower' box, p. 65).

Future trade prospects

It is widely recognised that China maintains a large number of export support programmes at sectoral, regional and business levels to achieve economic growth and employment generation objectives. The government has also provided industry-specific subsidies for land and technology to firms deemed "strategically important" by central and local governments. In recent years, these policies and subsidies have caused an increasing number of trade disputes, including antidumping and countervailing or "double AD plus CV" investigations.

However, in recent years, subsidies and trade support policies are becoming more expensive in terms of socioeconomic cost and environmental degradation. Moreover, since 2009, net exports are no longer a significant driver of economic growth, mainly because of weak global demand. A major rethink of trade policy is in order.

Figure 3 shows that after 2008 the contribution of net exports to GDP turned largely negative, with the exception of 2010, implying that net exports are no longer an engine for growth, but a drag on growth. In the last three years, governmental export growth targets have been missed for four consecutive years.

Figure 3 shows that after 2008 the contribution of net exports to GDP turned largely negative, with the exception of 2010, implying that net exports are no longer an engine for growth, but a drag on growth. In the last three years, governmental export growth targets have been missed for four consecutive years.

Meanwhile, Chinese leaders have realised that the current model of growth relies too much on investment and external demand, and is not sustainable in the long run. Continued support or subsidies to the export sector has lost its economic rationale. The mercantilistic view of "exports are better than imports" or "exports are better for economic growth" has lost its popular support, as people realised that "it is no longer worthwhile" to subsidise exports with a large amount of domestic natural and fiscal resources, benefi ting foreign consumers, while leaving the solid waste, and various pollutants at home.

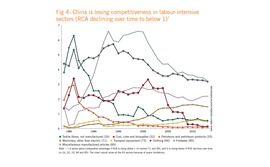

Strong empirical evidence suggests that China is losing its comparative advantage in certain labour-intensive industries because of rapidly rising labour costs, especially in the coastal regions. Using Comtrade data (Standard International Trade Classification Rev 3 at two-digit level), revealed comparative advantage (RCA) can be calculated for many countries, including China. The findings show that China's RCAs have been declining in labour-intensive, light-manufacturing sectors, such as textiles, clothing and footwear.1

Even though export volumes in these labour-intensive sectors have continued to grow or have remained stable, China is losing competitiveness in those sectors - as labour costs are rising rapidly and these labour-intensive sectors have become sunset sectors.

Figure 4 shows the export sectors with declining RCAs: textiles, clothing, footwear as well as all resource-related sectors.  There are, however, sectors with rising competitiveness, including electronics, computers, machinery and equipment, and other manufacturing items (including power-generation equipment, locomotives and railcars).

There are, however, sectors with rising competitiveness, including electronics, computers, machinery and equipment, and other manufacturing items (including power-generation equipment, locomotives and railcars).

In conclusion, a major rethink of the trade and investment policy is expected, resulting in a dramatic change in China's trade structure.

Domestic subsidies and support policies for exports are likely to be reduced, while tariff and non-tariff barriers are expected to be further liberalised, along with signing FTAs with many more countries. More generous unilateral preferences are expected to be granted by China to the LDCs.

With regard to the trade in services, the establishment of the China (Shanghai) Pilot Free Trade Zone (CSPFTZ), the Shanghai-Hong Kong Stock Connect programme, CEPA, and further deregulations in the fi nancial sector (see section two, pp. 31-58), will facilitate provision of financial services, other business services and tourism across borders.

These reform measures will strengthen China's position in the proposed new trade negotiations including the Free Trade Area of the Asia-Pacific (FTAAP), which was proposed by China in the Asia-Pacific Economic Cooperation (Apec) meeting in November 2014.

1 Following Balassa 1965, Revealed Comparative Advantage (RCA) is to measure whether the country has a revealed comparative advantage in a commodity that the country is already exporting. It is calculated as follows: Where xij and xwj are the values of country i's exports of product j and world exports of product j and where xit and xwt refer to the country's total exports and world total exports. Thus, if RCA < 1, the country has a revealed comparative disadvantage in the product, while if RCA>1, the country has a revealed comparative advantage in the product.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com