Monetary Policy

Fed does not respond to oil price shocks: CEPR paper

CEPR paper argues against the standard view that Fed’s policy responses to oil-price-led inflation caused economic instability

Bubbles a bigger threat than inflation: HKMA’s Chan

Hong Kong Monetary Authority’s Norman Chan sees irrational exuberance as greater risk than spiralling prices

Central banks should have control over credit

Two economists argue in support of a role for credit in central banks’ mandate, and analyse the claim that financial crises are “credit booms gone wrong”

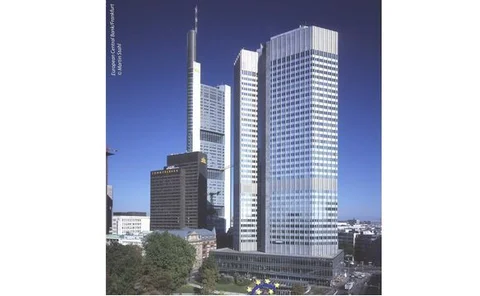

Imbalances must be addressed: Trichet

ECB president Trichet points to imbalances in emerging Asian countries and stresses importance of Europe-wide and international cooperation on macroprudential supervision

Using inflation to erode the US public debt

Paper examines relationship between size of debt and the temptation to inflate

Rate decisions this week

Korea, New Zealand hold but indicate tightening soon to come. Bank of England and Bank of Canada maintain policy stance, along with Peru and Brazil as Denmark and Iceland cut

America can learn from us: Uganda’s Tumusiime-Mutebile

Bank of Uganda’s governor says risk-based supervision saved the country’s banks; reinforces the importance of open-market principles for the economy

Iceland cuts on further signs of stability

Central Bank of Iceland continues with “gradual” easing as currency stabilises

SNB steps towards exit

Swiss National Bank announces end to credit easing

Explaining wage stickiness

Bank of Estonia research suggests workforce composition, factors in individual countries and a positive relationship with competition all explain the downward rigidity of earnings

CentralBanking.com panel: it’s too soon to exit

Charles Goodhart, Paul Mortimer-Lee, Lucrezia Reichlin and Gabriel Stein concur that dangers are greater from exiting too early than too late but warn that asset prices risk becoming over inflated

China to maintain “moderately loose” policy

People’s Bank of China indicates rates will be kept low for some time to support growth and stability; statement echoes the pledges of central economic conference

Israel minutes show division between advisers

Minutes of the Bank of Israel’s November meeting reveal one of the four advisers to the governor said rates should be left unchanged, while three voted for a 25bp hike

Ex-RBNZ head hits back at inflation-targeting critics

First governor to preside over the introduction of inflation targeting defends framework against recent criticisms

Former Fed economist calls for more stimulus

Ex-Federal Reserve official says focus must be on providing up to $6 trillion more monetary stimulus rather than exit strategies

Unconventional monetary policy reviewed

Claudio Borio and Piti Disyatat set out a framework of definitions to help categorise and clarify the functions of various monetary policy tools, and assess central banks’ actions since the crisis

Reflections on liquidity crises: Borio

The BIS’s Claudio Borio discusses ten propositions on liquidity crises, including the importance of improving buffers and the need for principles on central bank liquidity provision

Influences on crisis fighting in emerging markets

International Monetary Fund examines why some emerging-market economies took special-liquidity-easing measures during the crisis

RBI’s Gokarn drops more hints of tightening

Reserve Bank of India deputy governor Subir Gokarn among a slew of officials to comment on demands of rising inflation on monetary policy; calls for a staggered approach to exit

Inflation targeting remains relevant

Inflation targeting can and should survive recent criticisms, argues Don Brash, a former governor of the Reserve Bank of New Zealand – the first central bank to introduce the framework

Japan’s recovery to be moderate: Shirakawa

Bank of Japan’s Masaaki Shirakawa cautious on economic recovery

Eurozone lending tightened in October

European Central Bank reports decrease in the growth of credit to the private sector

Exit from extraordinary measures “straightforward”: NY Fed’s Sack

Brian Sack, the New York Fed's markets chief, says creating emergency facilities was harder than withdrawing them will be

Monetary policy in preventing boom-bust housing cycles

Bank of Canada paper argues that central banks should react less to inflation and more to output to avoid making boom-bust cycles worse