Monetary Policy

Canadian economy rowing to safety, says Poloz

Stephen Poloz says central bank's job is to fill the crater left by the burst bubble with liquidity - but when the economy has rowed itself to safety, the bank can reduce the injections

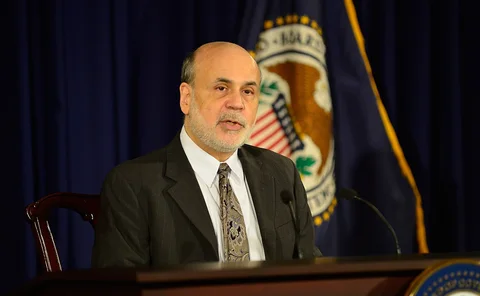

Bernanke defends Fed communication after QE surprise

Ben Bernanke says FOMC communication in June was justified as Fed shocks markets by ploughing on with asset purchases; economists question why markets were focused on September meeting

BIS papers probe LatAm currency interventions

Working papers written by economists from each of five Latin American central banks and published by the BIS investigate the efficacy of various currency intervention strategies

Panellists hit out at Fed’s forward guidance in CBP debate

Federal Reserve gets mixed scorecard for its extraordinary monetary policy and communication performance, according to panellists in Central Banking On Air debate

BoE appraises forward guidance as economy picks up

Bank of England MPC believes that market participants demonstrated an ‘increased understanding’ of the link between monetary policy and unemployment in the run up to its September meeting

Robert Pringle’s Viewpoint: Looking for a game-changer for the financial system

The world may need to look to central bank governors in countries such as China and India to champion reform of the global monetary architecture

Publishing minutes is vital for central bank comms, say markets

Market participant survey gives Fed highest score for policy and communication in the wake of the financial crisis; ECB scores worse in the absence of published minutes

IMF backs counter-cyclical fiscal activism in times of crisis

Fiscal stimulus had powerful effects in the wake of the financial crisis, but monetary policy is better suited to keeping the economy on an even keel in normal times, says IMF

RBA looks to exchange rate

The Reserve Bank of Australia keeps the door open for further rates cuts but emphasises that a weaker currency ‘would be helpful’ in boosting demand

A sad ending to Summers versus Yellen

The politicisation of the debate over who should be the next chair of the Federal Reserve may be a sign of the times, but it is a sad day for central banking, argues Thomas Cargill

Near-zero interest rates of limited help to non-financial firms

BIS quarterly review article finds that lesser pass-through is partly related to higher premium for risk required by financial intermediaries

Central Bank of Russia simplifies interest rate policy

New measures will streamline the interest rates that the central bank targets; changes brought in two days after the appointment of a new deputy governor for monetary policy

RBI sets up committee to make monetary policy ‘transparent and predictable'

Reserve Bank of India announces make-up and mandate of committee commissioned by new governor Rajan to overhaul the way the central bank conducts monetary policy

Hungary council members divided over rate drop

Central Bank of Hungary monetary council members were split over the size of last month’s rate cut; minutes from August meeting signal that easing cycle is winding down

Economists criticise ‘incomplete’ Bank of England guidance

Richard Barwell and Jagjit Chadha criticise the Bank of England for failing to lay out the path back to a more neutral monetary policy in its attempt at forward guidance

Dallas Fed highlights transformation of FOMC statements over past 20 years

Before 1994, markets were left in the dark over interest rate changes; statements have expanded seven-fold in the past 20 years, reflecting the evolution of monetary policy operations

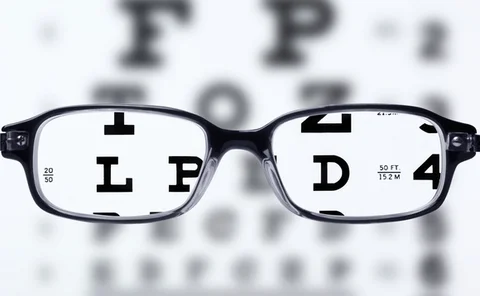

Turning forward guidance into 20:20 vision

The Bank of England’s vision of forward guidance is incomplete and could shake confidence in the central bank’s policy framework.

Carney defends Bank of England’s forward guidance

Bank of England governor defends use of state-contingent forward guidance despite bond market reaction; concern rises about mixed policy message

Asia-Pacific central banks shed light on future policy

Bank Indonesia hikes rates; Reserve Bank of New Zealand says it will likely tighten policy in 2014; Bank of Korea looks to buck emerging market trend and keep rates low as inflation drops

ECB calls for action as ABS market reaches ‘crossroads’

European Central Bank’s monthly bulletin calls on other institutions to help kick-start the market; suggests ABS transactions could be guaranteed in an attempt to boost SME lending

Bank of Russia names G-20 summit co-ordinator as first deputy governor

Ksenia Yudayeva takes over as one of four 'first deputies' from Alexei Ulyukayev, who was made an economics minister earlier this year

Asmussen: Eurozone governors should ‘withstand' pressure of public minutes

ECB executive board member Jörg Asmussen says eurozone central bank governors should be able to withstand the pressure of having their deliberations and voting made public

Bank of Mexico deputy welcomes QE taper

Manuel Sánchez singles out downshift in yield curves pushing domestic interest rates for different maturities to all-time lows as the biggest effect of lax monetary conditions on emerging economies

San Francisco Fed president warns asset price bubbles are ‘here to stay’

John Williams discredits economic theory on asset price movements; says bubbles are inflated predominantly by expectations of future price increases