Monetary Policy

Major central banks ready to respond to coronavirus

Fed, ECB and Bank of Japan say they are willing to act; central bank events disrupted

Ghana’s Addison on banking reform, innovation and the future of the eco

The Bank of Ghana governor speaks about the next steps in banking reform and why West Africa may need more time to start using a common currency

Policy responses to Covid-19

The coronavirus outbreak poses a real threat to the global economy, writes Sayuri Shirai

Did the Riksbank abandon negative rates too soon?

In January, a key inflation measure dropped sharply. Policy-makers face difficult choices if inflation does not recover

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

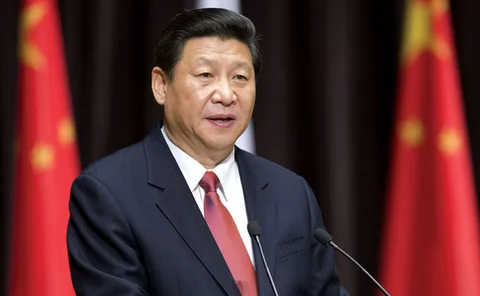

PBoC ready to ease further as Xi calls for more stimulus

PBoC deputy governor vows to safeguard economy from virus shock as president says monetary easing should be “more flexible”

Kyrgyz Republic hikes rates for first time since 2015

Inflation still well below target but climbing fast due to external pressures

Why Bulgaria needs to deepen its currency board

The BNB’s currency board rules should be extended to transaction deposits at commercial banks, which could in turn issue digital currencies, even in the event of euro adoption

ECB unveils plan for its strategy review

Eurosystem will host “listening” events with general public, academia and civil society organisations

Fed’s Brainard backs ‘flexible inflation averaging’

Governor hints at possible outcome of Fed’s policy framework review

PBoC cuts rates in bid to buffer impact of virus

Indonesian central bank also lowers rates in bid to limit effects of coronavirus

Weak eurozone banks hindered monetary policy – Bundesbank paper

“High-risk” banks failed to increase loan spreads despite ECB liquidity injection, researchers say

FOMC discusses communication ‘escape clauses’

Fed might need “leeway” to deal with financial instability, some FOMC members say

Economist joins Bank of Japan’s rate-setters

BoJ board member in favour of continued QE but has expressed doubts on negative rates

Turkish central bank keeps cutting rates despite higher inflation

Cut brings Turkish real rates into negative territory as currency renews slide against dollar

NY Fed speeds up repo withdrawal

US banks’ demand for cash remains high as NY Fed’s first term repo is oversubscribed

ECB’s TLTRO2 eased Italian credit conditions – BoI paper

QE measure lowered loan interest rates while increasing credit quantities, researchers find

Should the ECB add owner-occupied housing costs to its inflation measure?

Yves Mersch argues broader measure of housing costs would give more realistic inflation picture

Bank of Mexico eases again to combat ‘stagnant’ economy

Central bank makes first rate cut since moving to new communications regime

Advanced economies’ inflation more synchronised – Bank of Spain paper

Headline inflation rates are more highly correlated than core inflation, authors find

Bank of Mexico revamps policy communication

Board members allowed to express individual opinions and voting included in policy statements

BIS’s Pereira says green QE could distort market

Central banks should focus on financial stability mandate not green QE, says deputy general manager

Schnabel takes on Germany’s ‘false narratives’ on ECB policy

Criticism based on “half-truths” imperils trust in single monetary policy and “undermines European cohesion”

Bulgaria: long live the currency board

Bulgaria should reject the euro and extend its currency board to cover bank deposits