Communications initiative: Bank of Jamaica

Bank of Jamaica has done more than just lift the economic literacy of its society

Central banks recognise more than ever the importance of educating the public and guiding expectations with regard to macroeconomic policy. Today, communications strategies are dominated by transparency and the conviction that communication is essential for effective policy.

Few central banks, however, have deployed as much ingenuity and secured such high levels of engagement as the Bank of Jamaica. It broke the central banking mould with a reggae-inspired communications strategy aimed at educating the public on inflation targeting and the country’s transition from a fixed exchange rate regime.

The economy is now seven years into its dramatic economic turnaround. In 2013, the country entered into a major economic reform programme and in 2017 introduced the Bank of Jamaica Foreign Exchange Intervention and Trading Tool, which led to flexible two-way exchange rate movement. The tool was introduced to bolster the infrastructure around its flexible exchange rate regime.

In 2017, the central bank also stepped up preparation for moving from an ‘inflation targeting lite’ approach to fully fledged inflation targeting. And in the first half of 2020, a new central bank law is expected to be passed by parliament to provide full independence to the bank and enshrine inflation targeting into law.

Observers suggest the Caribbean central bank’s strategy has done more than just lift the economic literacy of its society: it may have also bolstered the Bank of Jamaica’s independence, helped to regain trust in policy-makers and potentially protected the economy against future poor fiscal discipline.

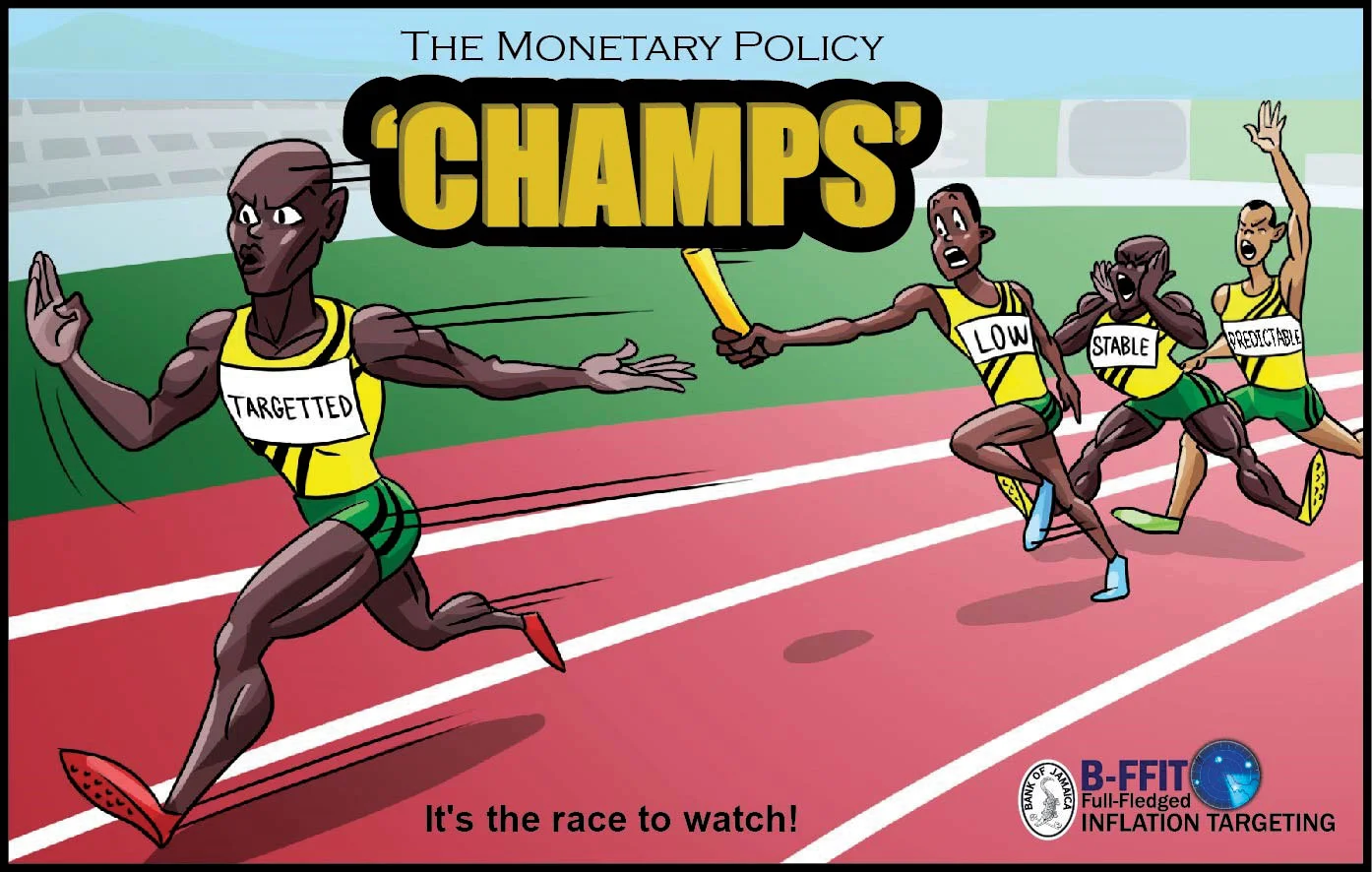

Since December 2018, the central bank has called upon local reggae stars to produce a series of tracks aimed at educating the public about the importance of inflation and the Bank of Jamaica’s new 4–6% target. “That middle ground is what we want, ’cause low, stable and predictable inflation is to the economy like what the bassline is to reggae music” was a verse in one of the songs now viewed over 55,000 times on YouTube.

In addition to the inflation-expounding lyrics inundating social media – and the nation’s TV, radio and music festivals – the central bank has also erected a score of billboards across the island, posted adverts in newspapers and magazines aimed at primary school children and upwards, and created a James Bond-inspired ‘Agent Croc O Doyle’ for social media advertising.

The central bank has also hosted forums to engage directly with members of the public and educate them on the economy’s journey from high and variable, to low and stable inflation.

“It is part of the daily conversation – it is everywhere around you. You see it or listen to the songs so often that they are becoming ingrained,” Constant Lonkeng Ngouana, senior economist at the International Monetary Fund, tells Central Banking. “The IMF provided technical assistance on the regime shift, but we couldn’t have thought of this specific approach – it’s a mark of genius, a homegrown and far-reaching innovation!”

In October 2019, at the IMF annual meeting, managing director Kristalina Georgieva congratulated the Bank of Jamaica on its creative approach to bring society on board with the regime shift and sound economic policy. “Dance and sing your way through trouble!” she declared.

Jill Vardy, the Bank of Canada’s communication adviser and chief of staff to the governor, tells Central Banking: “The Bank of Jamaica is instinctively doing what I think some of the bigger central banks are grappling with, which is how to make ourselves more friendly and accessible and relatable for citizens.”

Given where the central bank is in terms of the evolution of its monetary policy framework, the Bank of Jamaica is “using a sound approach”, she adds: “They’re understanding that accessible communication and clear explanations of the framework should be laid out concurrently with the development of the framework.”

A shift in tone

Tony Morrison, director of public relations at the Bank of Jamaica, tells Central Banking the dramatic fiscal turnaround from 2013 – which followed 32 of the 57 independent years as a country in successive IMF adjustment programmes – meant that the central bank finally had breathing space to reform its monetary policy framework.

“This new environment created the opportunity for us to officially say: ‘OK, we’re going to switch to inflation targeting and go full steam ahead,’” says Morrison.

The biggest challenge to switching regimes, however, came down to the communication, he says: “While staying in sync with the economics behind it, the communication strategy simultaneously had to be bigger, much bigger and more far reaching than anything I’ve ever done for the Bank of Jamaica. That was my mandate.”

Since the Bank of Jamaica launched its bold strategy, the tone and type of questions asked by market participants on policy decision days have become “deeper and much more sophisticated”, says Ngouana, who spent just over three years from mid-2016 in the country as the ‘IMF resident representative’ to Jamaica.

“The public is increasingly focused on fundamentals – things like the transmission channel of monetary policy and forex hedging instruments – and less so on what the exchange rate was yesterday,” he says.

“The conversation is more forward-looking, which should help further anchor inflation expectations and support the shift to full-fledged inflation targeting, as Jamaica continues to transform its economy.”

Bank of Jamaica deputy governor Wayne Robinson says that, since launching the communications strategy, inflation expectations have been better anchored within the central bank’s target inflation range. The bank’s surveys show expectations of pricesetters during the past year have centred around 4–5%, down from around 5–6% in 2018.

“In terms of creating public awareness of our target, the strategy has been very successful so far,” he says. An anecdotal measure of the success, adds Robinson, are frequent comments from stakeholders asking for the bank to adopt the same approach to help explain its other responsibilities for the economy and financial sector: “We get that comment all the time.”

Regaining trust

While the songs and campaigns have been effective in educating the public on the importance of low and stable inflation, Peter Henry, dean emeritus of New York University’s Leonard N Stern School of Business, believes the central bank has “done something much deeper”.

He says that, by educating citizens, the central bank is creating a “shift in the political equilibrium” by inoculating the public against irresponsible politics in the future. The effect, says Henry, is not only anchoring expectations on inflation within the central bank’s target, but also anchoring the expectations of the electorate: “The Bank of Jamaica are tying everyone hands to the mast of low and stable inflation.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com