Currency services: De La Rue

UK-based banknote provider secured new clients and transformed focus towards technology in 2018

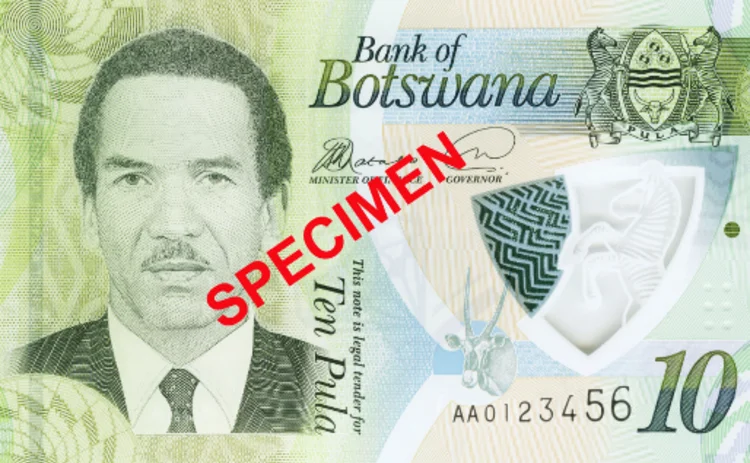

De La Rue has had a very successful year helping currency clients. The UK-based banknote services company has assisted the launch of 20 new currency designs; developed nine new security products; and formed a new partnership for its paper business to free up revenue for increased research and development.

To top the year off, De La Rue was awarded a new contract with one of the world’s oldest central banks, Sveriges Riksbank – a new client for the company, winning the business from the central bank’s long-standing paper printer, Crane Currency.

De La Rue has printed and designed banknotes for more than 200 years, during which time its client base has grown to include some of the world’s most prominent central banks. But the currency services provider makes sure it caters to clients of all sizes.

“De La Rue really are a clear standout in the market,” says Daniel Haridi, chief manager of currency and banking operations at the Central Bank of Solomon Islands. “They understand what central banks need, both in terms of issuance and security. And every time they provide a quality service.”

As the banknote sector has evolved and new competitors entered the market, De La Rue has continued to innovate in an effort to get ahead of trends.

“Our focus has been on our holographic technology,” says Steve Mitchell, product marketing manager for security features at De La Rue. “We did not want to produce old products that had additional aspects – we wanted to create new products.”

One of the company’s new features is Ignite, a new form of colour-changing thread. It layers proven liquid crystal colour shift with advanced optical microstructure technologies to create the effect of a moving, colour-changing image within a security thread when subject to light and movement. The thread is available in six different patterns and three different colour shifts. De La Rue has also adapted the technology for central banks to create their own bespoke pattern or image for the thread.

The UK company has also launched PureImage, another security thread easily identifiable when vertically tilted. This image has been created as a ‘level 2’ feature, typically used to help the public and cash handlers identify counterfeits. Clients also have the option of integrating machine-readable and ultraviolet fluorescence into the thread.

“We like to think we are innovating ahead of the market,” says Mitchell. “These features have helped us to expand our portfolio, which is not easy when a lot of this technology is protected by intellectual property patents.”

New relations

The surge in research and development has been possible in part because of a change in structure in De La Rue’s core business lines. In February 2018, the banknote printer sold its majority stake in its banknote paper arm, later to become known as Portals, to private equity firm Epiris.

The sale, which included its paper mills in Overton and Bathford, saw De La Rue relinquish a 90% shareholding in Portals, for a cash payment of £61 million ($78.3 million). The company still retains a 10% stake in the business and, as part of the transaction, Portals De La Rue has committed to supply pre-agreed volumes of paper to De La Rue with a pre-agreed price mechanism for the next 10 years. Meanwhile, De La Rue will be Portals’ preferred supplier for security features.

New design

One of De La Rue’s more prominent recent launches was the Bank of England’s new £10 note. Four new polymer designs were created, and close to 1 billion banknotes were delivered in partnership with the BoE and the Scottish commercial banks. During the process, De La Rue also won a supply contract with the UK central bank to provide a new polymer substrate – Safeguard – for the new £20 note.

“There really was a lot of commitment from them, to drive forward a real transformation in UK banknotes,” says Andrew Baker, senior contract manager for the BoE.

As part of the delivery of the new series, De La Rue committed to replacing two lines of equipment at the BoE’s printing facilities. “They really delivered on that, and it was not an insignificant feat, considering they also delivered the banknotes on time and to budget,” adds Baker.

De La Rue has helped a number of countries transition to polymer, including Macedonia, which switched over in April 2018. “We have printed a total of over 200 million banknotes since partnering with them,” says Sonja Kanevce, banknote manager at the National Bank of the Republic of Macedonia. “They have always offered the most favourable bids for a complete set of products and services.”

Both the new polymer £10 and the new £5 (released in 2016) feature security elements including a translucent window with an image of Queen Elizabeth, a multi-coloured rainbow and a £ symbol that changes colour.

Unlike other banknote designers, De La Rue’s design studio is in a single location to ensure consistency from concept to finished product. “We have fine art students and engravers working here,” says Julian Payne, creative director at De La Rue. “The range of backgrounds means we have designers who design in different ways, which fosters creativity within the department.”

Payne’s team of 25 is responsible for creating around 40% of denominations in circulation. As well as UK banknotes, De La Rue has also printed a new series for the Hong Kong Monetary Authority and a new commemorative note for South Africa in 2017.

“They have an extraordinary design team, who work with a high level of professionalism. The range of products and services they offer is unrivalled,” says Kanevce.

Data-driven

One of De La Rue’s newest offerings is its analytical tool, DLR Analytics. Using data supplied by central banks, the software allows banks to understand more about their cash cycle to both help inform decisions regarding design as well as forecasting future demand.

A large number of small central banks have begun using the software to great effect.

“Even before the introduction of DLR Analytics, they were helping us understand how to get the most out of our banknote data,” says the Solomon Islands’ Haridi. “But their new tool has helped us understand more about the movement of cash within our economy and understand which denominations are needed at the end of the year.”

The Central Banking Awards were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Rachael King, Victor Mendez-Barreira, Joel Clark, William Towning and Tristan Carlyle

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com