Central Banking staff

Follow Central Banking

Articles by Central Banking staff

Europe leads on reserve manager salaries

Central banks pay a wide range of salaries to their reserve managers

- Benchmarking

Many Paris Agreement signatories do not use ESG screens

Most reserve managers fail to take environmental factors into account for FX portfolios

- Benchmarking

Emerging markets act as standard bearers for tranching

Nearly two-thirds of reserve managers tranche; largest allocations made to investment tranche

- Benchmarking

Lower-income nations invest more with external managers

Third-party institutions offer staff training and new asset class investments

- Benchmarking

Collateral posting spreads among swaps users

Following the Bank of England’s example, most derivatives users now have two-way CSAs

- Benchmarking

Some large reserve managers eschew liquidity stress tests

Majority of central banks test for thin trading, but three in 10 larger managers do not

- Benchmarking

Sarb to buy government bonds

South African central bank also broadens refinancing operations to boost liquidity

Major economies already engaging in ‘currency wars’ – former IMF chief

De Larosière floats new commodity-based exchange rate regime; says “trust” is key to avoiding “beggar-thy-neighbour” policies

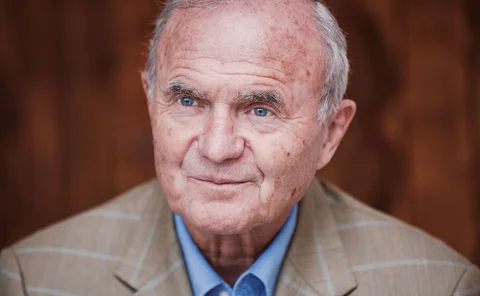

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Specialised lending initiative: BNP Paribas

A new ‘global’ setup helped secure US dollar-denominated assets from a Eurosystem central bank

Transparency: Reserve Bank of New Zealand

Publication of new MPC handbook and minutes increases RBNZ’s openness

Communications initiative: Bank of Jamaica

The Bank of Jamaica broke the mould with its reggae-inspired communications strategy, but observers suggest it has done more than just lift the economic literacy of its society

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Global markets award: HSBC

The UK-headquartered bank is a leader in green finance and helped its clients navigate the low-rate environment over the past year

Website of the year: Central Bank of Brazil

The new bilingual site offers enhanced communications to the full range of stakeholders

Initiative of the year: Bank of Thailand

The Thai central bank has used two-way communications to support the delivery of major initiatives, including an instant payment system

Currency manager: Bank of Mexico

Central bank invested in new printing plant to address capacity and concentration risks

Economics in central banking: Matteo Maggiori, Brent Neiman and Jesse Schreger

The Global Capital Allocation Project has helped pick apart the tangled network of cross-border capital flows. The work may prove essential to those looking to shore up the international monetary system

Advisory services: Deloitte

The consultancy has shown its strength in a wide range of technological and governance advisory roles in the past year

Currency services: Note Printing Australia

Improved IT and data provision helped the Reserve Bank of Australia

Custody initiative: Euroclear

The securities depository has debuted instant dollar settlement in central bank money outside the US – a service that has virtually eliminated settlement risk

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform