Risk

IMF user guide takes stock of current toolkit for systemic risk monitoring

Paper provides guidance on selecting and interpreting monitoring tools; a continuously updated inventory of key categories of tools; and suggestions on how to carry out systemic risk monitoring

IMF paper weighs effect of shifting bank funding in eastern Europe

Researchers from the International Monetary Fund find banks rebalancing their funding sources away from foreign loans; warns global regulation may make this process too rapid

Basel’s ‘99.9% standard’ for op risk is unreliable, says ORX chief

Giulio Mignola says Basel II's 'one-in-a-thousand-years' threshold for tail risk is fundamentally flawed

Belgian supervisor warns against Basel III over-simplification

National Bank of Belgium’s Rudi Bonte calls for the Basel Committee to take a ‘moderate’ stance on the trade-off between simplicity and complexity in its risk and capital rules

IMF paper explores link between low interest rates and bank risk-taking

Working paper finds banks take more risks in low short-term interest rate environment; more so if they are well capitalised

Basel securitisation reform creates 'perverse incentives’, says senior Japanese banker

Inconsistent rules are damaging financial intermediation, according to Takashi Oyama of Norinchukin Bank

Bank of Israel’s outgoing chief, Stanley Fischer, on the challenges of central banking

Stanley Fischer believes his work as governor of the Bank of Israel is done. He tells Chris Jeffery about the reform process in Israel as well as the challenges facing the world economy and the IMF

HKMA's Chan identifies inherent flaws in risk models

HKMA chief questions the use of financial models in risk management; argues the inability of models to account for irrationality is a major defect

Danish paper uses three centuries of data to show tail risks underestimated

Research says severe stress cannot be properly understood with short time horizons; suggests results could be used to design tougher stress tests

Bundesbank research proposes improved structure for counterparty credit risk

Discussion paper finds ‘quadri-partite’ structure gives best results for managing counterparty credit risk

Polish paper examines banks’ risks when state safety net grows

Study finds that banks in central Europe take higher levels of risks under a larger deposit insurance scheme; less so in times of financial crisis

FSB to assess efforts to end ‘mechanistic reliance’ on credit ratings

Peer reviews aim to hasten a move away from rating agencies, with countries expected to eliminate references to credit ratings from laws and encourage better internal credit risk assessments

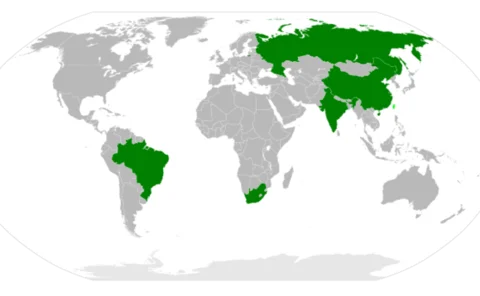

Chilean paper finds room to reduce risk by diversifying investment in Brics

Statistical analysis finds little co-integration of stock market vectors in Latin America and the Bric countries; says this gives investors a good opportunity to diversify, which would reduce risk

Nalm 2013: Sound central bank risk practices could choke off liquidity

Central banks are more activist in reserves management, with some looking to private sector for inspiration. But there are dangers with such a approach, say panellists at Central Banking conference

Bundesbank paper raises concerns over accuracy of systemic risk measures

Researchers find market-based systemic risk measures may give a façade of safety even as banks enter ‘major tail risks’

ECB’s LTROs contribute to 12% drop in repo transactions

Icma report warns ‘abundant’ liquidity provided by ECB’s long-term refinancing operations is undermining the repo market in Europe; notes signs of increased risk appetite

IMF paper advocates hybrid discretion and rules-based macro-prudential policy

Researchers say discretionary systems can be gamed but rules struggle to properly account for risk; combination of ‘strong baseline’ and time-varying component gives best results

Booknotes: The Ponzi Scheme Puzzle: A History and Analysis of Con Artists and Victims

Tamar Frankel offers us a colourful and broad picture of con artists who have initiated their own ‘Ponzi schemes’.

Central banks need to define clear role for operational risk

Despite crossing management and business lines, operational risk must be defined within the wider risk management framework at central banks. By Rudy Wytenburg.

Byres hints at Basel Committee rethink on risk-weight modelling

Secretary-general weighs challenges of balancing complexity and simplicity of capital requirements; outlines possible changes to banks’ risk modelling choices

BIS paper urges policy-makers to consider co-ordinated bond strategy

Research finds effective response to a bond market crisis has become more difficult due to heavily laden central bank balance sheets, raising the need to better co-ordinate a crisis framework

Basel report proposes curbs on bank modelling choices

Basel Committee report finds ‘considerable variation’ in risk-weighted assets for bank trading books; says policy-makers should consider limiting modelling options and improving disclosure

Bundesbank paper quantifies ‘considerable’ risk spillovers

Researchers design new methodology for measuring systemic risk and contagion effects, finding spillovers are significant but vary from region to region

IMF research finds inflation targeting can dampen risk premiums

Working paper suggests inflation targeting reduces a country’s risk premium, although this effect is stronger for emerging markets and where inflation targeting is successful in stabilising prices