Money market funds

Central bank of the year: The Federal Reserve System

Overwhelming Fed interventions in March 2020 forestalled a damaging global financial crisis, as policy overhaul prompts introspection in Europe and Japan

Covid-19 reveals systemic flaws – Brainard

Fed board member weighs impact of March 2020 crisis in money markets, warning some risks remain

Penalty fears drove US funds’ March run – NY Fed paper

Research finds “sophisticated” investors respond to asset signals but retail investors do not

Quarles: policy-makers have ‘work to do’ on non-bank fragilities

FSB chair outlines areas where non-banks may have amplified the Covid-19 shock

Judging scarcity of reserves depends on Treasuries outstanding – paper

Increase in short-term Treasuries causes money markets to behave, as there is a scarcity of reserves, researchers find

Yellen calls for ‘new Dodd-Frank’

Fed prevented financial crisis in March, says former chair, as Brainard backs calls for reform

The Fed must be careful to avoid bank deposit crowding out

Rising US government debt will have a major effect on bank funding, write Wenhao Li, Yiming Ma and Yang Zhao

New York Fed to tighten repo operations

Fed sees “substantial improvements” in dollar funding markets

BoE’s Hauser: Covid-19 forced “largest and fastest” actions ever

Executive director gives blow-by-blow account of how the BoE tackled the Covid-19 crisis in the markets

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

Stress levels rising: investment funds and the Covid-19 shock

Extreme market stresses due to Covid-19 are underscoring the central role non-banks play in crisis contagion, as in 2008. Were regulators better prepared this time?

US MMFs transmitted Covid-19 stress to banks – BIS research

Banks outside the “epicentre” of the dollar squeeze still felt the effects, researchers say

Failure to curb ‘binge borrowing’ could worsen downturn – Yellen

“Excessively” high corporate borrowing may trigger a “wave of corporate defaults” in the coming months, former Fed chair warns

Fed starts financing money market funds

US Congress overrules Dodd-Frank clause at Treasury request as Fed brings in sweeping measure

Book notes: After the crash, by Sharyn O’Halloran and Thomas Groll

The book seeks to identify seeds of the next crisis, and the overriding impression is a plea for more regulation

Will the Fed pass its year-end funding test?

An unprecedented rate spike in September prompted the Fed to inject billions into funding markets. But will its efforts be enough to foil year-end pressures? Could opening the standing repo facility to foreign central banks help?

BIS paper tracks new channel for funding ‘dry-ups’

A squeeze in one market can spill over to institutions with no direct exposure, authors find

FCA signs new agreement with Asic as Brexit looms

UK regulator ensures continuity for trade repositories and alternative investment funds

Sarb says new interest rate benchmarks may be calculated with ‘actual’ transactions

Current benchmark rate based on flawed market data, South African central bank says

Podcast: Post-crisis monetary policy

Many things behave like money in the modern economy and central banks have not yet figured out how to control them all, says Andrew Metrick

Bank lawsuit pushes Fed to rethink monetary system

The Narrow Bank has the potential to alter how the Fed conducts monetary policy

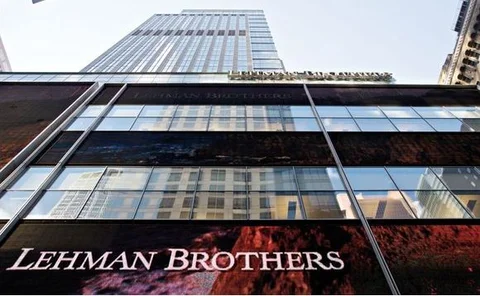

A decade on: Lehman Brothers at the brink

On September 14, 2008, there remained hope that Lehman could be saved and a crisis averted. Events moved rapidly thereafter

MMFs lower risky investments in low-rate environment – paper

After a 1% rate cut, money market funds decrease risky investments by 25 percentage points

EU money fund rule threatens negative rates management tool

Constant net asset value funds may have to change format during prolonged spells of negative rates