Monetary policy

Low inflation partly down to luck – CEPR report

David Miles and co-authors argue advanced economies’ luck on inflation could run out; recommend central banks prepare

Brazil’s central bank slows pace of monetary easing

Central bank scales back cuts to 75bp with suggestion it will slow pace further moving forward; inflation continues to fall as forecast

ECB likely to extend QE despite stronger growth, analysts say

Central bank expected to prolong programme by six months at reduced monthly rate of €30 billion

The optimal size for central bank balance sheets

As the Fed seeks to reduce the assets on its balance sheets, Charles Goodhart examines the role between monetary and fiscal policy, central bank and debt office, and the optimal size of a central bank’s balance sheet

Sri Lanka working to introduce ‘proactive’ policy – governor

Central bank in the past tended to do “too little, too late”, leading to big swings in interest rates, says Coomaraswamy

RBNZ faces mandate review under new government

Coalition agreement retains Labour pledge to consider shake-up of Reserve Bank mandate

Interview: Edward Prescott

The Nobel Prize-winner speaks to Daniel Hinge about time inconsistency and real business cycle theory, and explains why there is no ‘productivity puzzle’

RBA needs representative for the poor – religious group

The proposed new board member would help the central bank understand the effect monetary policy has on the poor, says group

Fiscal policy shocks amplified by accommodative monetary policy – paper

IMF research analyses impact of government spending spillovers, noting effects are amplified in countries with interest rates near the lower bound

Goldfajn stresses current target remains ‘credible’

Central bank pushed back against calls for the target to be raised during 2016 debate

Higher rates contributed to recovery in Latin America – IDB economist

Less hawkish policies can fail to generate growth but push up inflation, research finds

Inflation target supports price setting and wage formation – Ohlsson

Target contributed to economic recovery in Sweden, Riksbank deputy governor says

BoE’s new MPC members disagree on future path of hikes

New deputy Dave Ramsden sees current degree of slack to be too great to warrant removal of stimulus, while Tenreyro believes it cannot “persist for too long”

Blanchard and Summers call for rethink of stabilisation policy

Both economists question consensus on fiscal prudence and advocate stricter financial regulation

BoE paper sheds light on global policy transmission

Comparison of UK and Hong Kong based on bank-level data finds evidence of both portfolio and funding effects

FOMC split over inflation forecasts, minutes show

Participants expressed concern that low inflation this year might reflect not only transitory factors

IMF cautions global vulnerabilities put growth at risk

Fund calls central banks to provide needed monetary support while tackling underlying threats

IMF: global recovery is broad but incomplete

Fund ups its growth forecasts but says many are missing out; Maurice Obstfeld urges policymakers to take action while “times are good”

Eurozone rate rises would have mixed impact on banks, ECB says

Keeping rates at the same level would decrease net interest income absent credit growth

More communication may hamper monetary policy, paper says

Independence and bigger MPCs may convey confusing messages and provoke forecast errors

Disagreement over inflation expectations weakens monetary policy – Bundesbank paper

Research uses data from Fed’s survey of professional forecasters from 1968 to 2017

Theory of inflation dynamics is not good enough, warns Tarullo

Former Fed governor says economists have “almost paradoxical” mix of scepticism towards and reliance on shaky concepts

Costa Rican central bank gets $1bn to shore up exchange rate

Regional fund offers credit line as central bank aims to boost reserves and relieve pressure on exchange rate; central bank plans a move towards inflation targeting

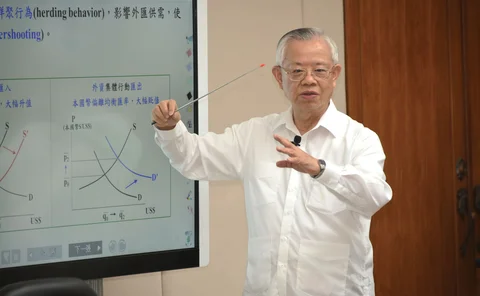

Perng Fai-nan on how Taiwan has eluded crisis for 20 years

Taiwan’s governor explains how pragmatic interventions have engendered two decades of financial stability, despite the island’s status as a small, open economy