Independence

What makes for good financial supervision?

The Wirecard debacle has led to calls for more effective oversight in Europe. Andreas Dombret identifies four essential elements

Bank Indonesia to buy $28 billion of government debt

Central bank increases direct financing of government, raising fears over currency and independence

Peter Praet on Europe’s Covid-19 responses

The former ECB chief economist talks about threats to financial stability, negative rates, common debt issuance and steps to improve the EMU

Ukrainian governor resigns in protest

Smolii says he has been the target of “sustained political pressure” aimed at stopping him doing his duty

Weidmann to testify quarterly in parliament to explain ECB policy

Measure follows constitutional court ruling requiring ECB to demonstrate proportionality of government bond purchases

Chilean government wants to give central bank QE powers

Draft law would allow Central Bank of Chile to buy government debt in “exceptional circumstances”

Norges Bank supervisory board strongly criticises contract with new SWF head

Board tells lawmakers the contract agreed by central bank governor lacks sufficient safeguards

Mauritian central bank to use $2 billion of reserves to fund firms

Central bank will also issue debt instruments to give government $1.5 billion in new funding

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

Campos Neto on reforming Brazil’s economy amid Covid-19 distress

The Central Bank of Brazil governor speaks about how Brazil is managing fallout from the coronavirus pandemic, the benefit of large reserves, his plans to deploy emergency asset purchases and why he favours extending the IMF’s SDR funding

Carstens, Jordan, Weber: respect the boundaries of fiscal and monetary policy

Axel Weber says huge US deficit could pose problems for global financial stability

Norges Bank signs working agreement with Nicolai Tangen

Tangen’s appointment as SWF chief had been questioned due to his relationship with his predecessor

The complex art of reserve management

The coronavirus lockdown represents another inflection point for central banks seeking to optimise the management of their $12 trillion in FX reserves

Economists debate monetary financing of China’s government debt

PBoC adviser dismisses idea of monetising government bonds despite calls from Ministry of Finance think-tank

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

Pandemic debt will test policy-makers – Richmond Fed research

Authorities may opt for “financial repression” policies with central banks keeping rates low – paper

German court leaves Bundesbank caught between two legal decisions

Ruling may hamper ECB’s new PEPP programme as it is not constrained by PSPP limits

Norges Bank proceeds to draw up contract of new SWF chief

Nicolai Tangen’s appointment came under scrutiny after it was revealed he asked incumbent for help during hiring process

Could engineering higher inflation help manage fiscal deficits?

Fiscal and monetary co-ordination could be a workable option for the Covid-19 recovery, Chicago Fed paper finds

Debts, deficits, central banks and inflation

Forrest Capie and Geoffrey Wood ask what insights history can provide for central banks and governments managing abrupt, large increases in debt

Norges Bank supervisory council requests information on SWF’s new head

Executive asked to answer questions on hiring process amid ongoing expenses scandal

Norway’s SWF leadership caught up in expenses scandal

Incoming chief executive asked current CEO for a favour weeks after inviting him to a seminar in the US

Proposed changes to law could damage independence – Swedish central bank

Lawmakers’ proposal would hinder crisis management capability, Sveriges Riksbank says

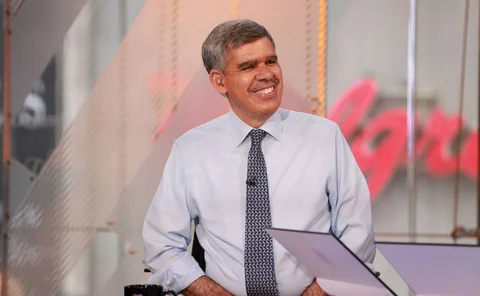

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load