Exchange rate

Mexico should ‘phase out’ daily FX sales, IMF staff say

Staff at IMF find interventions have ‘contributed to stability’ in the foreign exchange market, while a report following Article IV consultations recommends moving away from daily auctions

Challenging crosscurrents from divergent monetary policy

Divergent monetary policies around the world and challenges linked to China’s economic rebalancing present central bankers with some opportunities as well as numerous threats

Bank of Namibia defends currency deal with Angola

Namibia's central bank addresses stakeholders' concerns over its currency conversion agreement with the National Bank of Angola, including the latter’s ability to buy back kwanza

Information content of capital flows affects exchange rate impact, SNB paper finds

Private information conveyed by different kinds of capital flows affects the impact on the exchange rate, a working paper published by the Swiss National Bank finds

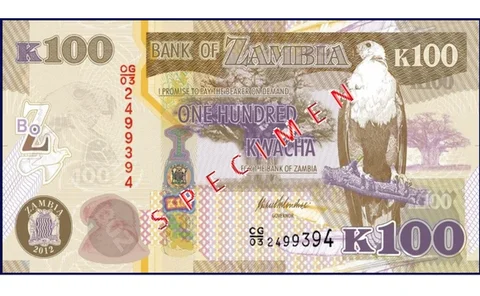

Zambia hikes by 300bp as inflation almost doubles

Bank of Zambia increases policy rate to 15.5% in an effort to keep inflation expectations anchored in single digits; annual inflation jumps to 14.3% in October as kwacha slides

Central Bank of Iceland approves failed bank plans

Central Bank of Iceland approves ‘composition agreements’ by failed banks, offering them the opportunity to duck a heavy stability tax

Swaziland currency drops under Fed decision pressures

Delayed Fed rate rise put pressure on Swaziland lilangeni, central bank says, and more moves are likely

Former Nigerian governor Sanusi attacks current central bank policy

Former governor of the Central Bank of Nigeria Sanusi Lamido Sanusi challenges monetary policy stance of Nigeria’s central bank and calls for a currency devaluation

FOMC minutes spell out inflation concerns

Several members were concerned disinflationary pressure from low oil prices and a strong dollar could persist longer than anticipated and ‘delay or diminish’ the expected rise in inflation

ECB watching oil and euro closely for inflation risks

Deflation has become less likely in the eurozone since the implementation of quantitative easing, but falling oil prices are pressing on inflation expectations, governing council says

European real effective exchange rates are hugely misaligned, paper argues

Real effective exchange rates for European Union countries do not correspond to national economic fundamentals, a working paper from the Bank of Lithuania argues

FSB report finds mixed progress on benchmark reforms

Report welcomes ‘good progress’ on many recommendations, particularly surrounding London fix, but identifies room for improvements

‘Little support’ from data for theories of disconnect between trade and exchange rates, IMF report says

Data largely supports conventional economic wisdom linking movements in trade flows with levels of exchange rates, according to WEO chapter; Japan may be an exception

Lithuanian paper explores macroeconomic imbalances

Working paper advocates a more refined analysis of the misalignments in current accounts and real effective exchange rates for the macroeconomic imbalance procedure

IMF paper offers recipe for ‘de-dollarisation’

High levels of dollarisation in central Asia are contributing to macroeconomic instability, paper says; authors offer various options that could help reduce reliance on dollars

Poloz expects Canada to manage adjustment well

Bank of Canada governor says the floating exchange rate will help the country to adjust to the resource price shock, while reducing the disinflationary risks that come with it

Russian governor weighs exchange rate pass-through

Elvira Nabiullina discusses the bank of Russia’s estimates for how much the depreciation of the ruble will impact inflation, conceding prices have increased faster than expected

BoE’s Forbes calls for rethink of exchange rate pass-through

MPC member outlines new, more nuanced approach to measuring the exchange rate’s impact on inflation, noting this implies rates could need to be tightened sooner than older models suggest

PBoC reveals $93.9 billion drop in reserves

People’s Bank of China reveals size of drop last month, driven by intervention in foreign exchange markets after devaluing yuan; reserves sat at $3.56 trillion at end of August

FX working group grappling with enforcement, says Debelle

Harmonisation of global foreign exchange codes is proving relatively straightforward, but 'adherence is our biggest challenge', says RBA assistant governor

RBA deputy welcomes ‘considerable’ exchange rate adjustment

Philip Lowe says flexibility of the exchange rate, labour market and monetary policy have helped Australian economy adjust to ‘downswing’ in commodity prices and mining investment

Zhou says markets have stabilised as G20 meetings end

The central bank governor says the renminbi and Chinese stock markets have largely finished correcting; G20 policy-makers pledge to avoid competitive devaluation

EAC officials highlight exchange rate pass-through concerns

Both central banks wary of potential for domestic inflation to increase in face of depreciating currencies; concerns over impact of external environment raised in EAC member statement

National Bank of Denmark calls end to crisis measures

Central bank has moved from buying to selling foreign exchange in recent months, opening up room to return deposit limits to more normal levels and re-start government bond issuance