Debt

Schnabel takes on Germany’s ‘false narratives’ on ECB policy

Criticism based on “half-truths” imperils trust in single monetary policy and “undermines European cohesion”

Bulgaria: long live the currency board

Bulgaria should reject the euro and extend its currency board to cover bank deposits

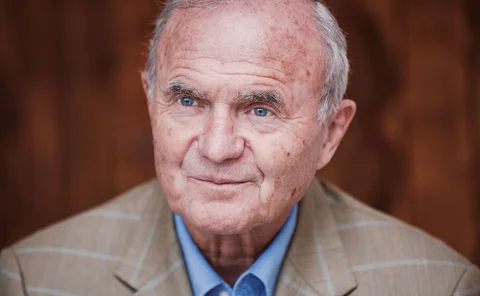

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Twelve countries’ financial sectors under IMF spotlight in 2020

Fund reveals which nations will undergo financial stability assessments, detailing which areas will face greater scrutiny

IMF praises Somali reforms and says debt relief is possible

New agreement between IMF and Somali authorities prioritises central bank development

Fed paper models new transmission channels of forward guidance

Allowing for household borrowing amplifies forward guidance effectiveness, researchers find

Economists call for action on risk of dollar liquidity crunch

Credit to non-banks and currency mismatches have grown, while oversight is “fragmented”, report warns

Ageing populations will keep interest rates low – BdF paper

Housing availability can attenuate decline in rates, authors find

BIS paper: banks may harm customers through ‘steering’

Nudging “naive” households to take decisions can harm their welfare, authors find

Crises are non-linear, beware high debt levels – research

IMF paper warns against complacency on high debt levels

Monetary easing can boost birth rate, BoE paper finds

People had more children after rates were slashed post-crisis, researchers find

Manufacturing leverage weakens ECB monetary policy – BoI paper

Eurozone industrial firms’ response to policy shocks decreases as leverage rises, researchers find

IMF sounds warning over global debt

Debt in both public and private sector may leave many countries at risk in next downturn, IMF says

Government cannot ‘grab’ central bank’s resources – Njoroge

CBK governor reiterates central bank-funded bailouts “never work”, as state agencies are forced to surrender excess securities and Treasury bills

Banks could be stuck with riskiest corporate loans during downturn – Fed paper

Researchers say loan syndication may leave banks unable to offload leveraged debt in downturn

China should bolster macro-pru framework – IMF paper

Lack of accurate credit information weakens macro-prudential measures, researchers say

Climate prudential policies could ‘backfire’, IMF economists warn

Lack of international standards could result in ‘greenwashing’ and increased financial stability risks, economists warn

Will the Fed pass its year-end funding test?

An unprecedented rate spike in September prompted the Fed to inject billions into funding markets. But will its efforts be enough to foil year-end pressures? Could opening the standing repo facility to foreign central banks help?

De La Rue faces uncertain future as profits collapse

Profits plummet 87% as firm scrambles to cut costs

Canada’s Poloz on monetary policy limits, transparency and cyber recovery

Bank of Canada governor Stephen Poloz speaks about stagflation risks from trade wars, the importance of market signals, Canada’s CBDC plans and why he is not a fan of minutes

Emerging markets face growing debt risk – IMF paper

One-third of emerging market debt over-valued as low-income countries set to issue more

The challenges facing Christine Lagarde

The new ECB president will need to focus on a successful review of the ECB’s monetary and communications policy, while encouraging fiscal stimulus and structural reform

Bank of Jamaica should ‘modernise’ regulatory framework – IMF

Fund’s recommendations follow completion of country’s second consecutive support programme

New IMF chief maintains focus on unsustainable debt levels

Debt levels at all-time high and well over twice global GDP, Kristalina Georgieva warns