Banks

Riksbank cautious on plans for new macro-prudential tools

Central bank broadly welcomes government proposals but takes issue with elements it sees as limiting flexibility

Swift rolls out new cyber defences for central banks

System uses machine learning to spot patterns and anomalies, so central banks and other institutions can act early on suspicious transactions

Lebanese banking sector holding up, despite Syria crisis – central bank

The banking sector remains liquid and well capitalised despite a “strained” Lebanese economy, the central bank says; new compliance unit formed

Financial integration enables EMs to improve trade integration – paper

BoE paper sheds light on relationship between foreign direct investment and international trade, highlighting the “substantial” economic effects for emerging markets

Kashkari rejects Dimon’s claims on too big to fail

Minneapolis Fed chief rebuts assertion by JP Morgan CEO that US banks are no longer too big to fail; says capital is too low, not too high

Congress urged to curb Fed’s regulatory powers

House hearing revives the debate on consolidating US regulatory agencies

Esma calls for greater powers over national supervisors

Supervisor also wants the authority to pause the application of some rules

Brexit will be ‘litmus test’ for global system – Carney

Global financial system has reached “fork in the road”, says Bank of England governor; UK financial firms told to submit robust set of Brexit contingency plans by July

BIS report: build liquidity co‑operation early to prepare for crisis

CGFS report urges central banks to build networks domestically and across borders to have liquidity ready for the next crisis

Tarullo admits Volcker rule may be ‘too complicated’

Outgoing Fed governor says Volcker rule probably needs adjustment, though he warns against any measures that would weaken the capital regime

Fed paper searches for optimal bank capital

Study weighs higher cost of equity against the reduction in costly financial crises implied by higher capital, estimating an optimal figure

BoJ builds on BIS banking statistics

Researchers break down the statistics further, shedding new light on patterns of cross-border banking

Bahamas further relaxes capital controls

Specific sectors of the economy will be able to obtain foreign exchange from banks both at home and abroad; non-resident firms to gain credit from international banks licensed in the Bahamas

Basel Committee outlines enhanced disclosure framework

Revised Pillar 3 standard adds “dashboard” of banks’ key prudential metrics and consolidates all existing Basel Committee disclosure requirements

Basel Committee to retain provisioning treatment as IFRS 9 launches

Committee admits differences across countries are likely to remain in the interim, while it works to design a new approach to the regulatory treatment of expected credit losses

IMF working paper examines the impact of “de-cashing” on monetary policy

IMF working paper examines the impact of “de-cashing” on monetary policy, claiming transmission would become “easier” and “faster”

Bank and capital market financing not created equal – BIS paper

Substituting bank loans for non-bank finance after a shock appears to have a negative impact on the economy, authors find

Bank of England launches first ‘exploratory’ stress test

BoE will assess banks’ longer-term resilience to periods of stagnation; cyclical test made tougher

Kenya’s Imperial Bank given 90-day lifeline

High court extends commercial bank’s receivership to allow shareholders and receiver to reach agreement; Kenya’s central bank takes first step toward removing licensing moratorium

Extended monetary easing in US has larger impact abroad – paper

IMF paper examines the impact of periods of prolonged monetary easing on risk-taking behaviour; leverage ratio and other measures of vulnerability increase

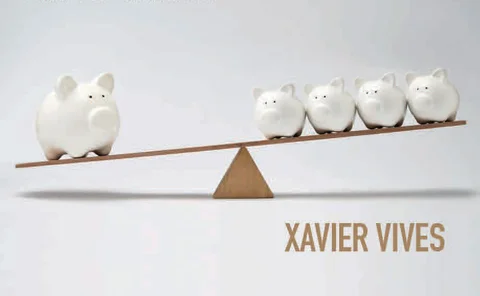

Book notes: Competition and Stability in Banking, by Xavier Vives

Xavier Vives has written a fascinating book that highlights many important issues in banking regulation. But there are some flaws in his argument

CEPR report ‘cautiously optimistic’ on bail-in

Thomas Philippon and Aude Salord find range of issues with European bail-in rules, but say they can probably be fixed; Cyprus bail-in “terribly” executed but still worked

London financial sector likely to ‘lose prominence’ following Brexit, says Sarb bulletin

South Africa to watch developments in London closely following Brexit vote, as domestic banks decrease exposures to the UK

Norges Bank paper offers method of stress testing with fire sales

Model recognises possibility of indirect exposures, which could affect outcome of bank stress tests