United States

US Phillips Curve “not broken” – IMF paper

Working paper finds economic behaviour since the crisis reflects different sources of disturbances, and not a change in the dynamics of the Phillips curve

Fed’s Tarullo looking for more evidence on inflation

Daniel Tarullo wants to see more convincing evidence that inflation is returning to target before tightening monetary policy; headline and core PCE inflation are still below target

Rate delay could deprive Fed of tools in future, warns Mester

Cleveland Fed president says there is a “non-negligible chance” unconventional tools will be deemed as “ultimately ineffective” by the public if the Fed is too slow to normalise policy

Two banks fail Fed’s annual stress tests

Most bank holding companies pass the Comprehensive Capital Analysis and Review, but Deutsche Bank Trust Corporation and Santander Holdings USA pulled up for “substantial weaknesses”

IMF paper examines factors affecting US wage growth

US labour market changing “more fundamentally” than before, author finds; wage growth expected to accelerate in near term

Fed’s Powell sees potential for ‘new headwinds’ in Brexit

Governor says global risks to US outlook have increased in the wake of the UK’s vote to leave the EU

Effective lower bound has ‘tail risk’ influence on monetary policy, ECB paper argues

The ‘tail risk’ induced by the possibility of rates reaching their effective lower bound can cause serious undershooting of inflation targets, an ECB working paper argues

News impacts stock prices through more than transient sentiment, paper finds

Working paper uses textual processing to examine more than 900,000 news stories; negative stories have a longer and more delayed reaction, authors find

Yellen says July hike ‘not impossible’ as Fed holds

Fed keeps policy unchanged as widely anticipated; expected path of interest rate hikes becomes more gradual while the long-run level is revised down again

Oil price falls may have negative effects on global economy, ECB warns

Falling oil prices may negatively affect global GDP growth and could threaten financial stability across emerging markets, ECB bulletin says; demand not supply now main pressure on prices

Low rates driving up housing share of income – RBA paper

Share of aggregate US income from capital is on the rise, and housing accounts for a large portion; low nominal rates explain strong demand for housing, economist argues

Yellen upbeat but concerned by weak jobs data

Janet Yellen expects continued progress to Fed’s objectives; says latest labour market report is “concerning” but warns against reading too much into it

US jobs report puts Fed hike expectations on ice

Small increase in non-farm payrolls leads market to all but write off prospect of a rate hike later this month; Lael Brainard and Eric Rosengren keen to see more data

Financial crises raise transmission of US spillovers to Latin America – paper

Central Bank of Colombia paper shows Brazil is a “net transmitter” of volatility; transmission of spillovers increases in times of political and financial uncertainty

Kohn encourages Chinese efforts on financial stability

Don Kohn, an external member of the Bank of England's FPC, welcomes Chinese work on a framework for macro-prudential regulation, and offers his insight on counterparts in the UK and US

Researchers propose new measure for US fixed-income market liquidity

Authors say it is the first index to apply financial stress indicator methodologies to both US government and corporate debt securities

June hike an option but Fed officials split on prospect

Minutes from FOMC meeting in April show “most” participants happy to hike next month if incoming data continues to improve, but some suspect gains may not come fast enough

Colombian paper sees role for international co-ordination of housing policy

This may be needed where national policies have “important” cross-border effects; discusses macro-prudential policy and capital controls

Central bankers may talk too much, economist warns

The public's limited attention span might distort the intended message, publication warns; central bankers might consider talking less and delivering a more succinct message when they do

Mester favours ‘error band’ around FOMC projections

Cleveland Fed president Loretta Mester would like to some kind of “error band” introduced around FOMC projections, to reflect the uncertainty the committee is grappling with

Traditional banks played leading role in creating US credit boom, paper finds

Traditional banks played a larger role than ‘shadow’ banks in originating US loans in the lead-up to the financial crisis, paper published by Deutsche Bundesbank says

Building a fast, flexible and free DSGE model

A team at the New York Fed is part way through translating its DSGE model into Julia, a fast, open-source mathematical programming language

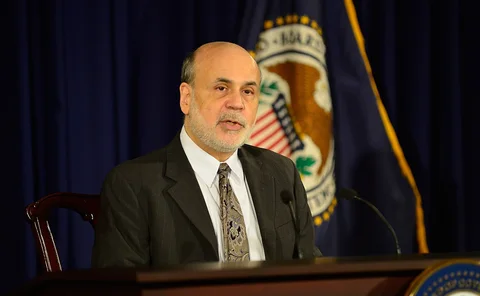

Meltzer criticises Burns and Bernanke over Fed independence

Allan Meltzer criticises the former Fed chairs for giving independence away; wants to incorporate a rule into policy-making, while Peter Conti-Brown favours governance reforms

Fed board gets financial stability division

The office of financial policy and research, established in 2010 to co-ordinate work across the board, is reclassified as a financial stability division; Fed cites “growth in responsibilities and staffing”