Former central bank chief to head up Zimbabwe SWF

Kombo Moyana will chair board governing the country’s new sovereign wealth fund

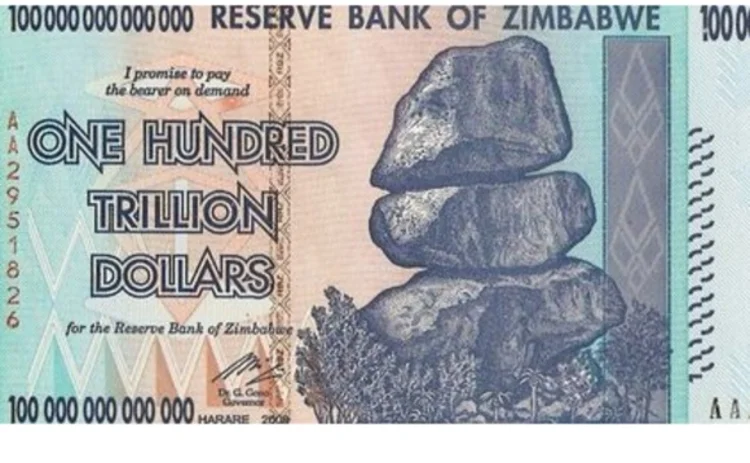

A former two-term governor of the Reserve Bank of Zimbabwe (RBZ) will head a 10-member board governing the country's new sovereign wealth fund (SWF), according to reports from Zimbabwean media which claim the appointment was announced by the finance minister on June 19.

Kombo Moyana was the first black governor of the Reserve Bank of Zimbabwe, a post he held from 1983 to 1993. In 2010, he returned to the RBZ as a member of its board, though he is not currently listed as a member on the RBZ

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com