News

Fed presidents in conflict over 'too-big-to-fail'

Lacker, Fisher, Hoenig and Bair called before US Congressional committee to voice their opinions on Dodd-Frank Act's Orderly Liquidation Authority

Fed proposals seek to shine light into money markets

Proposals for daily data reporting by a panel of 155 banks aim to improve the Federal Reserve's ability to supervise shadowy money markets

Basel Committee reveals leverage ratio formula

Proposals detail leverage ratio calculation framework and disclosure requirements that will enter force in 2015; committee keeps options open for a higher leverage ratio than originally planned

Chinese financiers hit out at 'blind' PBoC

China central bank accused of being blind to potential capital market reaction in its attempts to clamp down on the shadow banking sector

Bank of England concerned by ‘vulnerability’ to interest rate increases

Financial Stability Report calls for assessment of financial institutions' exposure to increases in global interest rates; recommends banks are allowed to reduce their liquid asset holdings

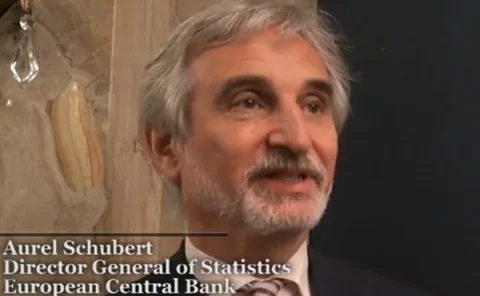

Central bank statistics departments facing multiple strains, says ECB’s Schubert

Meeting new monetary, micro-prudential and macro-prudential data requirements is a major burden for central bank statistics departments, says ECB statistics head Aurel Schubert

King defends Bernanke over communication of Fed policy

Bank of England's Mervyn King says Fed chairman Ben Bernanke could ‘hardly have been clearer’ over future of monetary policy; vents his frustration at slow pace of economic reforms

Stein and Wheatley to head up new FSB benchmarks steering group

Financial Stability Board sets up steering group to improve benchmarks; private sector invited to contribute to the review process

Financial institutions must prepare for higher interest rates, says Carney

Incoming Bank of England governor calls for ‘continued vigilance’ to avoid the financial system being caught out by volatility and interest rate rises caused by an exit from easy monetary policy

Switzerland passes Basel III implementation test

Assessment finds country ‘compliant’ overall with Basel III capital framework, although a number of regulations had to be tweaked to make the grade

Jane Austen ‘quietly waiting in wings’ to feature on UK banknote

Bank of England governor Mervyn King says Jane Austen is a likely candidate to feature on next £10 note; fails to appease concerns over all-male banknote roster

BIS's Caruana wins term extension as Cecchetti prepares to quit Basel

Jaime Caruana to stay at BIS to 2017, but Stephen Cecchetti will leave in November this year; RBA's Debelle and FDIC's Verley take up other Basel posts

BoE and PBoC open ‘very important’ renminbi swap line

Bank of England and People’s Bank of China establish three-year 200 billion yuan swap line; fourth largest of its kind and first in European Union

Frenkel to rejoin Bank of Israel as Fischer replacement

Former Bank of Israel governor nominated to replace Stanley Fischer; decision surprises some as deputy governor Karnit Flug appeared to have Fischer's backing for the role

PBoC maintains hard line on liquidity

People’s Bank of China insists there is a ‘reasonable’ level of liquidity in financial sector and says commercial banks are responsible for their own levels of reserves

Central banks need to start tightening policy, says BIS

The Bank for International Settlements says easy monetary policy has reached the end of what it can usefully do, warning that continuing QE will exacerbate risks and delay necessary reforms

PBoC leaves banking sector sweating over liquidity squeeze

Tight credit conditions persist as the People’s Bank of China remains silent about liquidity injections into increasingly strained banking sector

ESRB issues macro-pru advice, as IMF warns over possible conflicts

European Systemic Risk Board recommends five ‘intermediate objectives' for macro-prudential policies in the EU; IMF paper warns of potential conflicts with micro-prudential measures

Bangladesh governor targets stronger debt market

Atiur Rahman concerned by public and private sector reliance on bank funding, but says government should wait until after elections to issue first sovereign bond denominated in US dollars

ESM direct recapitalisation gets go-ahead

Eurogroup reaches agreement over main features of direct bank recapitalisation under the European Stability Mechanism, but commentators warn the deal could still falter; CRD IV also adopted

UK's Royal Mint brings back golden guinea to mark 350th anniversary

New £2 coin designed in the style of the now disused guinea, featuring the crest of King George III; coin will enter circulation later this year

Fed's monetary policy deviates from best practice, says Bullard

Fed monetary policy has deviated from central bank best practice and should be used ‘to meet policy objectives, not calendar objectives', says St Louis Fed president

BoE's King says expectations less important than economic conditions

Bank of England governor says focus should be on creating the right economic conditions for normalising monetary policy rather than talking people through it

Bernanke plays down Jackson Hole importance

Kansas Fed's renowned symposium is a conference sponsored by just ‘one of the 12 reserve banks' says Bernanke, who declined to comment on his future following FOMC meeting