News

IMF: rise of non-banks is reshaping policy transmission

Pass-through of monetary policy grows as non-banks become more important, but changed transmission mechanism demands better data to understand risk-taking channel

PRA tightens standards for buy-to-let market

“Interest coverage ratio” and affordability stress tests to be implemented by January 2017, while remaining measures must be implemented by September 30

Bank of Canada should not raise inflation target – Obstfeld and co-authors

Central bank has been overtaken in transparency metrics, authors say; forward guidance would catapult Canada to top of rankings and could avoid the need for unconventional measures

Rajan and co-authors present paper to ECB research conference

Paper introduces “pledgeability” as analytical tool; concept helps explain prolonged financial downturns, authors say

Big data could cut regulatory costs, say panellists

Big data could lead to a reduction in costly regulatory reporting, but three experts say there is still a long way to go before the figures are up to scratch

Fed’s Yellen defends Brainard against congressman’s charges of political bias

No sign of political bias from FOMC members, Yellen says, amid accusations Lael Brainard might be looking for a job in a Hillary Clinton administration

Bahamas launches new banknote series with innovative security thread

Central Bank of Bahamas launches “Crisp Evolution” series, the first “circulation banknote” to feature new colour-changing security thread; $10 note to enter circulation immediately

Armenia cuts again as deflation deepens

Central bank cuts headline rate as inflation dips further below zero, though the board maintains it will be able to return inflation to target in medium term

Inflation expectations more sensitive near the zero lower bound – IMF study

IMF study examines whether monetary policy can boost inflation in constrained environment; countries near zero lower bound could see inflation respond more to shocks

Central banks adopt Swift harmonisation charter

Three central banks join 18 other institutions in global rollout of messaging standard ISO 20022; separate taskforce working on publishing market practice guidelines

Fed members differ on monetary policy, as Trump again attacks Yellen

Rosengren calls for “modest, gradual tightening”, while Kashkari sees slack in labour market; Republican candidate questions Fed’s political impartiality

BoE’s Salmon warns forex industry on adherence

Chris Salmon, the Bank of England's executive director for markets and lead on global code adherence, says regulation could be on the horizon as soon as 2020 if market participants don't adhere to the new Global Code

Fed’s Tarullo: stress testing needs to evolve

Fed is planning to toughen its stress-testing framework with better alignment with regulation and incorporation of dynamic “amplification” effects – though more research is needed

ECB says it has learned lessons from simulated cyber attack

Federal Reserve, eurozone central banks and private firms took part in exercise to test Target2 payment system

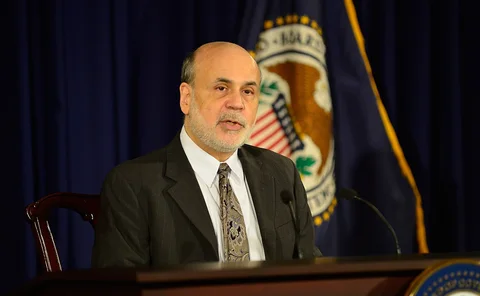

Inclusion of renminbi in SDR is ‘symbolic’, says Bernanke

Former Fed chair sees inclusion of renminbi in SDR basket as a ‘symbolic’ gesture rather than a major shift; Eswar Prasad argues currency will never be a safe haven

Sama intervenes to ease liquidity pressure on banks

Saudi central bank makes deposits worth over $5 billion at commercial banks struggling with low liquidity, and introduces new repo facilities

RBNZ floats idea of bank regulatory dashboard

Bringing regulatory disclosures together in one place could impose market discipline and allow more straightforward comparison of risks, central bank says

Crane invests $100 million in new banknote plant

New banknote facility in Malta to add to existing operations in Sweden and the US, employing 200 people

Yemen’s president sacks governor and announces new central bank in Aden

Move may increase humanitarian crisis as former central bank head managed to prevent worst outcome in “dire” circumstances, expert says

ECB officials and Borio disagree on falling real rates

Vítor Constâncio and François Villeroy de Galhau emphasise importance of saving-investment mismatch, while Claudio Borio stresses financial cycle, but speakers find some points of agreement

Distributed ledgers ‘too much of a moving target’ to write business standards, says Swift

Paper addresses questions about how DLT automation can run smoothly in multi-party network environment; Swift recognises full-scale standardisation of distributed ledger use is premature

Bank of Israel moves to eight-meeting policy cycle

Cut in number of meetings reflects stability of economic indicators and will allow for more detailed analysis at each meeting, central bank says, though one member criticises loss of flexibility

Central Bank of Barbados launches biannual economic magazine

Barbados launches financial magazine after “ironing out” issues; central bank’s latest venture “demystifies” economics for the general public

ESRB publishes guide to OTC derivatives database

Draghi repeats pledge to extend central clearing regulation to all forms of derivatives; ESRB paper sheds light on “opaque” markets