Denmark’s move to a holistic and dynamic risk budget

Jacob Wellendorph Ejsing and Morten Kjærgaard

Trends in reserve management: 2018 survey results

Denmark’s move to a holistic and dynamic risk budget

Custody in 2025: a primer for reserve managers

Assessing sources of excess return: style analysis for active investing

The role of reserves in Iceland’s post-crisis recovery

Interview: Solomon Kavuma

Since the 1980s, Denmark has successfully maintained a fixed exchange rate policy, first against the Deutschemark and, since 1999, against the euro. To support the currency peg and safeguard financial stability, liquidity management of the country’s foreign reserve is of primary policy importance to its central bank, the National Bank of Denmark. Over the past decade, the central bank has intervened frequently in foreign exchange markets, and has had to navigate both massive currency outflows and inflows.

Although the foremost concern of reserve management is to ensure the availability of ample and liquid reserves, central banks also strive to earn the best possible return, given their constraints and risk tolerance. To better support this goal, the National Bank of Denmark has transformed its approach to reserve management in recent years. A major milestone on this journey has been the introduction of a holistic risk budget based on a quantitative model encompassing all assets and liabilities. Here, a risk budget can be thought of as a way of expressing policymakers’ acceptable range for overall financial risk. The latest step – taken in 2017 – has been to define a “policy portfolio” that reflects the central bank’s unavoidable policy risks, and to use this as a reference when setting the overall risk level. This, in turn, has made the risk budget dynamic, as the risks related to policy mandates vary over time. Reformulating the risk budget has facilitated communication regarding the financial implications of the National Bank of Denmark’s various objectives. In addition, it has improved the available risk/return trade-off.

This new, more data-driven, investment approach has worked well through various market gyrations over the past few years. Not least, it has contributed to significant excess returns relative to a continuation of the previous investment strategy, and it has achieved this without increasing overall risk.

The chapter will first discuss the holistic approach to risk, and then policy portfolio as risk reference, before examining the higher returns for the same level of risk and outlining the data-driven investment process. It concludes with a discussion of in-house risk modelling, including a methodology for setting returns on investment strategies.

Holistic approach to risk

The primary purpose of the reserves is to ensure the National Bank of Denmark will be able to intervene to support the fixed exchange rate policy. Moreover, reserves must be able to support financial stability and lend to the International Monetary Fund at short notice. To ensure the fulfilment of these objectives, reserve assets are categorised into two tranches: a liquid tranche (tier 1) and a less-liquid tranche (tier 2). The amount that may be invested in the less-liquid tranche is capped.

In addition to the consideration of a sufficiently liquid reserve, the Danish central bank also aims to increase earnings while keeping risk at a target level. To that end, it takes on investment risk. Investment risk can be taken in both the tier 1 and tier 2 tranches, as well as in derivatives-based overlay strategies. A German government bond, say, would belong in the tier 1 tranche, as it is a liquid asset, although its inherent interest rate risk is part of the investment risk. A corporate bond, on the other hand, as a less-liquid asset, would belong to tier 2, and add interest, credit and liquidity risk to the investment risk. The derivatives-based overlay includes bond and equity index futures. The use of an overlay facilitates the separation between liquidity and risk management decisions. Due to individual assets’ differing risk characteristics and the use of derivatives, the breakdown of the portfolio in terms of cash assets (see Figure 2.1, left-hand column) – which is dominated by money-market instruments – is very different from the breakdown in terms of risk (see Figure 2.1, right-hand column). For Figure 2.1, risk contributions reflect the combined contributions from assets and liabilities, and, adjusted for diversification, are computed as marginal risk contributions.

Overall risk is managed using a holistic risk budget, which – on a day-to-day and mark-to-market basis – seeks to capture the risks on all assets and liabilities. Specifically, risk is defined as the average financial result in the worst 5% of cases (ie, expected shortfall), and the budget specifies an acceptable range for the risk. In keeping with the central bank’s accounting principles, gold as well as all financial assets and liabilities are marked-to-market – and revaluations directly affect the profit and loss (P&L) account. Overall risk includes investment risk but also risks related to the central bank’s policy tasks as discussed below. The holistic approach makes apparent the benefits of diversification and thereby also facilitates the introduction of new asset classes.

At the level of governance, the transformation has resulted in major simplifications. In the reserve management area, policymakers can now focus attention on decisions regarding liquidity and the overall risk level, and, in turn, delegate decisions concerning detailed lines and limits to the operational level. In particular, the board of governors now expresses its risk tolerance through the single, overarching risk budget.

Policy portfolio as risk reference

Once an all-encompassing risk metric is in place, a decision must be taken on what overall risk level to target. For the typical central bank, the trade-offs and constraints are arguably more diffuse than for tightly regulated institutions such as banks and pension funds. Therefore, what should guide risk appetite?

To answer this, we revisit our mandate. Central banks’ main task is not to take financial risks to generate profits, but rather to ensure monetary and financial stability. However, often the fulfilment of central banks’ policy mandates – whether they involve management of exchange rates, quantitative easing programmes or gold purchases, etc – will entail some significant and unavoidable financial risks. Taking no risk is usually not a viable option. Hence, a natural starting point for deciding on the risk level is to consider a situation where the central bank does not engage in any return-seeking activities, and only holds the assets and liabilities it needs to fulfil its policy functions. This situation is referred to below as the central bank holding its “policy portfolio”. In this case, the central bank does not take on any investment risk, and is only exposed to “unavoidable policy risks”.

The exact meaning of unavoidable policy risks will differ among central banks and monetary policy regimes. For countries with a floating exchange rate, fluctuations in exchange rates vis-à-vis the main reserve currencies will be an unavoidable source of risk. For central banks engaged in quantitative easing, market and credit risk will also be significant policy-driven sources of risk – seen from a fair-value perspective.

In the case of Denmark, there are three major sources of unavoidable policy risks related to the central bank’s policy mandates. First, the central bank must hold a sufficiently large currency reserve. This exposes the National Bank of Denmark to fluctuations in the exchange rate in terms of the euro. The fixed exchange rate policy, however, ensures that these fluctuations are very limited. Also, holding currency reserves necessarily exposes the central bank to fluctuations in the spread between domestic and foreign short-term interest rates. In 2018, this contribution to risk has been limited, as the spread between short-term rates in Denmark and in the euro area has been fairly stable. Second, the central bank must – according to the country’s central bank act – hold a certain quantity of physical gold. Gold is the main source of risk in the portfolio (see Figure 2.1) as the volatility of the gold price is much higher than for any other policy-related asset or liability. Third, the central bank must provide credit against collateral to domestic banks. Due to the terms and collateralised nature of these credit provisions, this risk is comparatively small.

To calculate risk numbers and decompositions of profit and loss for the policy portfolio, the concept of unavoidable policy risks has to be made fully explicit. There are inevitable trade-offs between realism and simplicity, but the guiding principle is that the central bank should be able to hold the policy portfolio if it decides to do so (see Box 2.1).

Box 2.1 Defining the policy portfolio

The policy portfolio should reflect the simplest possible portfolio with very little risk that allows the bank to fulfil its policy mandates. As central banks generally take investment risk by investing in other assets in the actual portfolio, hypothetical and counterfactual assumptions on the composition of the policy portfolio are required. The construction of this portfolio should be “model-free” in the sense that no portfolio optimisation should be required for determining its exposures.11For example, it may be that the policy portfolio could reduce its risk by adding modest amounts of equity exposure. However, such optimisation would make the policy portfolio’s composition directly dependent on specific modelling choices (such as estimated covariances and assumed returns). The policy portfolio thus typically resembles an orthodox central bank portfolio comprised of monetary policy assets and liabilities, gold as well as short-term marketable fixed income assets with as little credit and liquidity risk as possible.

For operational purposes, the National Bank of Denmark defines the policy portfolio as a simple balance sheet, which on the asset side only consists of gold holdings and money-market equivalent instruments, and on the liability side consists of capital, currency in circulation and (net) monetary policy deposits. On the asset side, part of the policy portfolio’s holdings of money-market equivalents is defined as the actually held positions in cash accounts (mainly with other central banks) and reverse repos, but – to account for concentration and other limits – the remainder of the policy portfolio’s assets is assumed to be held in short-term government bonds with all interest exposure swapped to an overnight rate. ■

Higher returns for the same level of risk

Given that the risk of the policy portfolio in a sense represents the central bank’s innate risk level, a natural first step to consider is what return-enhancing strategic exposures can be added without increasing overall risk. Or, in other words, what reallocations can be undertaken to move the portfolio vertically in the risk/return space closer to an efficient allocation? As it turns out, returns from bond and equities have historically had low – or even negative – correlations with gold returns (measured in euros). Therefore, adding moderate equity exposures to the policy portfolio can actually increase the expected return without increasing overall portfolio risk.

One way to think about this is that, until a certain level of equity and duration exposure has been reached, a central bank holding a portfolio where risk is dominated by gold has a comparative advantage in taking on equity exposures. Such a central bank faces a highly attractive risk/return trade-off at low levels of equity exposure. As more and more exposure is added, however, the tradeoff converges to that faced by the market as a whole.

Making the risk budget dynamic

In early 2018, the National Bank of Denmark’s investment risk increased the expected return, but it did not increase the total financial risk. In other words, total risk was comparable to the risk of the (specified) policy portfolio. The Board of Governors decided to express the risk budget as a symmetric range around the risk level of the policy portfolio of the form: [risk of policy portfolio – a; risk of policy portfolio + b] where a and b are constants (and, in National Bank of Denmark’s case, a = b). At the time of writing, March 2018, risk is centred around the risk of the policy portfolio, but it could in principle be higher (a < 0, b > 0) or lower (a > 0, b < 0).

It follows that the upper and lower risk limits shift with the risk of the policy portfolio. The risk budget therefore becomes dynamic, as it uses the policy portfolio as reference. One consequence of this is that if the gold price (or its volatility) has increased since the previous rebalancing, the target for equity exposure will typically also increase. This reflects the role of equities in diversifying gold exposure: with higher gold exposure, more equity exposure – which offers additional expected return – can be added without increasing overall risk.

This built-in positive co-movement between gold and equity exposures contrasts sharply with the mechanics of a static, absolute risk budget in the form [a, b]. In that case, were gold exposures to increase, say, if its price increased, it would be necessary to cut back on other exposures, such as equities, in order to continue to meet the absolute risk target. This reaction pattern is particularly unfortunate given that more gold exposure actually improves the marginal risk/return trade-off for equity exposure in the portfolio. Also, selling equities at a time when gold is soaring will usually lead to inappropriate, procyclical behaviour.22This is not an entirely theoretical concern. Jukka Pihlman and Han van der Hoorn, “Procyclicality in Central Bank Reserve Management: Evidence from the Crisis,” IMF Working Paper No. 10/150, 2010, shows that central bank reserve managers partially withdrew from riskier investments during the financial crisis of 2008–09, and point to a potential conflict between the reserve management and financial stability mandates of central banks. In more extreme, but not unimaginable scenarios, gold exposure could increase so much as to render the absolute risk budget unattainable.

The dynamic risk budget, on the other hand, takes into account the unavoidable nature of the risks stemming from the policy portfolio. By doing so, it ensures that the resulting risk budget is actually attainable by those responsible for day-to-day portfolio management. Seen from this perspective, the dynamic risk budget is a way to facilitate an ongoing, consistent choice of the risk/return trade-off over time and market states. The dynamic risk budget was implemented in June 2017, and since then the risk of the actual portfolio has been brought gradually in line with the risk of the policy portfolio, mainly via limited adjustments to equity and duration exposure (see Figure 2.2).

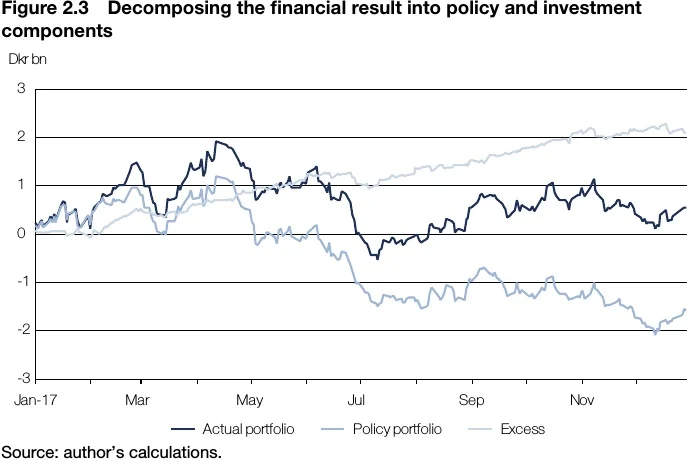

The distinction between the policy portfolio and the actual portfolio also allows for decomposition of the P&L account into components that reflect the policy mandates and other components, which in turn reflect active investment decisions. Doing this retrospectively for 2017, one can see that the policy portfolio suffered losses on the asset side due to gold and negative money-market rates. However, when one looks at the actual portfolio, due to diversification benefits and generally favourable market developments, the active exposures in equity and credit markets, as well as duration exposure, more than offset the losses of the policy portfolio. This resulted in a modest, positive overall financial result for the actual portfolio for the year (see Figure 2.3). Note that the numbers in Figure 2.3 are preliminary, and include only profit/loss from financial portfolios (not administrative expenses, etc).

Data-driven investment process

How does the investment process centred around the dynamic risk budget work in practice? The overall purpose and governance of the central bank’s financial portfolios is laid out in its principles for portfolio management. A more specific investment mandate, which must be approved at least annually by the board of governors, stipulates the overall risk budget, a cap on less-liquid investments and lists the set of eligible instruments.

Portfolio adjustments – including rebalancing towards the time-varying risk target – are decided at a monthly investment meeting chaired by the head of reserve management. Typical decisions include changes to duration (across currencies and maturities) and/or to equity exposure. The decisions are implemented within the following couple of weeks, unless the adjustments are unusually large or involve illiquid instruments. In the case of abrupt market developments or large changes in placement needs (eg, due to substantial intervention in the foreign currency markets), ad hoc investment meetings can be convened.

As long as the size of the reallocation is within the overall risk budget and exposure limits stated in the investment mandate, the portfolio adjustments can be implemented without a further approval process. This facilitates a very short cycle from analysis to implementation, reducing the likelihood that the reallocation proposals are overtaken by subsequent market developments.

The starting point for the periodical rebalancing decisions is a model-based proposal, which reflects the implicit “baseline view” incorporated in the model’s risk premia assumptions. These assumptions imply some leaning towards investment strategies exhibiting more carry (see Box 2.2). To mitigate the notorious robustness issues in portfolio optimisation, diversification constraints are imposed and the model is only allowed to reoptimise over a limited set of key exposures. The model-based proposal aims to bring the actual portfolio back to the centre of the dynamic risk budget in the most efficient way. At the monthly investment meeting, the proposed reallocations to individual exposures are then evaluated, also factoring in considerations that are not modelled explicitly.

Taking a quantitative portfolio model as the starting point for the investment process can have additional advantages in a central banking environment, where there is little incentive for risk-taking. For instance, the compensation of staff involved in asset allocation decisions is generally not linked directly to financial performance. There are good reasons for this, especially in view of the subordinate role profitability plays among central banks’ objectives. However, this incentive structure may lead to biases towards too little financial risk-taking, which a data-driven approach can help to alleviate to some extent.

In-house risk modelling

The risk-budget approach requires a relatively sophisticated quantitative framework. All balance-sheet items must be mapped to underlying “risk drivers” in a consistent way, and the volatility and correlation of these risk drivers must be carefully modelled. To control, and thoroughly understand, the modelling trade-offs involved, the National Bank of Denmark develops and maintains its own risk model (see Box 2.2).

Box 2.2 Purpose and overall structure of the strategic asset allocation model

The strategic asset allocation model (SAAM) serves two main purposes. First, the model is used to quantify the risk and expected return of the central bank’s financial portfolios. Second, it supports asset allocation decisions by quantifying the implications for risk and expected return of potential changes to the portfolios. Compared to various commercial alternatives, the model is better suited to handling the central bank’s longer-term perspective and avoids the often inappropriate square-root-of-time scaling of risk numbers. In addition, it takes into account the accumulated earnings over the horizon, as well as more realistic assumptions regarding the rebalancing frequencies of different exposures.

Scenarios for portfolio returns are generated by modelling returns on all relevant assets in the spirit of Meucci.33Attilio Meucci, Risk and Asset Allocation (Berlin: Springer, 2009). Assets returns are driven by a set of risk drivers. For example, the risk drivers for a given yield curve are taken to be the level, slope and curvature factors that can be extracted for that curve. Once historical series of risk drivers have been estimated, a joint (fat-tailed) distribution is estimated from which a large number of scenarios (currently 10,000) for all risk drivers – and thus asset returns – can be generated. Individual risk drivers are modelled either as a random walk (eg, equity indexes or the gold price) or a mean-reverting process (eg, the €/DKr exchange rate or yield curve slopes). Risk drivers are generally allowed to exhibit volatility clustering.

The simulation-based model delivers figures on aggregate risk and expected return, as well as breakdowns of these quantities along multiple dimensions. The breakdowns are used, for example, to decompose changes in total risk into contributions from different sub-portfolios/risk factors/asset classes. Results from SAAM also underlie the monthly risk report to the board of governors. The projection horizon of the model is 52 weeks and the model’s base currency is the Danish krone. Market data – and thus statistical models for risk factors – are updated weekly, whereas the portfolio positions are updated daily. ■

One of the key modelling choices is how to handle expected returns. To allow for quantification of risk/return trade-offs, it is necessary to set return expectations for all individual investment strategies considered. This is fraught with difficulties, not least because historical returns – especially for bonds – are unlikely to be a good guide for future returns. Driven by a desire for simplicity and consistency across investment strategies, a rather mechanical two-step methodology is used (see Box 2.3). Another more recent challenge is the potentially asymmetric bond returns at the current yield level. This is handled by using a “shadow-rate model” when simulating future yields. Addressing the issue of asymmetries is particularly pertinent at present, as one may otherwise overstate the potential diversification benefits between bonds and equities.

Given the notorious robustness problems of mean-variance style optimisation across a large number of assets, the portfolio model is only allowed to explore the risk/return implications of changes to a rather narrow set of major risk factors, mainly the level of equity exposure and key rate exposures to major government bond curves. Further, although it is the ambition to place the portfolio at an attractive position in the expected shortfall/expected return space, staying on the largely hypothetical efficient frontier at all times is neither realistic nor desirable in practice.

Box 2.3 Methodology for setting expected returns on investment strategies

It is well known that while covariances of returns can be estimated with some degree of reliability from historical data, this is not generally the case for expected returns. This has led to approaches, such as Black–Litterman,44F. Black and R. Litterman, “Asset Allocation: Combining Investors Views with Market Equilibrium,” Fixed Income Research, Goldman Sachs (September 1990). where baseline return expectations are derived from an assumption of market equilibrium, or the “risk parity” approach, which does away with the need for – at least explicit – return expectations altogether.

For the purpose of portfolio management, the National Bank of Denmark defines risk as the average financial result in the worst 5% of cases over the next 12 months. Given this relatively long horizon, assumptions about expected returns have a non-negligible effect on expected shortfall.55This is not the case for very short-term risk measures often used for regulatory purposes. Over a horizon of one week, say, the size of the expected return has essentially no impact on expected shortfall. Notwithstanding the difficulties, the setting of expected returns is therefore a prerequisite for using this longer-term risk metric. The challenge is to set expected returns on all relevant investment strategies. Ideally, the returns should be both mutually consistent and quantitatively plausible in light of other evidence. The methodology must be able to answer specific questions, such as “what is the expected return, over the next 12 months, on a strategy that on weekly basis rolls an exposure at the five-year point of the euro swap curve?”

One way to address this challenge – at least for yield curve strategies – would be to estimate so-called arbitrage-free dynamic term structure models (DTSM), and thereby directly obtain empirical estimates of term premia. While rigorous and attractive in principle, such model-based estimates of term premia often suffer from a lack of robustness that relates, among other things, to the fact that the long-term mean-reversion levels of yields are not well-identified in the historical data. Moreover, such arbitrage-free models – especially in their shadow-rate variants – can be rather cumbersome and time-consuming to estimate, which is inconvenient in a production environment where many different curves need to be estimated daily within a short timeframe.

Another potential approach would be to look at projections provided periodically by, for example, banks and asset management firms. One drawback here is that such projections typically do not cover all relevant combinations of currencies, maturities and rebalancing frequencies. Hence, an elaborate inter- and extrapolation scheme would in any case be needed. Even so, the impact of parameters such as rebalancing frequency may be difficult to take into account. A perhaps more serious drawback, however, is the lack of clarity about what exact methodology and assumptions were used to arrive at these return expectations in the first place.

Considering the shortcomings of the alternatives, it seems preferable to instead rely on a simple but general principle. Empirical evidence suggests that a “no change” assumption for market variables could serve as such a principle. Across multiple assets, time periods and regions, this seemingly naïve approach has historically been among the best predictors for future realised returns. For instance, this has been the case for the return on yield curve positions and foreign exchange carry trades.66See R. S. J. Koijen, T. J. Moskowitz, L. H. Pedersen, and E. B. Vrugt, “Carry,” Journal of Financial Economics 127(2) (2018): 197–225.

These empirical findings suggest a simple, yet general, way to generate assumptions for expected returns across investment strategies. For example, in the case of yield curve positions, first-step expected returns can be computed by assuming that the yield curve does not change over the forecast horizon. Using this logic, the expected return on a five-year position over the next year can be computed as the current five-year yield plus four times the current spread between the five-year and the four-year yield. The associated risk premium is then simply the difference between the calculated “no change” return and the (riskless) one-year yield. This provides mutually consistent expectations across all maturities.

However, the method will likely overestimate risk premia since a steep yield curve may partly reflect market expectations of increasing yields in the future. This effect can be taken into account by scaling down the previously derived risk premia by some fraction (eg, by half). The idea can be extended to other assets. For example, first-step expected returns for equities can be obtained – in the spirit of the Gordon growth model – by assuming unchanged dividend yield and constant market capitalisation relative to nominal GDP. Again, by subtracting the (riskless) one-year yield, risk premia are obtained.

The resulting expected returns across all investment strategies are robust in the sense that they change rather smoothly over time and do not rely on potentially over-parameterised models. However, they remain responsive to factors that have proven (somewhat) predictive for returns historically, such as the slope of the yield curve or the dividend yield for equities. In particular, expected returns for short-term fixed income assets, which make up the bulk of most central bank balance sheets, are generally quite reliable and provide an acceptable basis for projecting the financial result over multiple months. As long as adequate constraints are put in place to ensure an acceptable degree of robustness, the expected returns can also be used as input for portfolio optimisation. ■

Conclusion

Over the past couple of years, the National Bank of Denmark has transformed its approach to reserve management. Simpler investment governance and the introduction of a holistic risk budget based on a quantitative model encompassing all assets and liabilities have been major milestones. The most recent step – implemented in 2017 – has been to define a “policy portfolio” reflecting the central bank’s unavoidable policy risks, and to use this as a reference when setting the overall risk level. This has made the risk budget dynamic, reflecting that risks related to policy mandates vary over time.

The in-house risk modelling effort has enabled a better understanding of the key trade-offs, a high degree of customisation to fit the central bank’s analytical needs and swift implementation of new instruments and metrics. As a result of this transformation, the investment process has become more data-driven. When we periodically rebalance the portfolio, the starting point is a model-based proposal for bringing the portfolio closer to the risk budget centre in the most efficient manner.

Overall, the central bank’s new approach to reserve management has contributed to significant excess returns relative to a continuation of the previous investment strategy – and without increasing overall risk. At some point, of course, the discretionary investment exposures will lead to significant losses, and it will then be crucial to clearly communicate why having such exposures makes sense and to stay the course in times of distress.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com