Venezuela to adopt a more flexible exchange rate

Analysts say liberalisation and US sanctions on oil industry are likely to further boost inflation

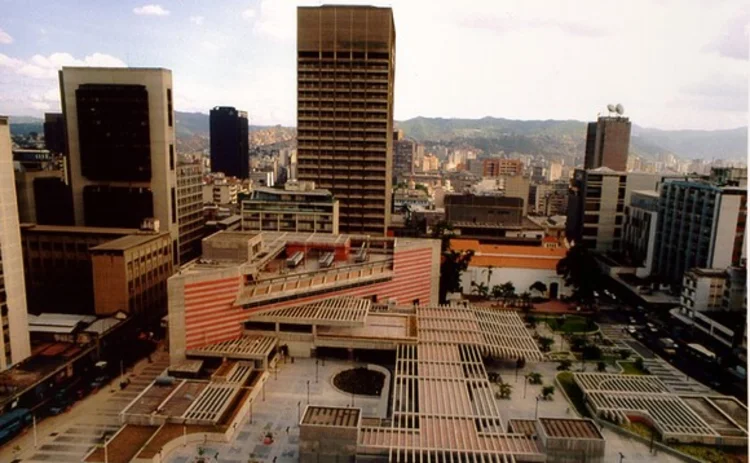

Venezuela announced a partial liberalisation of its restrictive exchange rate system on May 7 as the economy battles hyperinflation and US sanctions limit access to hard currency.

The new regulation allows local banks to act as intermediaries for exchange rate operations in the private sector for corporate and retail investors. The aim appears to be to achieve a more market-determined exchange rate and reduce the black market for the bolívar, although authorities did not explain the rationale

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com