Central Banks

BoE paper sheds light on global policy transmission

Comparison of UK and Hong Kong based on bank-level data finds evidence of both portfolio and funding effects

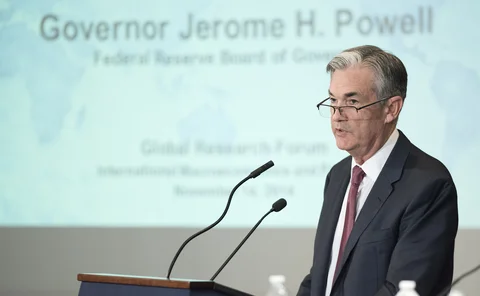

Fed’s Powell: normalisation will be ‘manageable’ for emerging markets

Fed governor says current capital flows appear to be in line with fundamentals; corporate debts a vulnerability but “situation is not alarming”

ECB strongly criticises Slovenian draft law on central bank

Proposals would put legal burden of proof in banking crisis cases on central bank, ECB says

Bank of Lithuania bans banks from virtual currency activities

Lithuanian financial firms must disassociate themselves from virtual currencies, says central bank, warning licences may be revoked

Birr plunges 15% as Ethiopia devalues currency

Move aims to tackle “severe” forex shortage; IMF recommends higher interest rates and more flexible exchange rate

FOMC split over inflation forecasts, minutes show

Participants expressed concern that low inflation this year might reflect not only transitory factors

London-based banks face ECB Brexit power grab

Drive to supervise swaps books from Frankfurt threatens cross-border balance sheet management

IMF cautions global vulnerabilities put growth at risk

Fund calls central banks to provide needed monetary support while tackling underlying threats

Bahamian central bank proposes law change to cap government debt holdings

New legal framework for Bahamas central bank would enforce “comprehensive” limits on government debt; holdings of long-term government debt stand at 12.52%

Emerging market incomes continue to grow despite trade impacts – Lagarde

Trade has not impacted emerging markets as negatively as their advanced counterparts, Lagarde says, as incomes continue to grow

BoE introduces new counterfeit initiative for ‘front line of defence’

New checking scheme will employ “targeted training” for cash handlers while retailers will help central bank gather data on current practices

Stressed banks may hamper deleveraging in eurozone periphery – ECB paper

Researchers use data on more than 400,000 companies and 900 banks from seven eurozone countries

Japan’s ineffective efforts at monetary easing

A study of the natural rate of interest indicates the Bank of Japan’s QQE may not have been as accommodative as claimed, Sayuri Shirai argues. The failings appear to be related to effectiveness, rather than scale

Swing pricing can help ease liquidity pressure – BIS paper

Open-ended mutual funds can mitigate the risk of “self-fulfilling” runs by using the pricing technique, researchers say

Fed policy has had bigger impact on global liquidity since 2009

A 25bp rate cut causes a cross-border lending growth to rise of two percentage points, versus 0.8 before the crisis, researchers find

Danish central bank critical of fiscal easing plans

As growth accelerates and inflation rises the economy risks overheating, the central bank says

DNB warns of overheating in Dutch housing market

Government should raise borrowing limits and reduce mortgage interest tax relief – DNB

Fed should have adopted BoE approach to mortgage lending – Tarullo

BoE’s approach to leveraged lending aimed to prevent “hard stop”, Cunliffe says; caps on mortgage lending were enforced by UK central bank in 2014

Irish firms must plan for ‘hard Brexit’, central bank official says

The UK’s exit from the single market is within the “planning horizon”, says Gerry Cross