Central Banks

Esma head issues Brexit warning over UK CCPs

Maijoor calls for continued access for EU members

Fed aims for real-time interbank settlement of faster payments

Brainard points to “growing gap” in US transaction capabilities

Political instability main risk for Brazilian banks – central bank

Financial system has expanded credit without increasing risk, Central Bank of Brazil says

Bank of Uganda hikes rates for first time since 2015

Rising oil prices and exchange rate volatility prompt central bank action

Draghi’s ‘whatever it takes’ cut bank risk-taking – BIS paper

Study examines Mexican markets to pick out effects of the ECB president’s intervention

What is the future of banknotes?

Antti Heinonen searches for clues on the future of banknotes at central banks worldwide

Fed could change capital rules for bigger banks – vice-chair Quarles

Deregulatory act had already softened regulations for banks with below $100 billion, up from $50 billion

Researchers explore impact of bank stress on the real economy

Large banks should be subject to more stringent requirements, authors say

Mersch issues warning to European payment providers

European firms must innovate or risk being competed out of instant payment sector

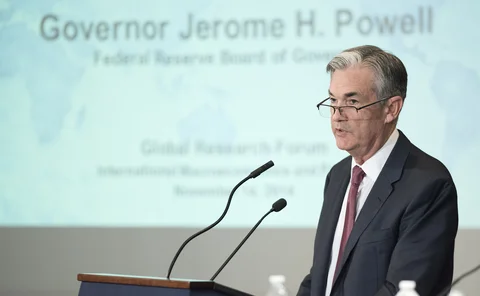

Powell downgrades Phillips curve importance

Unemployment forecasts are not too good to be true, Fed chairman argues

Liberia’s central bank says all ‘missing’ banknotes are accounted for

Internal investigation concludes banknotes ordered between 2016 and 2018 were delivered to vault

Zimbabwe banks ordered to ring-fence foreign currency accounts

Move appears to be a step towards de-dollarisation

Bail-in regimes lower costs of resolution for states – ECB paper

Researchers present structural model of bank re-capitalisation

Williams softens stance on neutral rate

“At times r-star has actually gotten too much attention”, says New York Fed president

Euroclear to offer US dollar settlement in central bank money

New settlement should reduce credit and operational risk on settlement banks