Monetary Policy

Tunisia further tightens policy to tackle inflation

Central bank increases basic rate of interest by 100bp to 7.75%

ECB prevented further eurozone deflation, BdF paper says

Researchers say inflation and GDP growth would have entered negative territory in 2015–17

Fed must account for spillovers of monetary policy – Yellen

Janet Yellen reflects on Fed monetary policy and “treacherous” currency manipulation in Brookings podcast

Philippine central bank handed new stability powers and mandate

Act removes money supply and credit as determinants for monetary policy in addition to granting central bank broader supervisory scope

RBA’s board stresses uncertain outlook in latest minutes

Trade tensions, slower Chinese growth and local consumption outlook behind policy decision

The role of e-cash in China

The use of e-cash stored on integrated circuit cards notably reduces cash handling fees and increases security. It also offers greater convenience notwithstanding the rise of mobile payments

ECB says Romanian government breached EU law over bank tax

Governor again warns emergency tax decree could harm banks and damage monetary policy

CBRT cuts reserve requirements, but stresses tight stance

Liquidity tools are more about transmission than policy stance, says Murat Çetinkaya

Flattening yield curve increased retail banks’ profits – Chicago Fed

The results reflect a change in banks’ business models after the financial crisis, researchers say

The Brexit conundrum

The Bank of England has only limited room to respond to a hard Brexit

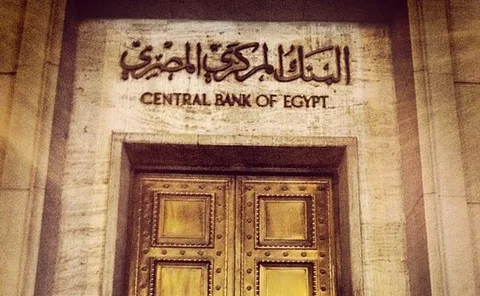

Egypt sharply cuts rates on lower inflation

Central bank reduces key overnight deposit rate by 100 basis points to 15.75%

PBoC issues 20 billion yuan of central bank bills in Hong Kong

Bills could help improve the yuan-denominated bond yield curve amid a lack of liquidity in the Dim Sum bonds market

RBNZ adopts new dual policy target

New Zealand’s central bank will now have maximum employment target alongside inflation goal

BoE’s Vlieghe says bleaker outlook calls for more cautious policy

Weaker growth and Brexit uncertainty imply one or two hikes a year may be too fast, he says

Globalisation is helping to flatten Phillips curve – Fed paper

Price sensitivity to output changes is significantly weaker in high trade-intensive industries

Fed to finalise balance sheet plans in upcoming meetings – Mester

Discussions over final size and future use of the balance sheet underway at the central bank

Riksbank maintains normalisation plans despite global slowdown

Next rate hike still expected in the second half of 2019

RBNZ keeps options open as rates stay on hold

Next rate move “could be up or down” says governor Adrian Orr

Myanmar adds yuan and yen as trade-settlement currencies

Move comes as yuan use rises and dollar use falls, analysts say

US expectations key influence on inflation - San Francisco Fed paper

Fed must maintain inflation expectations around target, researchers say

Balance sheet normalisation has put upward pressure on borrowing costs – Kansas Fed

Levels of reserves still influences borrowing costs despite post-crisis monetary policy framework

Riksbank faces changed circumstances in first meeting since December hike

Dissenting deputy governor Per Jansson won’t attend due to personal reasons