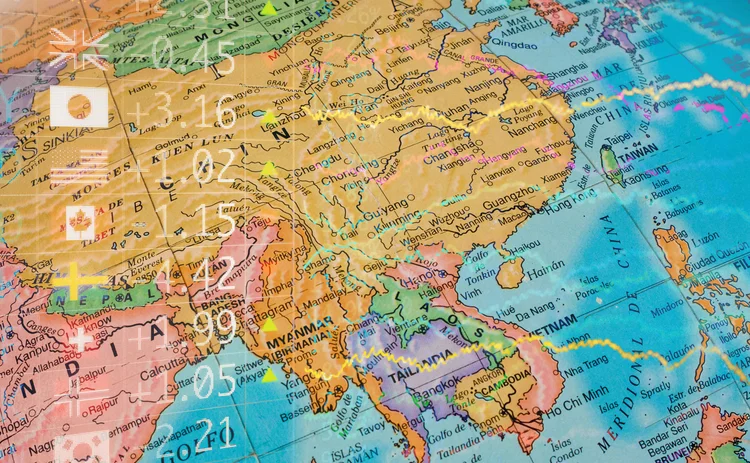

Cross-currency letters of credit gaining popularity in Asia

Divergent central bank policies see CNH LCs increasingly used to cover USD invoices

Dealers in Asia are seeing increasing interest in cross-currency letters of credit (LCs), with users looking to take advantage of preferable interest rates to finance dollar-denominated trade with foreign currencies.

Letters of credit are a common trade finance product issued by banks and serve as a buyer’s guarantee of payment to the seller until the final invoice is settled. The currency of the LCs is traditionally in line with that of the underlying trade invoice, usually denominated in US

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com