Financial Stability

EU leaders agree on new powers for ECB

European Central Bank to run single supervisory mechanism, but leaders fail to agree on when bailout funds can be directly injected into European banks

UK endorses Wheatley report to fix Libor

The UK Treasury has endorsed recommendations made by Martin Wheatley of the Financial Conduct Authority to fix Libor; will amend the UK’s Financial Services Bill

Hong Kong set to meet Basel III deadline as others struggle

Hong Kong to put final Basel capital requirements legislation in place by January 1 deadline, as most other countries struggle to hit G-20 deadline

Volcker warns of ‘permeable’ Vickers ring fence

Paul Volcker tells a UK parliamentary committee the Vickers ring fence has loopholes that will be widened over time by banks; says bad culture in trading arms ‘infected’ retail banks

Policy-makers debate how to restore trust in the financial system

Andrew Tyrie among speakers at BBA conference discussing how to develop greater trust in the financial system, ideas range from greater competition to code of conduct for bankers

Macao annual report sees ‘opportunity in crisis’

Monetary Authority of Macao annual report reveals drop in growth and climb in inflation; central bank chairman praises bank supervision developments

BoE’s Tucker says FCA may have to intervene to correct accounting failures

Paul Tucker says difference in market and banks’ asset valuations may require intervention by the Financial Conduct Authority; praises bail-ins as method of imposing discipline

BoE behind UK move to cut bank capital requirements

Bank of England’s interim Financial Policy Committee ordered a temporary easing of Pillar II bank capital buffers for British banks last month

UK’s Wheatley outlines steps toward new regulator

Chief executive-designate of the UK’s new Financial Conduct Authority outlines regulatory vision; new body to be created in 2013 as one half of ‘twin peaks’ approach

Canada’s Carney wants an end to ‘global angst’

Bank of Canada governor Mark Carney says quick and bold action needed to end uncertainty restraining economic growth

Robert Pringle’s Viewpoint: Fixing banks and regulation

Central bank balance sheets are ballooning due to the failure of banking systems and new rules are unlikely to address the issue. Only a full legal separation of banking activities will do.

Shirakawa proposes tackling financial stability as a ‘public good problem’

Bank of Japan governor, Masaaki Shirakawa, says an optimal solution to create the conditions needed for financial stability could be achieved by reviewing the challenge as a ‘public good problem’

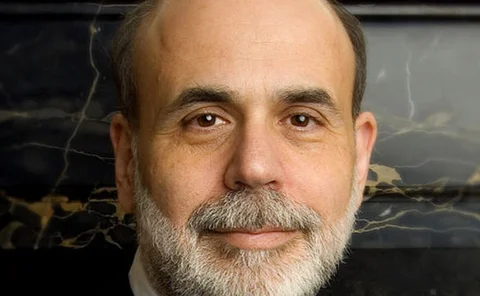

Bernanke plays down emerging market impact of QE

Fed chairman says negative impact of quantitative easing on emerging markets is offset by a stronger US economy. But countries such as Brazil have had to take action to protect their currencies

CFTC’s clearing timeline prompts backloading 'meltdown'

A re-reading of the CFTC's phase-in rules for central clearing is prompting alarm among buy- and sell-side firms

Europeans round on IMF as rescue plan takes shape

European policy-makers take on critics at the IMF saying the Fund’s view that matters now are worse in Europe compared with six months ago is flawed; set out a roadmap to eurozone stability

Tyrie to scrutinise draft of UK’s Banking Reform bill

The UK’s Banking Reform Bill published today will undergo parliamentary scrutiny; Andrew Tyrie concerned important details are being left to secondary legislation

UK needs ‘innovative’ policy levers beyond price stability, says FSA’s Turner

Adair Turner blasts past regulatory failings and says UK must now turn to ‘innovative and unconventional’ policies; remains a leading contender for Bank of England governorship

Asmussen trumpets progress on European debt stabilisation

ECB board member Jörg Asmussen says eurozone’s progress on debt stabilisation is ahead of other developed economies, but more work needs to be done

IMF paper untangles liquidity indicators

A study by IMF staff finds price and quantity indicators can be used to separate the effects of supply and demand shocks on global liquidity; changes especially telling in a crisis

IMF meeting set to reinforce global pessimism

Governments need to take urgent policy action to capitalise on the ‘breathing space’ created by central banks. But few attending the IMF meeting in Tokyo believe law-makers are fit for the task

Final rules for D-Sibs published as FSB holds plenary meeting

Financial Stability Board meeting in Tokyo endorses publication of final framework for regulating D-Sibs; principles focus on assessment methodology and higher loss-absorbency requirements

Central Bank of Malaysia raids ‘Ponzi’ scheme companies

Four gold-trading companies raided by central bank amid charges they were running illegal gold-trading schemes described as ‘Ponzi’ operations, according to the Malaysian central bank

Fed’s Tarullo says Dodd-Frank requires ‘extensive elaboration’

Daniel Tarullo highlights challenges in producing details of Dodd-Frank Act regulations; suggests limits to mergers by large banks and says SEC should strengthen money market fund regulation

Brazil second in world for non-cash payments

World Payments Report reveals Brazil is second only to the US for volume of non-cash payments; use of electronic and mobile payments shows ‘exponential growth’