Financial Stability

Bank of Spain rings organisational changes

General secretariat handed new department for market conduct and claims; new financial stability units set up to address banking analysis, macro-prudential policy and impact of regulation

Weidmann says regulation must strengthen principle of individual responsibility

Bundesbank president says higher capital requirements will enable banks to shoulder greater losses by themselves; correct sequence of liability under common European resolution rules also needed

Canadian deputy says shadow banking could push up household debt

Timothy Lane raises concerns over the securitisation of government-guaranteed mortgages through shadow banks; says the low-cost funding could increase lending for mortgages

RBNZ deputy threatens use of loan-to-value restrictions to curb housing demand

Grant Spencer says interest rate hike would not be an 'appropriate response' to strong housing demand while macro-prudential intervention could be effective

EU finance ministers strike deal on bail-ins

Rules seek to impose losses from bank failures on creditors; national authorities told to create resolution funds to absorb losses in ‘exceptional cases’

Monetary policy links to financial stability ‘are not straightforward', says Fed paper

Research paper from Fed's Finance and Economics Discussion Series finds monetary policy and financial stability concerns can be complementary - but the connections are complex

Fed presidents in conflict over 'too-big-to-fail'

Lacker, Fisher, Hoenig and Bair called before US Congressional committee to voice their opinions on Dodd-Frank Act's Orderly Liquidation Authority

Fed proposals seek to shine light into money markets

Proposals for daily data reporting by a panel of 155 banks aim to improve the Federal Reserve's ability to supervise shadowy money markets

Basel Committee reveals leverage ratio formula

Proposals detail leverage ratio calculation framework and disclosure requirements that will enter force in 2015; committee keeps options open for a higher leverage ratio than originally planned

Chinese financiers hit out at 'blind' PBoC

China central bank accused of being blind to potential capital market reaction in its attempts to clamp down on the shadow banking sector

Bank of England concerned by ‘vulnerability’ to interest rate increases

Financial Stability Report calls for assessment of financial institutions' exposure to increases in global interest rates; recommends banks are allowed to reduce their liquid asset holdings

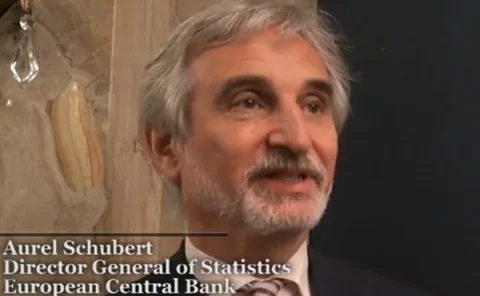

Central bank statistics departments facing multiple strains, says ECB’s Schubert

Meeting new monetary, micro-prudential and macro-prudential data requirements is a major burden for central bank statistics departments, says ECB statistics head Aurel Schubert

Stein and Wheatley to head up new FSB benchmarks steering group

Financial Stability Board sets up steering group to improve benchmarks; private sector invited to contribute to the review process

Bank of Italy paper finds women directors improve bank governance

Researchers find that women on bank boards tend to reduce the riskiness of investments, which they say is potentially both an argument for greater gender balance and a factor behind discrimination

ECB’s Asmussen urges greater efforts at global policy co-ordination

Executive board member says globalisation has led to greater interconnectedness and many more sources of risk, but institutions have not kept pace with the demanding environment

Malaysia’s Zeti calls for greater macro-prudential supervision of Islamic finance

Bank Negara Malaysia governor says ‘new wave of internationalisation’ of Islamic finance necessitates greater prudential supervision and cross-border cooperation

ECB paper proposes model for assessing European sovereign and bank spillovers

Working paper uses VAR model to quantify interdependencies between bank and sovereign CDS spreads

PBoC leaves banking sector sweating over liquidity squeeze

Tight credit conditions persist as the People’s Bank of China remains silent about liquidity injections into increasingly strained banking sector

ESRB issues macro-pru advice, as IMF warns over possible conflicts

European Systemic Risk Board recommends five ‘intermediate objectives' for macro-prudential policies in the EU; IMF paper warns of potential conflicts with micro-prudential measures

Bangladesh governor targets stronger debt market

Atiur Rahman concerned by public and private sector reliance on bank funding, but says government should wait until after elections to issue first sovereign bond denominated in US dollars

UK's Royal Mint brings back golden guinea to mark 350th anniversary

New £2 coin designed in the style of the now disused guinea, featuring the crest of King George III; coin will enter circulation later this year

Hong Kong launches renminbi Hibor fixing

New offshore benchmark rates to be produced starting next week; HKMA to provide oversight and surveillance of contributing banks' internal systems to ensure 'integrity' of submissions

UK banks told to find £13.4 billion in extra capital

Bank of England’s PRA says Lloyds and RBS need to raise extra £10.2 billion; Osborne says government will ‘do what it can’ to return both banks to the private sector

IMF paper weighs effect of shifting bank funding in eastern Europe

Researchers from the International Monetary Fund find banks rebalancing their funding sources away from foreign loans; warns global regulation may make this process too rapid