Big data in central banking: 2016 survey

Central banks looking to harness big data and improve data governance

This survey was conducted by Central Banking, in association with BearingPoint, during August and September 2016. The work has only been possible with the support and co-operation of the central bankers who agreed to take part, and who did so on the condition that neither they nor their central banks would be named in the report.

Key findings

● Central banks have an active interest in big data. This is manifested in improving processing technology, adapting institutional strategies and increasing staff awareness of the area.

● Central banks typically see big data as unstructured data that is sourced externally, although this view is not universally held.

● Overwhelmingly, central banks develop their own data platforms to handle regulatory data collection, a role that has taken on greater significance since the financial crisis as central banks have expanded their involvement in financial stability.

● Big data is predominantly regarded as useful for research, but a significant minority sees its immediate involvement in policy-making, or scope for this.

● Lack of support from policy-makers is seen as the most significant challenge to increase the use of big data.

● Central banks do not in the main have a dedicated budget for handling data, including big data, though many are seeking one.

● A little more than 80% of respondents said they have no intra-departmental or divisional bodies dedicated to big data.

● More broadly, central bankers have concerns over the arrangements in place for managing data in their institutions. Many are looking to improve data governance.

● More than three-quarters of respondents indicated they had a shared internal platform, typically in the form of reporting frameworks and data warehouses.

● Central banks generally source their own big data sets, though a significant minority increasingly look elsewhere. Overwhelmingly, they process the data sets themselves, and there is no indication of a desire for this to change.

● Monetary policy is seen as standing to benefit most from big data, though it is expected to have a significant impact on macro-prudential policy as well.

● Support from the executive level and policy-makers divided respondents: 35% saw it as the highest priority for investment within the central bank, while 38% saw it as being the lowest.

● Central banks have developed their own data platforms to deal with regulatory data analytics, often used in conjunction with other options. Excel remains popular.

● Central bankers broadly welcome the idea of self-assessment of data management using an adapted version of the Basel Committee on Banking Supervision’s principles for supervisory data aggregation (BCBS 239).

Profile of respondents

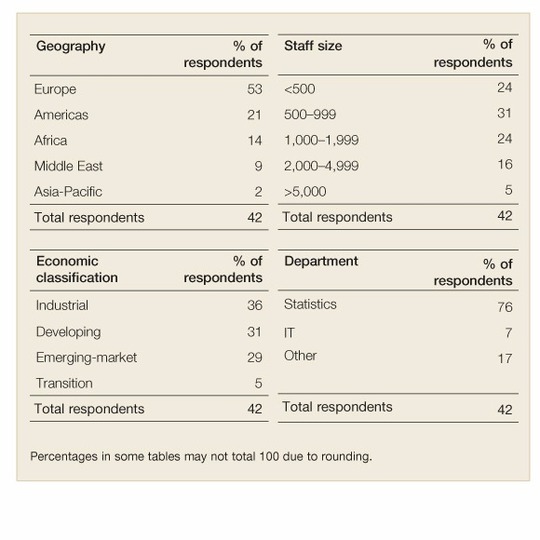

Responses were received from 42 central banks, of which the average staff size was 1,652; three-quarters of respondents had fewer than 2,000 employees. Just over half of respondents were from central banks in Europe. Those individuals taking part in the survey were drawn primarily from the statistics function: 32, or three-quarters of respondents, were located in this area; three were from information technology; and responses were also received from research, banking supervision, international relations, data management, infrastructure and technology, and data collection departments.

Detailed responses

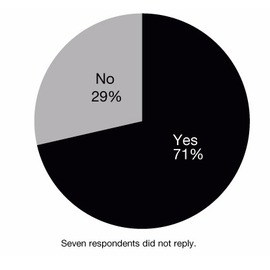

Has your central bank given any active consideration to big data in the past 12 months?

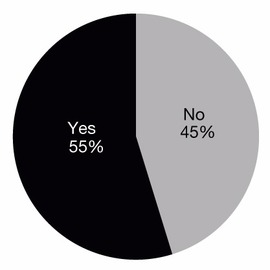

Central banks have an active interest in big data, particularly in improving processing technology, adapting institutional strategies and increasing staff awareness of the area. Just over half of respondents to the survey said they had given the area active consideration in the past 12 months. This group of 23 central banks was drawn from around the world, although European central banks figured prominently.

Seven central banks referred specifically to technological upgrades needed for, or focused on, big data – in particular updating infrastructures and embarking on data warehouse projects. A statistician from Europe detailed a recent innovation at the central bank: “In 2015, the central bank opened a new platform to share individual data.” An African central banker said their institution was building a data warehouse, and one central bank chief data officer said: “We are looking to adopt technologies that have evolved in the big data industries.”

Five central banks made reference to big data in strategic planning, either at a data departmental or bank-wide level. A European central banker explained how big data was playing a part in a broader strategic initiative: “The optimisation of the data we collect, to derive insight and enhance decision-making, is a key element of the bank’s strategic direction. Big data is a component part of this conversation.” A central banker from the Americas highlighted the secular increase in data: “This development is expected to continue at an ever-quicker pace and the central bank has reviewed its data and information strategies in order to benefit.” Another respondent, also from the Americas, indicated the strategic plan of the bank had been altered in the past year, adding: “We are also running projects using unstructured data sets.”

Several respondents described how their central banks were looking to increase awareness and skill sets in the area, notably through shared platforms, internal forums and training for employees. Another central bank had launched a big data forum, for internal discussion and “encouraging the development” of big data projects. A statistician from a developing country said it had initiated “training specific personnel in data science and R programming”, and officers from that central bank were actively discussing big data in the context of creating a new autonomous national statistics institution. One large central bank has created a specific big data team: “In the last two years we have been conducting some experimentation on both business and technological profiles. This year we set up a team to pursue the first statistical results from the application of big data technology from structured and unstructured data.”

In contrast, 19 respondents said that they were not actively considering big data. They included seven European central banks and two central banks from the Middle East. One European central bank said that, as it did not have a “predefined strategy”, big data was not a priority, and one said simply: “We do not intend to use big data.” However, several respondents who did not perceive big data as a priority in the short term commented that it would figure in plans in the medium term. A European central banker explained why it had not impacted their central bank to any significant extent: “We can say that the central bank’s actual involvement in the use of big data is currently rather limited, as we are relying mainly on the data from ‘official administrative’ sources. We are certainly aware of the growing worldwide interest in using new, private, big data sources such as Google search data, different commercial data vendors’ data sets, mobile positioning data and news media.”

Although big data was not included in its strategic plan for 2016–2021, a respondent from the Caribbean said it would move up on the list of priorities in the future and, as a result, the central bank has introduced training initiatives.

Which of the following types of data would you classify as big data?

Which statement, in your view, represents the most accurate definition of big data?

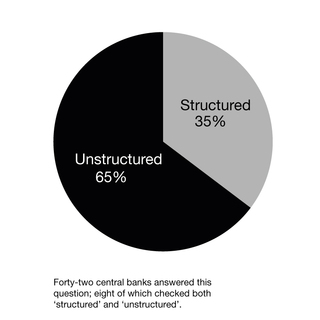

While there is no single, agreed definition of big data,1 industry has gravitated towards viewing it as large volumes of data, both structured and unstructured, which a standard desktop computer cannot handle. Central banks typically see big data as unstructured data that is sourced externally, though this view is not universally held.

Just under two-thirds of respondents believe big data should be defined as unstructured data sets. In a comment, a European central banker said: “‘Unstructured’ seems to be a more accurate definition of big data because at least it requires unstructured data processing, which is more challenging.” A central banker from the Caribbean stressed the typical sources of big data as driving their view: “I perceive big data as data collected in the course of current business: for example, data automatically collected by social media, by scanning machines and by CCTV cameras. As such, it is in general unstructured, and it is the job of data scientists to move in and extract structured, pertinent information.”

Few of the dozen respondents who view big data as structured gave comments explaining their thinking. However, one central banker in Europe said: “Central banks are mainly concerned with the management of structured data collected from reporting agents. Unstructured sets of data from social networking websites do not play a prominent role for the time being.”

Eight central banks said they recognised big data as both structured and unstructured. Big data lies in both categories, a European statistician suggested, saying the need to join together “many gigabytes” of tables in a few seconds is an example of structured data, while “textual information from the web” counts as unstructured.

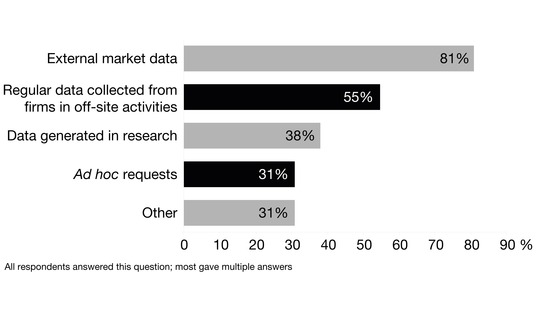

More than 80% of respondents said an example of big data was ‘external market data’, but only two respondents, both from Europe, checked this option exclusively. Nineteen of the 34 also chose ‘regular data collected from firms in off-site activities’. A statistician from a central bank in Africa included all five classifications in their answer and added “data from ministries, departments and agencies”. A European central bank ignored the suggested classification and offered the category of “commercial and administrative databases”, as indicated in the United Nations Economic Commission for Europe list of classifications.

How does your central bank deal with regulatory data collection?

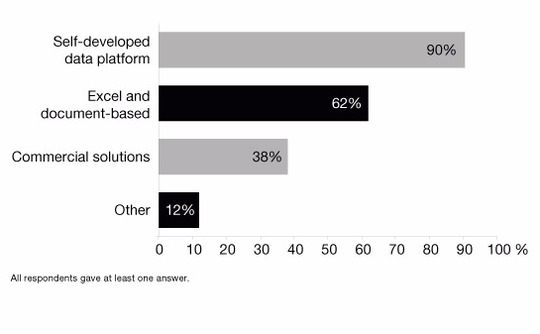

As central banks have expanded the depth and breadth of their involvement in financial stability policy-making since the financial crisis, so the importance of collecting accurate, complete and timely data from institutions has increased. Overwhelmingly, central banks develop their own data platforms to handle regulatory data collection. This was the view of 38 – or 90% – of the 42 respondents. A European statistician said the central bank has an “online portal” to support the collection of regulatory data, while a respondent from an advanced economy central bank commented that even though it does not handle the data collection itself, it nevertheless created the platform.

While own-built was the most popular response, only a minority said they use this solution exclusively. Half a dozen central banks from industrial economies and three from emerging markets also chose ‘Excel and document-based handling’. A further nine central banks checked those two options and ‘commercial solutions from the market’; four of these were African central banks. A respondent from an emerging market explained this was due to a multiplicity of sources and methods of handling data: “All are used due to historical differences in available technologies and regulatory processes.” An African central bank listed the commercial solutions it employed: “ETL DataStage and ERP Oracle.”

While own-built was the most popular response, only a minority said they use this solution exclusively. Half a dozen central banks from industrial economies and three from emerging markets also chose ‘Excel and document-based handling’. A further nine central banks checked those two options and ‘commercial solutions from the market’; four of these were African central banks. A respondent from an emerging market explained this was due to a multiplicity of sources and methods of handling data: “All are used due to historical differences in available technologies and regulatory processes.” An African central bank listed the commercial solutions it employed: “ETL DataStage and ERP Oracle.”

Commercial solutions from the market provide a viable alternative for central banks and were chosen by nearly 40% of respondents. These were typically used in conjunction with self-developed platforms, as was the case for three-quarters of this group. Ten central banks use all three of the given solutions, while one central bank in the Americas uses four, hiring “companies that develop solutions according to the specific needs of our institution.” Two central banks in the Americas indicated that commercial solutions were their only method of regulatory data collection.

A Caribbean officer explained: “The central bank is in the process of incorporating a commercial solution to replace our current system.” A respondent from the Americas said commercial solutions cater directly to the requirements of the central bank: “We hire companies that develop solutions according to the specific needs of our institution.” One central bank from Europe noted that, although it uses open-source software, it also employs Excel as a stopgap: “We use an open-source technology based on Hadoop and Hbase. Sometimes, in order to speed up the implementation process and to save costs, we use Excel as a temporary solution for data collection limited in scope.”

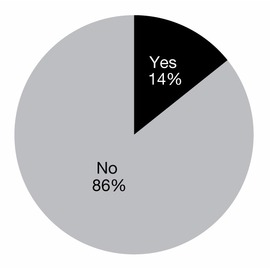

Has this approach to data collection changed in the past 12 months?

Arrangements for regulatory data collection display a high degree of continuity. Thirty-six respondents said their approach to regulatory data collection was unchanged in the past 12 months. Few respondents volunteered a comment explaining their view, though a handful indicated a transition is under way. A statistician from the Caribbean said his bank’s regulatory data collection approach is expected to change over the next six months. Similarly, a respondent from the Americas said: “We are in the process of creating better foundations for policy decisions and have therefore changed strategies for managing data and statistics.” One European central bank noted it is reviewing future plans, while another said it was implementing software for both the banking supervision and statistics departments, demonstrating the collaborative nature of big data projects. As a statistician explained: “We are in the process of implementing common reporting software at the central bank level for Banking Supervision and Statistics Department. This new project scheme was financed by the World Bank.”

New software and big data techniques are also under development. A central bank with just over 500 staff is implementing a new data capture and analytics solution, and a respondent from the Americas said the central bank is looking into “scraping” data. Six central banks have changed how they deal with regulatory data collection in the past 12 months. This group was dominated by central banks based in Europe, with one adding that it was necessary to change its data collection process “for technological and business reasons”.

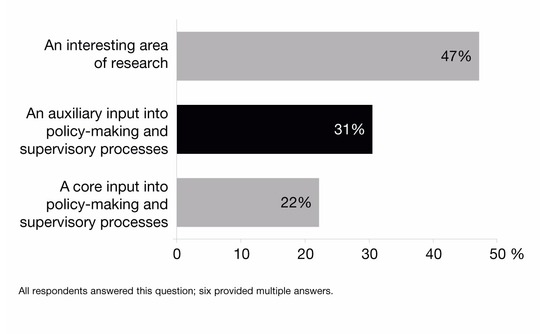

Which best represents your central bank’s view of big data?

Big data is predominantly regarded as useful for research in central banks, but a significant minority sees immediate involvement in policy-making, or scope for this. Nearly 50% of respondents chose ‘an interesting area of research’ as the best match for their central bank’s view of big data. A central bank with fewer than 500 staff noted: “This topic is a potential area for research of future possibilities and the pros of using big data for statistical and analytical work.” A European respondent echoed several others, saying: “The central bank’s view of big data is going to change over time. Right now, it is an active area of research.” A respondent from an advanced economy implied big data would influence policy: “The optimisation of data is of key importance in driving decision-making.”

The second most popular choice was ‘an auxiliary input’. One European central bank said it could see the potential “in the future” of big data as an auxiliary input in policy and supervision. A central bank from a developing economy said its statistics department manages a handful of micro-databases that are useful for cross-checking data: “The statistics department manages a set of micro-databases whose primary goal is to produce and disseminate high-quality statistics. In that sense this production chain benefits from a business intelligence architecture where data from different micro-databases (and sometimes different statistical domains) are intersected and validated. The use of microdata also brings flexibility to data management in a way that we can readily adjust and satisfy ad hoc requests, in some cases tailor-made to our customers’ needs. Finally, the establishment of protocols with other institutions gives us access to external and complementary information to our own sources, which is one of the primary keys to ensure data quality.”

Eight central banks indicated big data was a core input into policy-making and supervisory processes. This included the largest central bank that participated in this survey, as well as two respondents from the Middle East. One commented: “An efficient data management is obviously needed in the course of all missions for which the central bank (including the supervisory authority) is responsible. Big data techniques are useful in that respect.”

Has your central bank’s view changed in the past 12 months?

Views of big data’s role in a central bank are largely unchanged. More than 85% of respondents said their view had not changed in the past 12 months. “We expect this to change in the medium term,” observed a European central banker, who said the bank has dedicated a team to this work and therefore its view may change “as a consequence of our research conclusions”.

The six central banks that have made a change in the past 12 months highlighted how big data was having a catalytic effect on their institution. A statistician from Europe said that data management is part of the central bank’s new strategic plan. Another European central bank is advancing its work in this area, with dedicated teams within divisions outside of the statistics department: “There has been a change over the past 12–24 months that has seen the creation of dedicated analytics teams within supervisory divisions and a move towards creating a more data-centric organisation, which is reflected in organisational level objectives.”

An officer from the Americas looked to the importance of an information strategy for the future development of big data: “To ensure that information gathered is handled in an appropriate manner, a vision for information supply is therefore required, along with an accompanying strategy that guides

how data is required and processed.” A European statistician commented: “Data management is part of the new strategic plan launched this year by the central bank.”

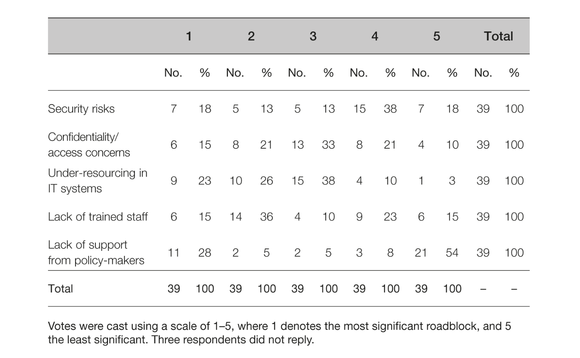

Which, in your view, present the greatest roadblocks or challenges to increased use of data sets in your central bank?

Lack of support from policy-makers was most commonly identified as the greatest challenge and, intriguingly, also received the most votes as the least challenging. Twenty-eight per cent of respondents – seven Europeans, and four from the Americas – scored this as the most significant hindrance. “There are no problems with security, but there is not enough support,” one European said. Conversely, 21, or 54% of, respondents saw a lack of support from policy-makers as the least significant challenge. This group was largely made up of developing and emerging market economies.

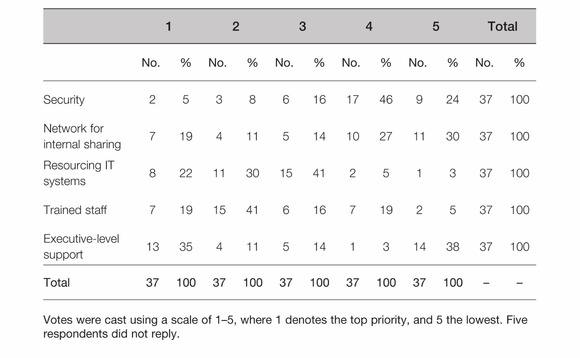

Concerns about skill sets figure prominently in central bankers’ thinking. Just over half of respondents placed a lack of trained staff as the first or second most significant challenge. This group contained a significant number of central banks from advanced economies. A respondent from Europe noted: “Specific skills are needed for an efficient management of large data sets, both in IT and statistical departments.” One respondent sounded a despondent note: “We expect additional human capital costs to be higher than acceptable compared to the possible benefits from using big data.”

Just under half of respondents placed under-resourcing of IT systems in first or second place. A respondent who ranked this as their bank’s greatest concern said: “The IT infrastructure is currently not sophisticated enough to support any use.” A third of respondents ranked confidentiality and access concerns in first place. Security risks were typically ranked in fourth place. A European central banker offered another challenge: “The key initial issues were co-ordinating a unified organisational approach with the differing divisional needs and balancing implementing organisational change while still meeting mandatory regulatory requirements.”

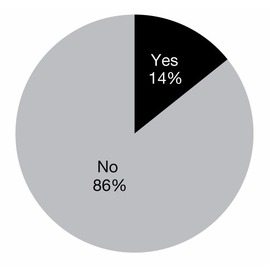

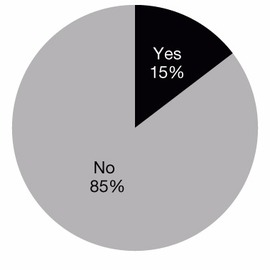

Does your central bank have a single allocated budget for the handling of data, including big data?

The vast majority – 85% of respondents – said their central bank did not have a single allocated budget for data. This group was largely made up of central bankers from advanced and developing economies. In comments, respondents typically attributed this to budgeting being divided on departmental or project-specific bases rather than by resource, function or output. In this way, data was often included as a component of the technology budget. One respondent commented: “The central bank has a general budget with a fixed share allocated to IT projects as a whole, which can only be partly related to handling of data but is not exclusive to this subject.”

One central banker commented: “Several entities are involved in the handling of data.” A statistician from Europe explained how data projects were referred to a central body for approval, but that a group had been created to look across these: “Data projects are handled as per all other projects (through an investment committee). A dedicated function has been put in place to handle data initiatives within the organisation to ensure there is a joined-up and consistent approach.”

A budget for data was the preserve of only a handful of central banks. On the subject of agreeing a budget, one central bank from Asia commented: “The budget is formed once a year by every division separately.” The allocated budget for one European central bank is used to cover the cost of the commercial solution: “The initial three-year software maintenance is included in the overall price of the contract. Additional charges in the software will be charged variably.” One central bank in the Middle East confirmed they did have an allocated budget, but declined to give more detail.

It is interesting to compare the results here with those from question 1, regarding active consideration. These six respondents were, naturally enough, among the 23 who said their central bank was actively considering big data. However, 17 central banks are giving active consideration but do not have a dedicated budget. At the policy-making level, of the eight respondents who said big data represented a core input into policy-making and supervisory processes, only one said they had a dedicated budget for data.

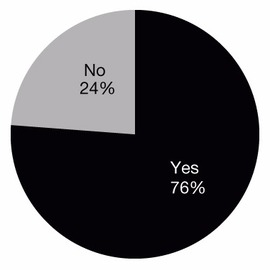

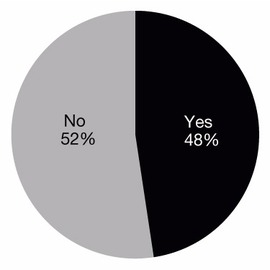

Does your central bank have a shared internal platform to enable different areas of the central bank to access data resources?

More than three-quarters of respondents indicated they had a shared internal platform, typically in the form of reporting frameworks and data warehouses. A respondent from a European central bank described the two-pronged approach used there: “We have a shared internal platform for accessing most of our supervision data. For other macroeconomic data we have another platform contributed by the economic department and used by everyone inside the bank.”

A respondent from a large central bank explained how it granted access to the data: “The first key element in the data strategy was to allow users with an appropriate business case to view all data relevant to them across the organisation. A technology solution was implemented to allow for this.”

Ten respondents do not have a shared internal platform at their central bank. This group included emerging-market and developing economies from across the globe. Within this group, three central banks – one each from Europe, the Americas and Africa – are still working towards creating their own internal platform. One described the project as “a single reference platform (register) for the identification and the characteristics of financial and non-financial companies”. Similarly, a central bank in the Americas is “in the process of developing a data warehouse to ensure data is stored in a standardised and secure way that is easily accessible to different internal data users.”

Commercial solutions also provide an alternative to self-developed platforms. Four examples were given by an African central banker: “PIF, SPTR, Sigma and SAP.” Respondents also made reference to reporting systems used for off-site regulatory reporting and an integrated reporting platform at a European central bank that is used for Finrep and MonStat.

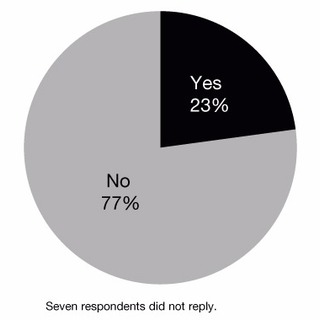

If your central bank has a shared internal platform, can this platform be accessed externally (for researchers or dissemination purposes)?

Typically, data-sharing platforms in central banks are built internally by the central bank and are not available for external use.

Of the eight central banks that allow external access to their self-developed platforms, five are European central banks, one is from the Americas, one from the Middle East and one from Africa. A European central banker said: “The data software is externally accessed by banking supervisors when examining the financial institutions. This platform is restricted for researchers and dissemination purposes.” Of the eight central banks that allow external access, six built their own platform independently.

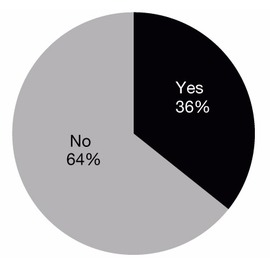

Was this shared platform built by the bank?

Several respondents from developed countries, however, said they were establishing platforms that would be available for external use. One central banker said “external access is still under development”, while another commented that some parts of the database were being made available to registered users.

An independent platform has been launched and provides anonymised data to external researchers, on a need-to-know basis: only data sets deemed useful for a research project will be provided on this platform.

In the main, central banks build rather than buy shared platforms: this was the experience of just over 70% of respondents. One European central bank said it used “in-house developments with standard big data infrastructures”. Ten central banks indicated they did not build their own platforms. Their reasons ranged from seeking assistance from another central bank in the development to subcontracting the process. A central banker in the Middle East said the institution had been “assisted by AbacusConsulting (Middle East) LLC”.

Does your central bank have clear data governance with defined roles and responsibilities, such as chief data officer and data stewards?

For many central bankers, data management arrangements are a concern, and just over half of respondents said their banks did not have clear data governance. European central banks featured prominently in this group, as did a significant number of respondents from the Americas. One said: “We have no chief data officer or equivalent.”

This is clearly an area of intense activity, however, as central banks are striving to improve data governance frameworks. A central banker from the Caribbean said the framework is “in its infancy” but is “expected to mature” in the coming years. An officer from a central bank in Africa commented that a clear data governance structure “is now being put in place”.

Several European central bankers said data governance is being discussed, but it had not been formalised, a view typified by this statistician’s comment: “Certain relevant people are more aware of their roles and responsibilities as data owners or data stewards, but it has not been fully formalised and implemented yet.”

Another European respondent set out the structure of their bank’s data governance: “Within the central bank, we don’t have the mentioned type of personnel. However, we have a sort of data governance, defined by the security policy.” A developed-country central banker noted: “We have a chief data officer and data stewards identified in place; however, more robust governance is being put in place over the coming months.”

Twenty respondents were more confident in the arrangements for data governance. One European central banker commented it has “data owners”, who can grant others the access to the data.

A statistician from the Americas said: “For each information-specialised area, there is a work team.” A central bank with more than 5,000 staff has committed a whole team to the supervision of big data: “Through the project, we have built a specific organisation in charge of security policy and the high-level supervision. A dedicated committee chaired by the director of general statistics including high-level representatives of all business areas is responsible for the high-level monitoring of the platform.”

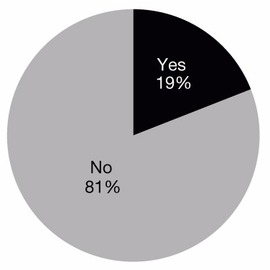

Does your central bank have intra-departmental or divisional bodies, such as committees or working groups, dedicated to big data?

Big data is generally confined to departments or divisions in central banks. Just over 80% of respondents said they do not have any intra-departmental or divisional bodies dedicated to big data. This group was composed of five African central banks and all nine central banks from the Americas, along with two central banks from the Middle East.

The following are comments made by the 19% of central banks that have intra-departmental or divisional bodies centred around bank-wide data teams and committees dedicated to big data. A respondent from a European central bank with more than 2,000 staff said: “We have committees dedicated to data, which include big data.” Another central bank commented: “This year we have started an inter-departmental team dedicated to big data issues”, while another made reference to big data being discussed within a team of people focused on data in general.

A central banker from an advanced economy said big data plays a part throughout the central bank; however, it is governed by the statistics department director: “Many projects deal with big data issues: the corresponding steering committees are temporarily chaired by the director of general statistics.”

Although 34 central banks indicated they do not have an intra-departmental or divisional body at their central banks, three said it was a field they are looking to develop. One such central bank in the Americas commented: “We have some employees working on big data.”

A respondent from a central bank with more than 1,000 members of staff explained how their institution was nevertheless bringing people together: “Even though we do not have an intra-departmental or divisional body, we do have the big data forum with a multidisciplinary team involved in roundtables on a temporary basis.”

Does your central bank use external data providers for big data sets?

Central banks generally source their own big data sets, though a significant minority look elsewhere. Respondents that do not use external data providers were predominantly from emerging-market economies, including 17 central banks from Europe.

Those that used external providers tended to turn to commercial banks and firms, social media and Google blogs, and mobile phone operators. “We employ data from blogs, social media and private websites,” said one respondent. A statistician from Europe commented on the techniques used to collect the data from websites: “Currently, we are doing web-scraping projects, collecting data from different websites.”

Does your central bank outsource any data processing for big data sets?

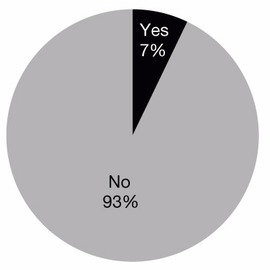

Overwhelmingly, central banks process their own big data sets, and there is no indication of a desire for this to change. More than 90% of respondents said they do not outsource any data processing.

A central bank in the Americas said, straightforwardly: “Data processing is run in-house”, while one central bank in Europe commented: “The data management and statistical analysis of big data sets is taken on by highly qualified staff in the directorate general of statistics with the support of the dedicated team in the IT department.” Three central banks outsource data processing for big data sets; however, they all declined to comment.

Of the 39 central banks that did not outsource data processing, only three noted this was likely to change in the near future. One central bank in the Americas is currently hiring in this sector to cater for in-house data processing: “The central bank is now recruiting an expert in the field of data architecture in order to develop intra-departmental systems and working routines of data.”

In your view, which of the following areas stands to benefit most from big data in practical terms?

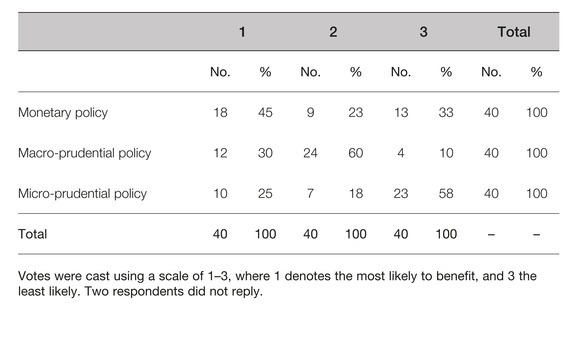

Respondents saw monetary policy as likely to benefit most from big data, though they said it will have a significant impact on macro-prudential policy as well. As a central banker from an industrial economy explained: “Monetary policy, macro-prudential and micro-prudential policies can benefit from big data. Monetary policy can benefit from better and timelier nowcasts of macroeconomic variables. Macro- and micro-prudential policies might benefit as well.”

Interestingly, 90% ranked macro-prudential policy in either first or second place. Those that ranked it in first place typically chose monetary policy as their second choice. Micro-prudential policy was ranked third by 58% of respondents but 10 respondents placed it first. One noted: “Big data applications shine at the most detailed level.”

Which area do you consider the priority for investment to increase big data use in your central bank?

Support from the executive level and policy-makers again divided respondents: 35% saw it as a top priority, 38% saw it as the lowest. Those that considered it a top priority were mostly central banks from Europe and the Americas. A European officer stressed the importance of having a budget: “Obtaining a budget is of fundamental importance in an initiative, so therefore is a key priority.”

Which of the following standards does your central bank use, or plan to use, for dealing with data exchange and collections?

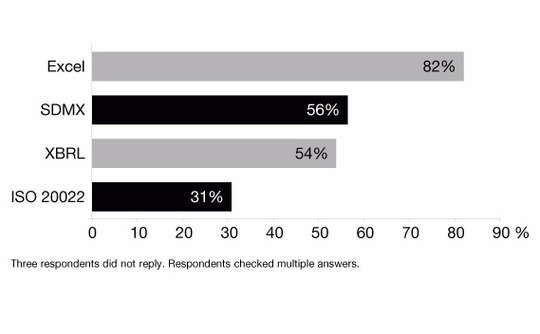

Excel is the most popular standard for central banks when dealing with data exchange and collection, but it is typically used in conjunction with another solution. Of the 39 respondents, 82% use Excel, of which around 40% use it exclusively. Of the remainder, most used either SDMX or XBRL as well, and three-quarters use both. “The central bank collects data from financial institutions using the XML format combined with Excel format”, noted one statistician from a developing economy. An officer from a developed country commented: “XML with structured data prescribed by the central bank is also used for data collection and data exchange.”

SDMX was the second most popular standard choice for the majority of developed, European respondents. One central banker commented: “SDMX is used for data exchange of statistical data, primarily in data exchange applications with the European Central Bank.” The statistics department of an African central bank is working towards implementing this standard: “SDMX is an ongoing project.”

The standards of XBRL and ISO 20022 are typically used for specific functions: supervision and payments, respectively. Twenty-one respondents indicated they use SDMX at their central bank. A central bank from an advanced economy noted: “XBRL is only used in the transactional system component of Register of Institutions and Affiliates Database application.” Although the least popular standard, ISO 20022 was also described by respondents as useful for specific functions. One European officer noted: “Currently we are using the three standards mentioned: SDMX and XBRL are widely used, whereas ISO 20022 is only being used in very specific exchanges.” An African central bank said: “ISO 20022 is being considered for payments.”

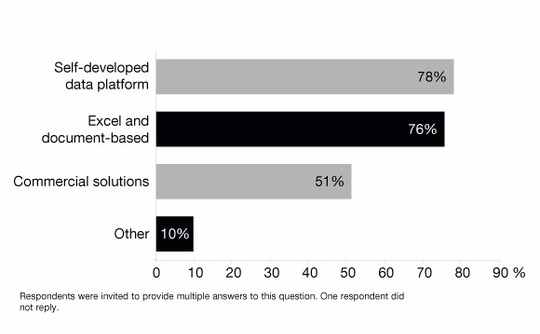

How does your central bank deal with regulatory data analytics?

Central banks have developed their own data platforms to deal with regulatory data analytics, but these are often used in conjunction with Excel and document-based handling. This was the answer from more than three-quarters of respondents, the majority of which were from developed countries. Only four of these 32 central banks use purely self-developed regulatory data analytics, while the remaining 28 combine it with another standard. Nearly all combined this with Excel and document-based handling, and just under half reported a commercial element to their regulatory data analytics workflow.

Commercial solutions from the market proved popular among respondents, with over half choosing this option. Interestingly, more central banks use commercial solutions from the market for regulatory data analytics than they do for regulatory data collection, with only 16 central banks.

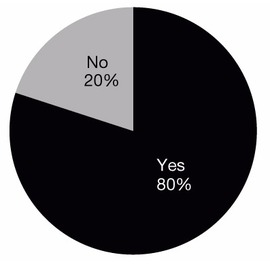

As of January 2016, the global systemically important banks (G-Sibs) have been regulated to meet the BCBS 239 principles, after carrying out self-assessments regarding data collection, data aggregation and dissemination capabilities. Would it be useful for central banks to self-assess using an adapted version of these principles?

Central bankers largely welcome the idea of self-assessment using an adapted version of the BCBS 239 principles for G-Sibs.2 Of the 35 respondents, 80% said such self-assessment would be useful.

As databases increase in size and complexity, there is naturally a concern that they are policed and governed properly. Furthermore, one central banker noted existing systems were under pressure “due to increasingly large and complex data that is now challenging traditional database systems”.

Several central banks drew attention to the internal processes already in place to regulate big data processing. One European respondent from an advanced economy noted: “There is a benefit that can be accrued from this. It is important to note, however, that our internal audit function already undertakes full audits in this area.” Another European respondent said BCBS 239 was handled by the supervision department: “However, if the objective of these principles is to strengthen banks’ risk data aggregation capabilities and internal risk reporting practices, it might be relevant to make a similar self-assessment in central banks.”

Conversely, seven central banks disagreed that it would be useful for central banks to self-assess based on an adapted set of principles. All were European except one from the Middle East. The BCBS 239 principles are not applicable to data collection, a European central banker noted: “BCBS 239 addresses issues pertaining to risk data aggregation and reporting capabilities for banks so as to achieve full compliance with regulatory expectations. The principles thereof focus on a specific use of data and do not take into account other dimensions of data valuation (for example, statistical analysis for other needs than those underlying the collection of these data).”

Notes

1. For examples of different definitions, please see David Bholat, Big data and central banks, Bank of England Quarterly Bulletin (2015 Q1); and Daniel Hinge, The big data revolution and central banking, Central Banking Journal (November 2015).

2. The BCBS 239 principles were created by the Basel Committee on Banking Supervision and put in place in January 2016. They consist of 14 principles for supervisors to follow when considering aggregation in the banks they supervise.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com