US rate hikes ‘lock in’ homeowners – Fed study

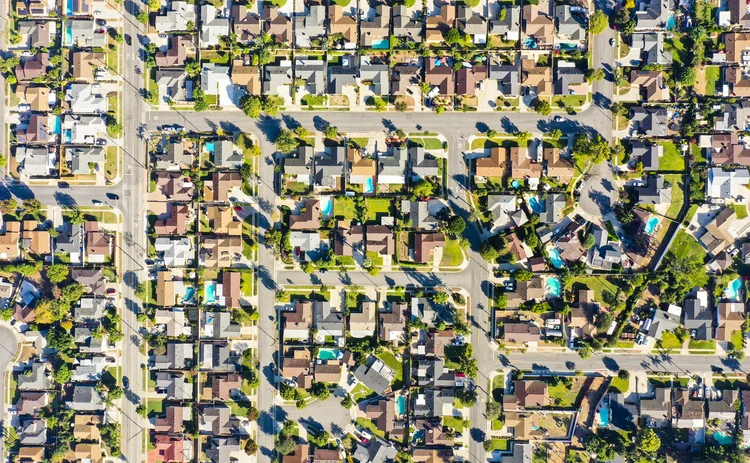

Tighter monetary policy raises house prices and reduces churn, research finds

Rising interest rates have created a phenomenon in the US known as “housing lock-in” whereby higher prices for new mortgages mean homeowners are less willing to move, research from the Federal Reserve Board says.

The paper argues that lock-in has reduced the number of active real estate listings and raised the asking prices for homes.

The authors – Aditya Aladangady, Jacob Krimmel and Tess Scharlemann – say their work highlights an asymmetry between the effects of rate hikes and rate cuts, with

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com