Battle for bilateral payments

The ultimate purpose of a bilateral payments system is to ensure countries can make trade and investment payments in their local currency instead of payments in that of a third country.

Since the 1990s, China has developed cross-border trade with its neighbours, using their domestic currencies or renminbi for settlement, and allows each commercial bank to open local currency accounts to facilitate this arrangement. Since 2009, China has promoted pilot projects for cross-border settlement in which renminbi is used not only in cross-border trade settlement, but also for all general trade, including investments.

Bilateral payments and settlement systems are developed from bilateral trade and investment. In recent years, economic and trade exchanges between China and the United Arab Emirates (UAE) have developed rapidly. In 2018, the trade volume between China and the UAE reached US$24.3 billion, an increase of 28% since 2017. The value of new contracts signed by China and the UAE reached $35.6 billion – an increase of 9% over the same period. And China’s investment in the UAE has reached $1.2 billion. These business activities have laid a solid foundation and serve as motivation for a bilateral payments system.

An exchange of visits between Chinese and UAE leaders has ushered in to both countries the best of times. China has become the UAE’s most important trading partner. And the UAE is China’s second-largest trading partner and the largest importer in the Arab region. In 2018, the bilateral trade volume reached $45.92 billion, representing a year-on-year increase of 12.1%. In the first half of 2019, the total trade volume between the two countries reached $22.66 billion – a year-on-year increase of 9.6%. Around 8% of the UAE’s imports and exports are related to China. And investment has also grown rapidly. Therefore, this economic and financial interaction demonstrates the necessity of bilateral settlement and payments.

Meanwhile, policies implemented by the two nations allow banks to open agency accounts for each other. The filing of customs records can allow the cash transfer of the two countries’ currencies. At the end of 2017, China had signed agreements on bilateral domestic currency settlement with nine neighbouring countries, and bilateral local currency swap agreements worth CNY3.67 trillion with the central banks and currency regulators of 38 countries. The UAE allows cross-border trade to be paid in any currency, including renminbi – that is, with no restrictions on currency payments.

The strengths of the bilateral payments system

Bilateral payments systems have two major advantages. First, the settlement will be more convenient. Through the accounts of the central banks or commercial banks, the transactions can be settled directly, which is time-efficient. Second, they can reduce exchange rate risk from the third party, meaning the currencies of the two countries are directly exchanged. As a result, the transactions won’t be affected by the exchange rate fluctuations of the third party’s currency.

But what is the main basis for establishing and connecting bilateral payments systems to national infrastructure? From the perspective of commercial banks, it should be based on the current payment infrastructure of the two countries. The renminbi has its own domestic payment systems comprising the clearing systems of banks and financial markets as well as its cross-border interbank payment system (Cips). The second phase of Cips, launched in May 2018, ensured cross-border payments could be made overnight. The system’s operating times have been extended to 24 hours on working days, with four extra hours on the first trading day after weekends and holidays – effectively covering the working hours of all financial markets worldwide.1 Six continents are covered under the system. The cross-border payment of renminbi can be made through directly and indirectly participating banks.

The UAE also has its own clearing system that allows local currency payments to be made through commercial banks’ accounts in the central bank. No matter the direction of the two countries’ currency flows, they will eventually flow into the clearing system of the home country. It is therefore clear the interconnection of the payment system between the two countries must be based on their own payment systems.

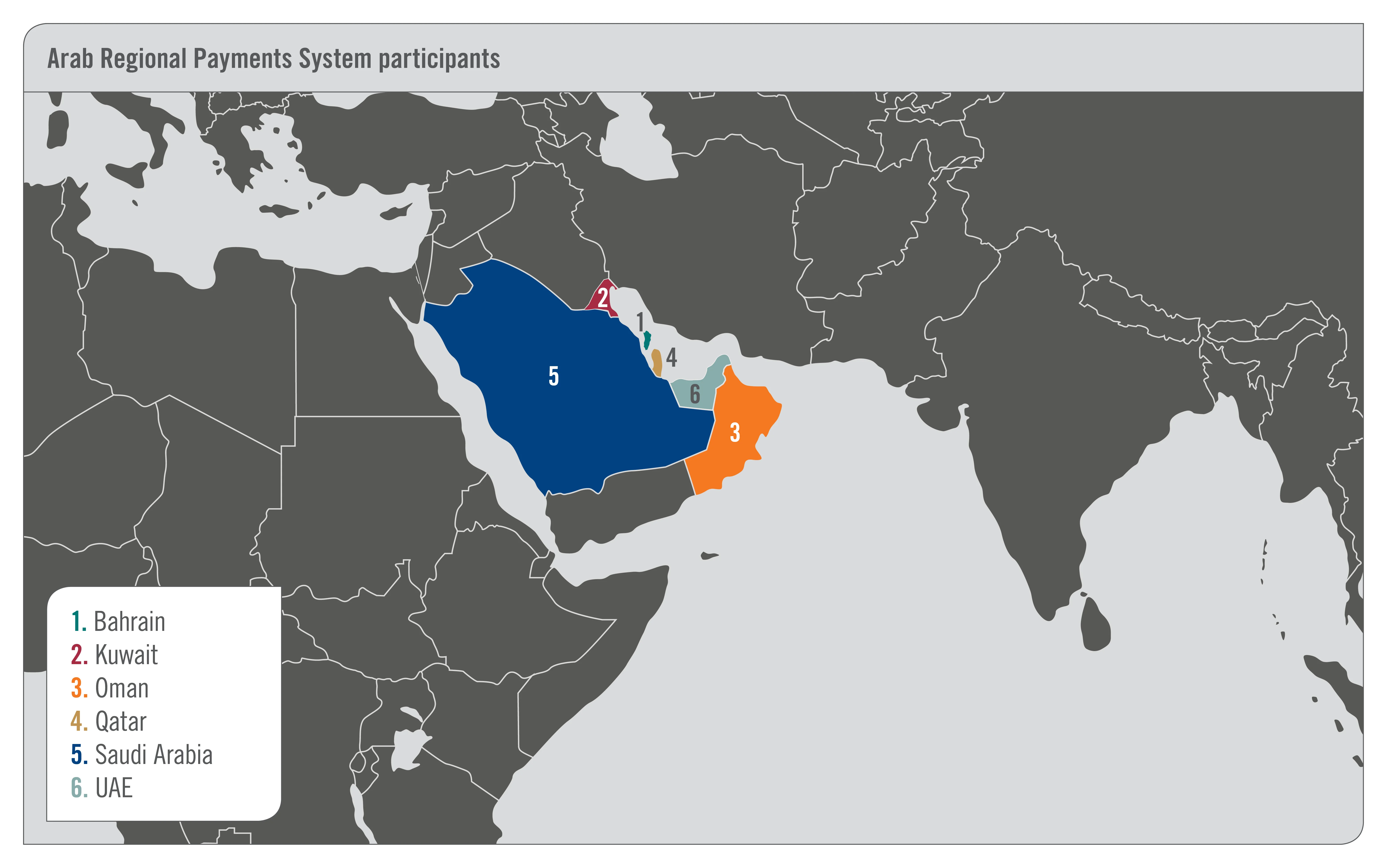

Regarding the establishment of a bilateral payments system between any two countries, from the perspective of the central bank, no country has yet reached the levels of interconnection. However, six central banks on the Arabian Peninsula – those of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE – are developing a regional dealing system, where commercial banks in these territories can conduct regional clearing through direct communication. It is inspiring that such a system has been built at the level of central banks.

The payment system will need to factor in how each commercial bank behaves, and then how the interconnection between the central banks will work. In May 2017, the Agricultural Bank of China established a Dubai branch. It has a wholesale banking licence issued by the Central Bank of the UAE and can conduct renminbi clearing, a power granted by the People’s Bank of China. The bank can also conduct deposits, transactions, clearing, trade, and financing and renminbi products.

At present, the currency clearing between the two countries can be achieved through the commercial banks in a number of ways:

Listing mechanism and exchange rate mechanism between the two countries

In the Middle East, China has exchange rate licences for the UAE dirham and the Turkish lira. It can exchange 62 currencies at the Central Bank of the UAE. Currency exchange is therefore viable between the two countries in terms of exchange rates.

The liquidity of renminbi

Commercial banks can stimulate renminbi circulation by providing the currency to financial institutions in the UAE and the market composed of highly liquid assets, such as treasuries. It can also meet the renminbi demand of local enterprises through exchange remittance.

Currency clearing

The commercial bank systems can connect with the local currency clearing system of the Central Bank of the UAE, as well as the Swift system adopted by banks in China. Therefore, dual currency clearing can be achieved.

Clearing banks have unique strengths

China’s interbank foreign exchange market can be accessed, alongside the interbank lending market and the interbank bond market, as a member. The message format of the Dubai clearing branch is directly changed from the message format of Swift so the transaction can be cleared through the interbank renminbi clearing system. Straight-through processing can therefore be achieved.

Establishing a bilateral payments system is a long process. Policy mechanisms required to achieve interconnection at the central bank level are challenging, and include the need for currency agreements signed by the two countries. But, in its early stages of development, the functional interconnection of a bilateral payments system can be achieved through the agency accounts of commercial banks.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com