Debt Management

S&P boosts Argentine rating one notch

Credit ratings agency Standard and Poor’s lifts Argentina’s sovereign credit rating from B- to B; cites strong economic recovery and solid debt management strategy

Spanish debt office in negotiations on credit support annex thresholds

Government agency looks to alleviate funding costs for bank counterparties in swaps transactions

Standard & Poor’s downgrades Ireland

Standard & Poor’s downgrades Ireland’s sovereign credit rating on fears over fiscal burden imposed by banking sector rescue

BoJ on dollar’s “exorbitant privilege”

Bank of Japan research notes that with great privilege comes great responsibility

Portuguese debt office agrees to post collateral to its dealers

Agency becomes one of first developed-market sovereigns to succumb to dealer pressure as costs of one-way collateral postings grow

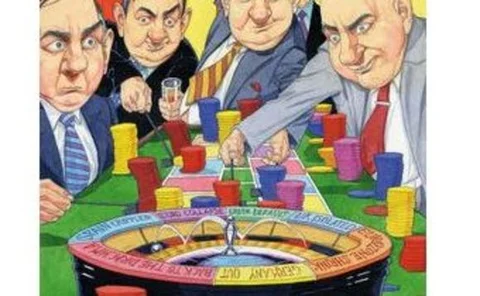

Greek debt crisis sparks widening of almost all global CDS spreads

Cost of protecting against a Greek default up 190% in three months to mid-June as CDS spreads widened for 93% of sovereign debt on back of sovereign debt crisis in Europe

IMF resumes financial aid to Ukraine

Fund approves new application for loans after funding was cut off in dispute over its burgeoning fiscal deficit

EU faces tough call on sovereign scenarios for stress tests

European Union officials split on whether to run sovereign debt scenarios on stress tests; plans afoot to extend number of banks tested

Caruana’s three policy challenges

Bank for International Settlements’ general manager outlines the key problems with which policymakers must grapple

BIS fearful over fiscal crunch

Bank for International Settlements warns advanced economies that rising debt levels risk hindering long-term performance

CentralBanking.com panel: ECB’s response to Greek crisis too slow

Mike Williams, Paul Mortimer-Lee, and Phil Davis say the ECB should have moved more swiftly to tackle the fiscal problems in Greece

Bank of Canada: foreign US Treasury holders depressed long term yields

A Bank of Canada study into long-term US Treasury yields finds foreign holders absorbed the excess supply of bonds and decreased yields pre-crisis

Shilling weakened after Kenya bought euros, say analysts

Analysts link recent weakness in Kenya’s shilling to euro purchases by the central bank

Maastricht criteria tough enough to contain crisis threat: Cyprus

Central Bank of Cyprus paper finds risk of default zero if debt-to-GDP and primary surplus ratios remain below limits set out in Maastricht Treaty; paper mentions Greece and Italy as states where there is a default risk n

ECB’s Bini Smaghi: Greece cannot default

ECB’s Lorenzo Bini Smaghi says an orderly default is simply not an option to solving Greece’s fiscal burden

Libor climbs as uncertainty in European markets grows

Libor rises to highest in more than ten months as lending in European markets slows down

Dubai World agrees restructuring terms

Government owned investment company agrees the terms of a $23.5 billion restructuring effort with creditors and state; markets welcome news

Central banks in biggest US Treasury sell-off for three years

Federal Reserve data shows foreign holders of US treasuries moved away from the dollar

IMF: fiscal prudence pays in emerging markets

IMF study shows that an improving fiscal position improves sovereign debt grading and reduces financing costs in emerging-market economies.

Senate okays disputed Argentine reserve transfer

Lawmakers in Argentina's upper house approve president’s decree to transfer $4.4 billion of central bank reserves to bond repayment fund

Trichet: economic, not monetary, reform of EMU necessary

ECB president Jean-Claude Trichet calls for broader economic reforms to mend Europe’s Economic Monetary Union (EMU)

Portuguese rating takes double-notch beating

Standard & Poor’s downgrades long-term rating to A- and short-term rating to A-2 on concerns over deteriorating macroeconomic environment, credit default spreads stretch further

ECB: fiscal deficits attributable to crisis

ECB paper shows European fiscal budgets were unprepared for intervening in markets during crisis

Greece’s $40 billion bailout an improvement, but issues remain

Markets soothed as firm details of Greek rescue plan are announced, eurozone will provide €30 billion at discounted 5% rate for year forward, analysts less convinced