Singer outlines evolution of Czech reserves

Miroslav Singer tells London audience the Czech National Bank reserve allocation remains “conservative”

The Czech National Bank’s (CNB) reserve allocation remains “conservative”, despite diversification into new assets and currencies in recent years, governor Miroslav Singer said today (March 3).

At the end of 2015, the central bank held €59.5 billion ($64.8 billion). This was an increase of roughly one-third on a year earlier, partly as a result of its exchange rate commitment. Of this, the CNB held 8.1% in equities.

The central bank began gradually building its equity portfolio in 2008, reaching 10% of reserves in 2011. It initially performed well. “We had positive returns on our portfolio until this year,” Singer told an audience at the National Asset-Liability Management conference in London.

Between June 2008 and September 2014, the total cumulative return on the portfolio was 61.4%, compared with a return of 15% on the fixed-income portfolio.

Despite a slump since then, Singer has said he remains pleased with the decision. In an interview with Central Banking in November, he concluded “it was a good move, even given the current equity plunges”.

Today, the governor noted that, when facing a setback in the equities portfolio, the central bank will communicate what the situation is, that “everyone is in it” together and facing negative yields. It can also, he said, highlight the wider performance of the economy, and other aspects of central bank policy.

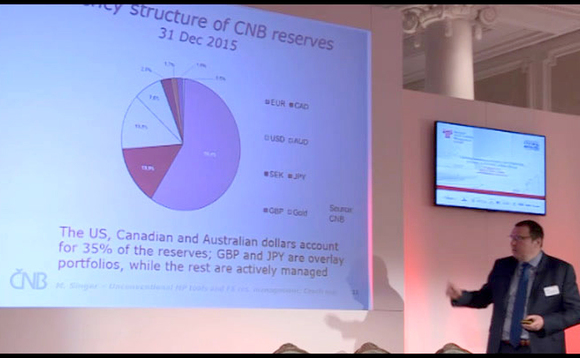

At the end of 2015, the CNB still held 61.9% of its reserves in government bonds. This prompted Singer to observe in his presentation that the “reserve structure is very conservative”. It also retains a large share of euros, at 58.4% of reserves.

Singer discusses the currency structure of the CNB reserves: play video

Since 2010, the CNB has also invested in a wider range of currencies, including the Swedish krona, Australian and Canadian dollars. “We have over 20% of reserves in smaller economies,” Singer said.

The CNB is not investing in renminbi. When asked about the potential for doing so, he said the central bank had “been discussing this option”, but noted there were “liquidity concerns”.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com