Monetary Policy

Riksbank board members clash over inflation forecasts

Minutes from December monetary policy meeting show disagreement over impact of 25-basis point rate cut on inflation

Fed’s Bullard blasts ‘fiscalisation’ of ECB

James Bullard defends central bank independence while criticising the European Central Bank for mixing monetary and fiscal policy in its outright monetary transactions

Fed could stop asset purchases ‘well before end of 2013’

FOMC members express concerns over costs of quantitative easing as the Fed’s balance sheet expands; most members see purchases ending within a year

BoJ research warns of unintended policy consequences from Libor

Working paper says reference rates such as Libor can provide valuable information to markets but may also skew central bank policy-making by adding noise to credit spreads

Fed research asserts ‘potency’ of quantitative easing

Working paper finds large-scale asset purchases by the Federal Reserve equivalent to a cut in the Federal funds rate of more than 3%; estimates are higher than previous studies

Bank of Russia increases inflation target for 2013

Guidelines for monetary policy in Russia over the next three years include revised inflation goal for 2013; inflation overshoots target band in 2012

Irish research measures domestic and imported inflation

Paper studies balance of internal and external factors behind sharp deflation during financial crisis; finds domestic economy is important determinant

BoJ boosts easing amid mounting political pressure

Policy board votes to increase asset purchases by ¥10 trillion ($119 billion); close proximity to election raises questions of political influence in decision

Riksbank cuts rates in face of slowdown

Executive board votes to cut benchmark interest rate by 25 basis points to 1% and revise down forward guidance on rates; some members say actions should have gone further

Pakistani minutes show weak economy but low inflation

State Bank of Pakistan minutes show low level of private-sector credit and declining foreign investment behind stagnant economy; inflation lower than expected

CB.com poll reveals concerns over inflationary impact of QE

Majority of participants believe extraordinary monetary policy measures will cause central banks to overshoot inflation targets

BoE’s Weale urges use of more nuanced economic models

Basing models on a single representative agent risks obscuring important results, says Bank of England’s Martin Weale; alternative is greater emphasis on behavioural economics

Central Bank of Curaçao and Sint Maarten could split

The two Caribbean islands are contemplating dividing their shared central bank; Sint Maarten minister of finance keen to avoid new currency

Philippines’ inflation target will drop in 2015

Goal will decrease from 4% to 3% in line with the government’s desire for ‘disinflation’ and higher economic growth

The Bretton Woods transcripts

Bretton Woods was one of the world’s most important financial conferences, but one that was little known about until now

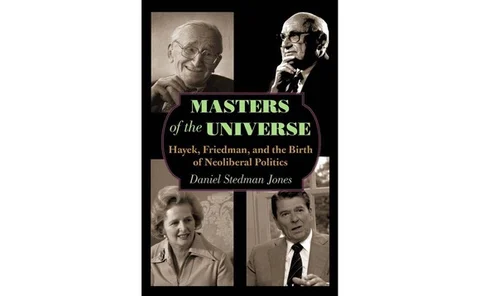

Book notes: Masters of the Universe: Hayek, Friedman, and the Birth of Neoliberal Politics

At first glance the cover of this book implies that the overweening attachment of Thatcher and Reagan to free market economics lay at the root of the 2007–08 crisis. But it is not as simple as that

SNB will not abandon minimum exchange rate, Jordan says

Thomas Jordan reaffirms the Swiss National Bank’s commitment to a minimum of 1.2 Swiss francs to the euro; inflation expected to remain negative next year

Fed to extend QE by $45bn per month

Federal Reserve gives equity markets a lift by unveiling an additional $45 billion of quantitative easing; adopts numerical thresholds

RBA’s Stevens addresses growing importance of policy spillovers

Australia’s Glenn Stevens says policy-makers are becoming increasingly aware of the need to consider the wider impact of domestic decisions, although discussion is in its infancy

Finland paper sizes up Chinese reforms

Research published by the Bank of Finland examines financial liberalisation in China and what it means for the country’s monetary policy framework

Carney and BoE chief economist clash on inflation targeting

Bank of England governor-elect Mark Carney suggests inflation target could be sacrificed for nominal GDP goal; Spencer Dale questions whether this would be effective or viable

QE ‘relief’ no substitute for deleveraging, says HKMA’s Chan

HKMA chief executive warns asset price growth must be supported by structural developments

Belize paper evaluates value of currency peg

Research published by the Central Bank of Belize highlights export growth and steady domestic inflation aided by peg to the US dollar

Central Bank of West African States boosts growth estimates

Monetary policy committee praises member states’ investment in agriculture and infrastructure; holds benchmark interest rate