Financial Stability

Germans in favour of kicking Greece out: poll

Survey in leading newspaper shows 53% of Germans think Greece should be kicked out of the eurozone if its debt troubles cannot be resolved, 67% want no part in a bail-out

ECB beefs up financial stability wing

European Central Bank readies itself for the establishment of European Systemic Risk Board; appoints director general

FSA’s Turner queries faith in deep and liquid markets

Britain’s top regulator calls for a conservative approach to liquidity, arguing that excessive financial activity is liable to do more damage than good

Riksbank’s Nyberg: cards systemically important

Riksbank’s Lars Nyber says cards are overtaking cash in Nordic countries, but security still an issue

British regulator asks for 10% more funds

Financial Services Authority puts bulk of responsibility to pay up on the bigger banks

British PM heralds global bank levy

British prime minister Gordon Brown flags growing consensus among leaders on a global bank tax following Obama proposals

India’s Gokarn rules out March hikes

Reserve Bank of India’s Subir Gokarn emphasises that, barring extraordinary circumstances, the central bank will not raise rates before April; central bank cracks down on PayPal

Community banks remain crucial for US economy

Chicago Federal Reserve summarises its conference on the impact of the financial crisis on community banks

Ex-Bank deputy wants shift in monetary policy remit

Former Bank of England deputy governor and Financial Services Authority chairman Howard Davies calls for central banks to broaden ambit of monetary policy; insists supervision best handled outside the central bank

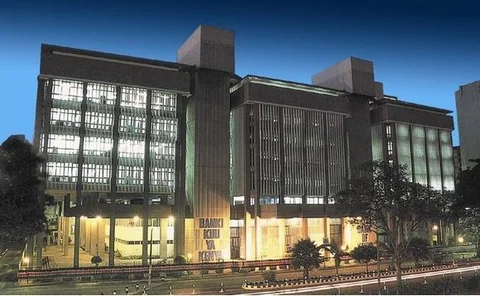

Kenya gets first credit-reference bureau

Central bank governor Njuguna Ndung’u says credit bureaux will increase the availability and lower the cost of loans for borrowers

BIS’s Caruana: central banks up to stability task

Bank for International Settlements’ Jaime Caruana says crisis highlighted the prominent role central banks should have in financial stability policy

Fed’s Kohn: don’t underestimate interest-rate risk

Federal Reserve’s Don Kohn says it is crucial interest-rate risk does not undermine the safety and soundness of the most important lenders

Hungary to buy forint mortgage bonds to spur lending

Move by the National Bank of Hungary highlights concern over return to euro financing, seen as key cause of crisis

Towards a euro monetary fund

Daniel Gros and Thomas Meyer team up on fix aimed at stopping another Greece

Barbados’ Worrell: supervisors of the region unite

Central Bank of Barbados’ governor urges Caribbean supervisors to ramp up cooperation

Chile on the pros and cons of connectivity

Central Bank of Chile looks at how shocks are transmitted across markets and banking systems

Europe is losing the “war on cash”: report

ECB and European Commission efforts to promote cashless payments are having some effect, but people still prefer cash, report finds

Greece should go to IMF, not EU for aid: Issing

Former ECB chief economist advocates tough love from Washington, rejects Brussels bailout; position conflicts with senior EU bureaucrat

Fed’s independence in public’s interest: Bernanke

Ben Bernake says the Federal Reserve will work with Congress to ensure maximum transparency

Iceland’s government knew banks were in trouble: Wellink

Dutch central bank president Nout Wellink says his Icelandic counterparts had informed the government that the country’s banking sector was in trouble

US can go it alone on reforms: Volcker

Former Fed chairman Paul Volcker says international consensus on reform not necessary

RBI’s Gokarn doesn’t rule out capital controls

Reserve Bank of India’s Subir Gokarn says intervening in market to keep capital flows in check is an option

Cooperation key to EU stability: González-Páramo

European Central Bank’s José Manuel González-Páramo says EU institutions must share expertise and statistical information

New rules in pipeline for financial plumbing

Head of Basel-based CPSS says decade-old principles for payments, settlement and clearing must be updated and financial resource requirements sharpened