Quantitative easing

Brazil changes law to allow QE amid chaotic response to virus

Finance minister says central bank will “shower” country with liquidity if needed

Fed set to adopt ‘elements’ of price-level targeting

Covid-19 could act as a catalyst for a Janet Yellen-supported Fed move to adopt elements of price-level targeting. But questions remain about the timing of such a move

BoE predicts sharp fall and fast recovery for UK

Forecasters predict limited long-term scarring from virus shock; banks are in strong position to lend, stress test finds

German court rules ECB must provide more evidence on PSPP

Judges strongly criticise ECJ’s ruling on QE programme, but stop short of declaring it unlawful

ECB launches new lending facility, but holds rates

Lagarde announces cut for banks’ borrowing rate, but the ECB has not expanded asset purchases

Riksbank open to future rate cut

Swedish central bank keeps stimulus package unchanged in monetary policy meeting

Riksbank unveils details of local bond purchases

Swedish central bank to buy up to Skr5 billion from Kommuninvest i Sverige

Bank of Japan steps up stimulus with unlimited JGB purchases

BoJ drops limit on government debt and quadruples corporate bond cap, but it is unclear if purchases will actually increase

Riksbank will start buying municipal bonds

Central bank includes new assets in 300 billion kronor purchase programme

Fed’s balance sheet increases by 50% since March

Total assets now just shy of $6.4 trillion, a new record high

Proposed changes to law could damage independence – Swedish central bank

Lawmakers’ proposal would hinder crisis management capability, Sveriges Riksbank says

Shadow banking increases need for asset purchases – ECB paper

Large non-bank financial sectors can impair transmission of monetary policy, paper finds

Bank of Canada unveils new purchasing programmes

Monetary policy report analysis shows economy could shrink by roughly 30% in Q2

Colombia cuts reserve requirements in extraordinary meeting

Measures permanently inject $2.3 billion in liquidity, says central bank

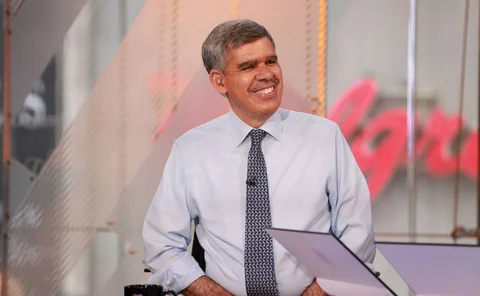

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

ECB minutes reveal resistance to lifting self-imposed limits on PEPP

Some governing council members did not deem new programme necessary, proposing to use APP or OMT

National Bank of Poland cuts rates to record low of 0.5%

Central bank includes state-guaranteed bonds in its asset purchase programme

RBNZ to start buying local government debt

Central bank expands its large-scale asset purchases in the wake of the Covid-19 shock

ECB buys Italian bonds well above capital key in March

Central bank bought €11.8 billion in Italian sovereign bonds last month, up from €2.2 billion in February

Should the Fed be next to implement yield curve control?

The Reserve Bank of Australia is now the second G20 central bank trying to control longer-term interest rates. Could the Fed be next?

The long march to global growth

Liang Tao, vice-chairman of the China Banking and Insurance Regulatory Commission, says that China’s growth is fuelling innovation and modernisation, but financial regulation and governance needs to be tightened up for China to take its place at the top…

Chile cuts rates to record low 0.5%

Central bank expands banking bond purchases to $5.5 billion, GDP expected to shrink by 5% quarter on quarter

ECB makes record sovereign bond purchases

Central bank ramped up purchases under the PSPP programme in the week to March 27

Brazilian central bank seeks power to buy government bonds

Governor Campos Neto said the central bank should be able to support markets as its peers are doing