Central Banking

IMF's Lagarde backs Fed over asset purchases

The IMF’s managing director believes the Fed should take a 'gradual' approach to reversing its asset purchases and rate cuts; stresses the importance of unemployment figures

Bank of Finland deputy urges banks to meet mobile and internet payments demand

Pentti Hakkarainen says banking sector has not met Finnish population’s demand for mobile, internet or real-time payments; says banks risks losing their data advantage over other institutions

Euro crisis will leave Greece stronger, says Herbert Grubel

Membership of a currency union initially failed to force Greece to reform its economy but the country is now set to emerge from the crisis unshackled from former vested interests; the case of Greece may offer lessons for other democracies

RBNZ closing loan valuation loopholes

Reserve Bank of New Zealand proposes stricter rules on how banks value housing loans and residential properties to prevent them undermining new macro-prudential policy

Rosengren paper tackles role of banks in monetary transmission

Boston Fed president presents evidence on the effectiveness of the bank lending channel and provides observations about likely consequences of changes associated with the financial crisis

Australian sovereign bond market infrastructure developments analysed

Reserve Bank of Australia article provides an overview of the CBS market and assesses recent changes in the market infrastructure

SNB reiterates commitment to franc price ceiling and zero interest rate

Swiss National Bank is ready to buy unlimited quantities of foreign exchange and take other measures if required to hold the franc down; inflation should turn positive next year, it says

Scandinavians open macro-pru toolbox to cool overheated housing markets

Rising property prices, increasing household debt and towering banking sectors are pushing Norway, Sweden, and Denmark to consider unconventional measures to pre-empt a crash

Canadian economy rowing to safety, says Poloz

Stephen Poloz says central bank's job is to fill the crater left by the burst bubble with liquidity - but when the economy has rowed itself to safety, the bank can reduce the injections

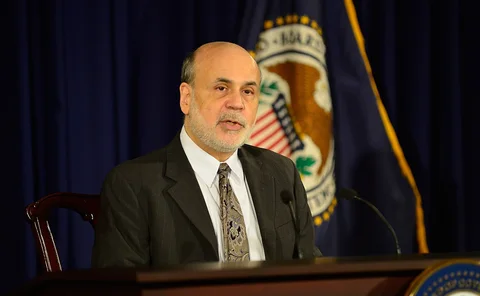

Bernanke defends Fed communication after QE surprise

Ben Bernanke says FOMC communication in June was justified as Fed shocks markets by ploughing on with asset purchases; economists question why markets were focused on September meeting

Carney new vice-chair of ESRB as King joins Fischer at CFR

Mark Carney takes over from Mervyn King as deputy to European Systemic Risk Board chairman Mario Draghi; King joins US think-tank Council on Foreign Relations as a distinguished fellow

BIS papers probe LatAm currency interventions

Working papers written by economists from each of five Latin American central banks and published by the BIS investigate the efficacy of various currency intervention strategies

Panellists hit out at Fed’s forward guidance in CBP debate

Federal Reserve gets mixed scorecard for its extraordinary monetary policy and communication performance, according to panellists in Central Banking On Air debate

ECB seeks women to fill four senior economics vacancies

Re-organisation in the ECB's directorate general for economics creates four vacancies for head of division; new targets means bank will want to hire women to the male-dominated department

IMF greenlights new wave of funds for ‘resolute' Cyprus

New IMF report says most conditions have been met with a ‘comfortable margin' but warns that the banking crisis' impact on households and corporates could be larger than anticipated

BoE appraises forward guidance as economy picks up

Bank of England MPC believes that market participants demonstrated an ‘increased understanding’ of the link between monetary policy and unemployment in the run up to its September meeting

Hungarian economists wary of foreign bank branches

Researchers are concerned that a shift away from foreign bank subsidiaries to branches increases the risks of inadequate supervision and threatens financial stability both at home and abroad

BIS research dismisses fears over high-quality asset shortage

Article says increase in high-quality assets appears sufficient to meet rising demand, but risks could still come from elsewhere

Minutes reveal Riksbank reluctant to give up say on macro-prudential matters

Deputies say democratic accountability is more about who has the right to make decisions than achieving policy objectives; see ‘clear link' between macro-prudential policy and monetary policy

BoE's Tucker clarifies FPC's macro-prudential powers

Article gives details of the inner workings of the Financial Policy Committee, including powers of direction and recommendation, its accountability and powers to hide information from the public

Robert Pringle’s Viewpoint: Looking for a game-changer for the financial system

The world may need to look to central bank governors in countries such as China and India to champion reform of the global monetary architecture

Publishing minutes is vital for central bank comms, say markets

Market participant survey gives Fed highest score for policy and communication in the wake of the financial crisis; ECB scores worse in the absence of published minutes

Africa leads growth in financial inclusion, finds IMF study

Most comprehensive financial inclusion data set to date highlights rapid expansion of financial access in Africa; emphasises close links between growth and SMEs' access to finance

IMF backs counter-cyclical fiscal activism in times of crisis

Fiscal stimulus had powerful effects in the wake of the financial crisis, but monetary policy is better suited to keeping the economy on an even keel in normal times, says IMF