Central Banking

Swift announces trials with ECB instant payment system

Linking “Swift gpi” to ECB’s Tips will greatly reduce delays in settlement, consortium says

IMF publishes first review of programmes since financial crisis

Directors say growth assumptions are often unrealistic and call for closer look at debt restructuring

Bank of Jamaica continues with monetary easing

Central bank has now lowered rates three times this year and cut reserve requirements twice

Cyber crime is ‘present danger’ for financial system – BoE deputy

Sam Woods emphasises need for more widespread stress-testing of cyber security

Powell plays down fears about record levels of corporate debt

Fed chair’s remarks strike similar chord to those of Ben Bernanke in 2007, but Powell says this time is different

BoE seeks to make financial stability more transparent – Brazier

Policy-makers look to improve communications and design tests more systematically

BIS paper finds cross-border links between monetary and macro-pru policy

Authors discover “significant interactions” between policies

RBA eyes rate cut as growth and inflation disappoint

Trade tensions and weak household income hamper central bank’s previous plan to tighten policy

ECB criticises revised Romanian tax law

New proposals could harm banks and distort lending, ECB says

Crypto assets have little impact on monetary policy, says ECB team

Task force concludes crypto assets do not fulfil functions of money

New Zealand banks attack RBNZ capital proposals

Central bank proposal would almost double banks’ minimum capital requirements

SBP hikes to 12.25% as inflationary risks grow

Government has been borrowing heavily from central bank and rupee has weakened

Israeli banks and households resilient to higher rates and unemployment

Housing market withstands adverse scenarios in macroeconomic stress test

Saudi central bank fines 16 commercial lenders

Country’s largest banks fined in what may be part of crackdown on consumer finance abuses

Johannes Witteveen, 1921–2019

Witteveen headed IMF during one of the most turbulent periods in monetary history

Open and closed economy central banks react differently to inflation – research

Some economies respond more strongly to certain variables, Fernando Leibovici says

Bank of Canada warns of corporate debt risks

Annual financial system report notes the growing corporate debt in Canada’s extractive industries

RBNZ paper hunts cause of flattening Phillips curve

Paper explores trend of declining relationship between inflation and economic activity

Senior Fed officials call for overshooting inflation target

Kashkari says Fed acted too early in tightening while Brainard says policy must meet ‘new normal’

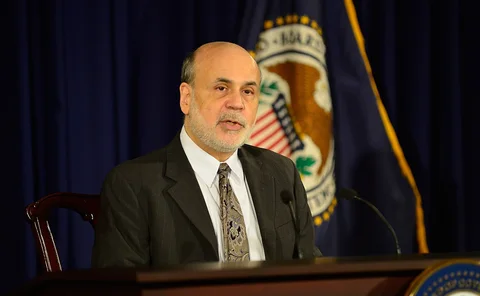

Weakened international co-operation could hinder crisis response – Bernanke

Christina Romer ‘loses sleep at night’ about internationals' readiness to fight a future crisis

BoE’s Woods sees value in ditching EU-style rulemaking

Detailed legislation behind banking regulations may be unnecessarily restrictive for UK, says PRA chief; post-Brexit harmonisation with Europe could still cause problems

RBNZ: New Zealand’s biggest bank cannot use own risk capital model

New Zealand central bank says ANZ had “a persistent failure in its controls and attestation process”

Bank of Italy paper looks at impact of long-term rates

Long-term rates have significant impact on Italian banks’ risk appetite, researchers find

Israel’s banking system resilient to geopolitical shock, governor says

Recent stress tests measured impact of geopolitical shock on domestic economy