News

DRC central bank more than triples rate amid reserves squeeze

Congo central bank raises headline rate five percentage points as foreign reserves continue to dwindle; economy is suffering from copper slump and difficult external environment

Inflation worries prompt action from Bank of Mexico

Central bank hikes interest rate by 50bps in last monetary policy meeting before the US presidential election; peso proves volatile in face of international events

Global sharia standards desirable, but impractical – Lebanon’s el Gemayel

Complete standardisation impractical, but other options are available, says Central Bank of Lebanon’s Joëlle el Gemayel; Islamic banking landscape is shifting

Central banks must do more on green finance – UN report

Current progress is not enough to deliver long-run stability; central banks should work with other stakeholders to align the financial system with climate change goals, UN report says

People: RBNZ appoints new board chair; reshuffle of senior management at Australian central bank

Reserve Bank of New Zealand replaces board of directors’ chair after 10 years at bank; assistant governors swap roles at the RBA as the bank looks to hire new talent; and more

EBA default standards could prove ‘burdensome’, banks warn

Implementation likely to be costly, especially for IRB-based firms, authority admits; standardisation necessary in view of wide range of current practices

IMF: rise of non-banks is reshaping policy transmission

Pass-through of monetary policy grows as non-banks become more important, but changed transmission mechanism demands better data to understand risk-taking channel

PRA tightens standards for buy-to-let market

“Interest coverage ratio” and affordability stress tests to be implemented by January 2017, while remaining measures must be implemented by September 30

Bank of Canada should not raise inflation target – Obstfeld and co-authors

Central bank has been overtaken in transparency metrics, authors say; forward guidance would catapult Canada to top of rankings and could avoid the need for unconventional measures

Rajan and co-authors present paper to ECB research conference

Paper introduces “pledgeability” as analytical tool; concept helps explain prolonged financial downturns, authors say

Big data could cut regulatory costs, say panellists

Big data could lead to a reduction in costly regulatory reporting, but three experts say there is still a long way to go before the figures are up to scratch

Fed’s Yellen defends Brainard against congressman’s charges of political bias

No sign of political bias from FOMC members, Yellen says, amid accusations Lael Brainard might be looking for a job in a Hillary Clinton administration

Bahamas launches new banknote series with innovative security thread

Central Bank of Bahamas launches “Crisp Evolution” series, the first “circulation banknote” to feature new colour-changing security thread; $10 note to enter circulation immediately

Armenia cuts again as deflation deepens

Central bank cuts headline rate as inflation dips further below zero, though the board maintains it will be able to return inflation to target in medium term

Inflation expectations more sensitive near the zero lower bound – IMF study

IMF study examines whether monetary policy can boost inflation in constrained environment; countries near zero lower bound could see inflation respond more to shocks

Central banks adopt Swift harmonisation charter

Three central banks join 18 other institutions in global rollout of messaging standard ISO 20022; separate taskforce working on publishing market practice guidelines

Fed members differ on monetary policy, as Trump again attacks Yellen

Rosengren calls for “modest, gradual tightening”, while Kashkari sees slack in labour market; Republican candidate questions Fed’s political impartiality

BoE’s Salmon warns forex industry on adherence

Chris Salmon, the Bank of England's executive director for markets and lead on global code adherence, says regulation could be on the horizon as soon as 2020 if market participants don't adhere to the new Global Code

Fed’s Tarullo: stress testing needs to evolve

Fed is planning to toughen its stress-testing framework with better alignment with regulation and incorporation of dynamic “amplification” effects – though more research is needed

ECB says it has learned lessons from simulated cyber attack

Federal Reserve, eurozone central banks and private firms took part in exercise to test Target2 payment system

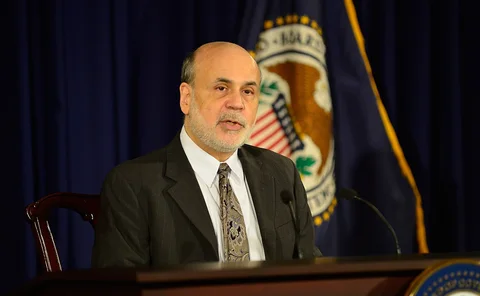

Inclusion of renminbi in SDR is ‘symbolic’, says Bernanke

Former Fed chair sees inclusion of renminbi in SDR basket as a ‘symbolic’ gesture rather than a major shift; Eswar Prasad argues currency will never be a safe haven

Sama intervenes to ease liquidity pressure on banks

Saudi central bank makes deposits worth over $5 billion at commercial banks struggling with low liquidity, and introduces new repo facilities

RBNZ floats idea of bank regulatory dashboard

Bringing regulatory disclosures together in one place could impose market discipline and allow more straightforward comparison of risks, central bank says

Crane invests $100 million in new banknote plant

New banknote facility in Malta to add to existing operations in Sweden and the US, employing 200 people