News

BIS paper finds Fed’s QE had little discernible impact on real economy

Results are still preliminary, authors say, but “cast some doubt” on the effectiveness of US quantitative easing

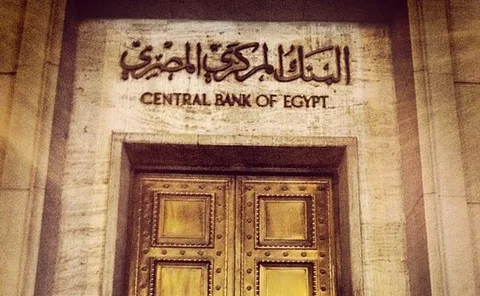

Money targeting key to Egypt reform programme

Central bank to maintain flexible exchange rates and keep a close rein on the money supply as IMF pledges $12 billion support

Xi says China is open for business as US turns away

China to become a bigger player in global markets as US seems to be turning inwards, says President Xi; firms looking to invest overseas

Central Bank of Nigeria bans banks from using digital currencies

CBN warns on AML-CFT risk to banks from dealings with “virtual currency exchangers”

‘Digital base money’ could hinder monetary policy, ECB official warns

Mersch examines means of issuing central bank-backed digital money to non-banks

Irish central bank sells old premises for €67 million

Move to new purpose-built premises due to be completed by end of first quarter

Davos panellists highlight risks posed by strong dollar

At the World Economic Forum, experts underline the risks of a strengthening dollar on not only US monetary policy, but also on emerging markets’ economies

Review urges BIS to curb dominance of ‘house view’ in research

Panel including UK’s Charlie Bean finds BIS research has at times been “genuinely path-breaking” but should give economists more room to differ from the house view

Eichengreen sees danger in US fiscal stimulus

Veteran economist warns infrastructure spending in the US may prove damaging to both the domestic and global economy, without necessarily fixing secular stagnation

Carney: 250,000 jobs lost by 2018 if BoE had not acted after Brexit vote

BoE governor defends 2016 action by underlining policy trade-off, but warns consumers are "looking through" Brexit-related uncertainties

South Sudan president dismisses bank governor, reports allege

Country’s economy in crisis, but central bank role appears limited, experts say

IMF raises projections for US and eurozone growth for 2017

US policy mix still uncertain, but IMF staff do not yet believe changes will trigger an international trade shock; growth projections for emerging economies revised downwards

‘Humiliated’ RBI staff urge Patel to resist ‘unwarranted’ government interference

Reserve Bank of India staff send impassioned letter to governor to protect the central bank’s autonomy; finance ministry objects to claims, stating central bank is fully independent

People: RBNZ appoints new CIO; former BoE deputy to chair BBC

Reserve Bank of New Zealand appoints new CIO and head of risk assessment; David Clementi, former Bank of England deputy for financial stability, to head new BBC board; and more

Measurement error a big part of ‘missing growth’ – Philippe Aghion

Statistics fail to capture creative destruction, French academic argues; US researchers say productivity in IT sector points to continued puzzle

Dutch paper looks at sovereign bank interdependencies

Researchers apply correlation between sovereign and bank credit default swaps

ECB minutes show dissent over asset purchases

Some council members expressed “scepticism” over asset purchases; two programme extension options were discussed

Bank of Lithuania plans to cut costs by a fifth

Strategic plan aims at improvements to payments system; bank aims to increase income from investment

BIS fails to find single cause of sterling ‘flash crash’

Report finds “numerous” factors which amplified the effects of the depreciation, including “inexperience staff” and “fragile” market conditions; lessons must be learned, BIS warns

Bitcoin exchange halts service after PBoC clampdown

BTC123 becomes first exchange in China to halt services due to ongoing investigation by government agencies into virtual currency; cuts rates on wealth products

US may not experience fiscal stimulus – Atlanta Fed president

Dennis Lockhart says the US economy has reached a “transitional” juncture; says declines in key growth factors are holding the economy back

Swift creates distributed ledger proof-of-concept

Swift, in conjunction with Hyperledger working group, will launch private distributed ledger network to help banks manage their cross-border payments

FSB finalises recommended action on asset management risks

Set of recommendations tackle liquidity, leverage, op risk and securities lending; work on globally systemic designations pushed back until 2019

Brazil ups pace of easing as inflation drops

Size of cut surprises observers, though inflation proves more favourable than expected; rates still rising in real terms