News

Ukrainian central bank bars PwC from further audits

NBU says firm verified “misrepresented information”, but PwC denies charge

Tensions rise as EU payments deadline nears

Europe’s revised payment services directive is meant to boost innovation, competition and security, but many are concerned it has serious flaws

Guinea Bissau still struggling with NPLs, says latest IMF assessment

Country still reeling from failed bailout that saw two banks default; fund stresses the need for prudential regulatory compliance and praises three-pronged approach

France should broaden macro-prudential oversight – FSB report

Country should widen its outlook to include asset managers and other risky areas, a peer review finds; report recommends action to boost communication and disclosure

Central Bank of Paraguay re-enters markets with World Bank support

World Bank to provide assistance on efficient portfolio management following re-entry into international markets

ECB will look afresh at policy this autumn – Draghi

Draghi says recovery is continuing, but strikes a cautious note on inflationary pressures

Sarb takes action amid ‘extremely weak’ demand

Central bank revises down its forecasts as economic situation deteriorates; governor warns of possible cliff effect if there are further rating downgrades

Bank of Japan cuts inflation forecast as policy remains on hold

The BoJ cuts its forecast for prices as it struggles to hit its inflation target; keeps policy steady

Russian central bank reorganises senior personnel

First deputy governor will resign on September 1; responsibilities to be split among other board members

Verbs matter in forward guidance – Italian paper

Researchers look at verbs used in ECB statements from 2002 to 2015

Fed fines BNP Paribas over forex manipulation

French bank is to pay $246 million to settle an investigation of misconduct

IMF praises Madagascar’s approach to monetary framework change

Madagascan central bank to introduce overnight deposit facility to form basis of an interest rate corridor; fund notes effects of vanilla bean shock still being felt by banks

BoE opens RTGS to non-bank payment service providers

Non-banks gain direct access to settlement accounts at the Bank of England for the first time, though they will not be able to participate in monetary operations

Bank of England unveils Jane Austen £10

New banknote will be the first to include tactile features for the visually impaired; Carney says timeline for the new £20 remains on track despite polymer controversy

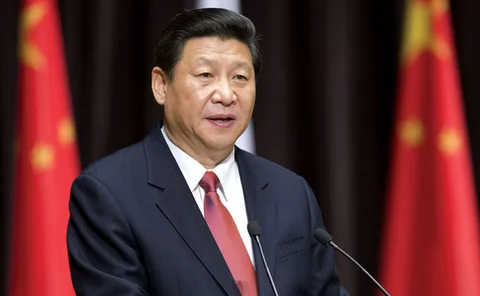

China's president hands PBoC stronger role in tackling financial risks

China will set up a financial stability and development committee to co-ordinate financial supervision, and the central bank will play a stronger role in financial regulation, Xi Jinping said at a national financial work conference.

People: Malta finds replacement for Mifsud; DNB appoints new board member

People: Malta appoints new deputy governor; Netherlands picks Else Bos as new board member for prudential supervision; and more

IFRS 9 will improve stability – ESRB

New measures could reduce the procyclicality of asset impairments in downturns

Malaysian central bank strengthens onshore hedging

Bank Negara complements NDF restrictions with more open onshore market

IMF continues building up Somali central bank

Planned currency reform should give the central bank the ability to implement monetary policy

Madagascar launches high-denomination banknote

New banknote series will use new security features on a number of substrates, one of which has been created by Banque de France

Uganda central bank sues Crane Bank director for over $100m

Bank of Uganda investigation finds troubled Crane Bank owned wholly by one person; third party to file action against the central bank for negligence in handling Crane saga

RBNZ considers cutting contingent instruments from capital regime

Central bank casts sceptical eye over debt instruments with in-built conversion triggers, following recent problems in Europe

Fed would remove Wells Fargo board if ‘appropriate’, says Yellen

Fed chair asked why stricter penalties had not been imposed after bank opened millions of fake accounts; senator Warren says current system has created “bullet proof” executives

BoJ ups asset purchases to curb bond market pressure

The Bank of Japan has increased the size of JGB purchase operation and announced unlimited purchases of 10-year JGBs at a fixed rate of 0.11%