In a year of exceptional circumstances – especially true for gold, which, in August, saw an all-time high price – Invesco explores how pandemic-driven uncertainty has returned the precious metal to the spotlight of the global monetary system.

Earlier this year, on August 6, the price of gold hit an all-time high of more than $2,060 per troy ounce. It had fallen back to below $1,900 by the end of September, but many analysts expect the $2,000 threshold to be breached again soon.

The roller-coaster ride has been lucrative for investors. Gold was comfortably the best-performing of all asset classes during the 12 months to the end of the third quarter of 2020, returning more than 28%. By marked contrast, real bond yields recently slumped to record lows, with the amount of negative-yielding global debt topping $15 trillion.

Gold’s role in central bank reserve management has itself been a story of ups and downs. While 2018 and 2019 were banner years for purchases, August 2020 saw central banks become net sellers for the first time in 18 months – a pullback broadly attributed to the need to free up resources to deal with the Covid-19 crisis.

On balance, much of the evidence today indicates the use of gold in international reserve portfolios will increase. And the arguments in its favour seem to boil down to one crucial objective: diversification.

This is a key message of our white paper, Central bank foreign currency reserves management – Revival of gold as a reserve asset. As discussed in more detail in the companion article to this piece, it is also a dominant theme in the Gold reserves in central banks – 2020 survey.

So why has gold regained its shine for central banks? And why might it go on to gleam even more brightly? This article explores the past, present and likely future of a commodity that, in some way, shape or form, has been central to the worldwide monetary system for millennia.

A brief modern-day history of gold

International acceptance of a fiat currency untethered to gold or silver is a relatively novel phenomenon. It dates back, of course, to 1973 and the collapse of the Bretton Woods system of monetary management.

Under the gold standard, used from the 19th to the first half of the 20th century, major countries’ national currencies were accepted for settlement only if backed by an issuing government’s commitment to convert its notes into gold at a predetermined price. Under Bretton Woods, conceived in response to the world wars’ depletion of gold stocks in the UK and Europe, the US dollar assumed centre stage.

Bretton Woods saw the US fix the dollar to gold at a set price; other nations, in turn, fixed their own currencies to the dollar. Thus the US cemented its position as the new leader of the democratic world, generally seeking to achieve economic and political stability through multilateral means.

The concept of ‘benign hegemony’ proved persuasive. In 1973, when President Richard Nixon de-linked the dollar from gold, many countries were content to keep their currencies and monetary policies anchored to those of the US – in part because there was no viable alternative, and partly because sporadic American excesses or errors were usually reversed in due course.

As a result, perhaps inevitably, gold lost some of its lustre. By the early 1980s, with US Treasuries generating strong investment returns, it was starting to take on the air of a relic. Developed market central banks set about selling it in the 1990s, leading to the signing of the Gold Accord in a bid to co-ordinate sales and minimise market disruption.

Yet the sanctity of the dollar would not endure in perpetuity. The global financial crisis of 2007–08 put paid to the notion of US government and agency securities as ‘risk-free’ assets. Developed market central banks stopped divesting their gold, with the Gold Accord finally allowed to quietly expire in 2019; meanwhile, emerging market central banks embarked on substantial investments in gold to reduce exposure to the US financial system. The desire to diversify had taken hold.

Proven long-term performance

Naturally, there have always been reasons for central banks not to invest in gold. These might include a lack of understanding of the market, an aversion to higher volatility or a determination to find superior returns elsewhere. Yet research casts few doubts on gold’s capacity to preserve capital and aid portfolio performance.

As reported in our white paper, gold has achieved positive annualised returns ever since the breakdown of Bretton Woods – albeit with considerable short-term fluctuations in price. During the past decade alone, its annualised price volatility of 17% was more comparable to that of equities than that of bonds.

Gold has produced negative returns during 41% of calendar years since 1973. The average loss during these negative years has been -10.7%. This underlines gold’s standing as a long-term asset and a strategic component of international reserves.

Maybe more significantly, so too does its positive performance overall during both expansionary and recessionary cycles. This, as remarked on in All that glitters – Surveying central banks on gold reserves, has set gold apart from most financial assets, which have tended to be pro- or countercyclical.

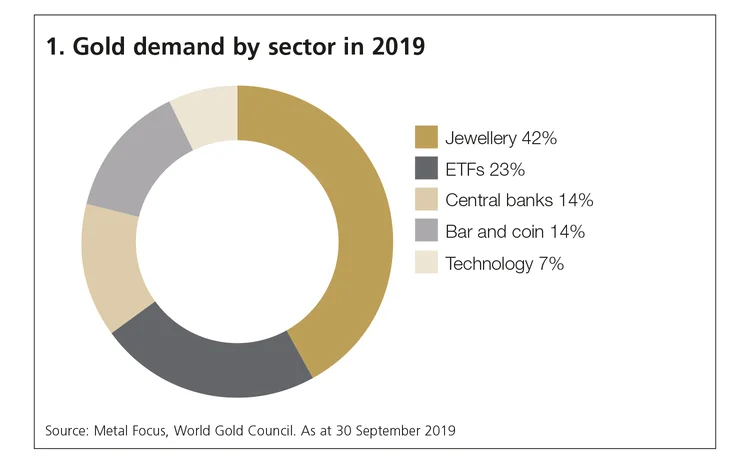

We can account for gold’s uncommon behaviour in this regard by examining the drivers of demand. As illustrated in figure 1, there is a fairly even split between consumption, as represented by the jewellery and technology sectors, and savings/investment, as represented by central bank purchases, exchange-traded funds (ETFs) and physical gold. Consumption demand for gold goes up during expansionary periods, whereas gold’s status as a perceived ‘safe-haven’ asset goes up in the face of recession or financial shocks.

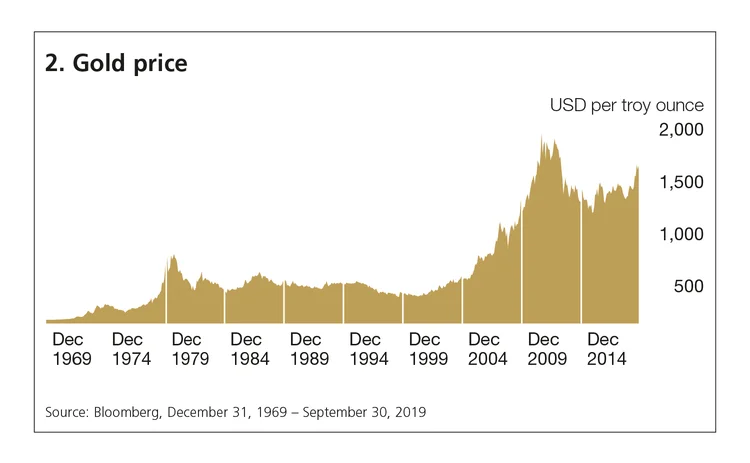

The influences of both forces can be observed in figure 2, which depicts changes in the price of gold during the past half-century.

The rise that occurred between 2000 and 2019 corresponded with robust economic growth in China and India, both of which are major players in the gold jewellery market, while the twin peaks witnessed in 1979 and 2008 coincided with rampant inflation and the global financial crisis, respectively.

The appeal of negative correlation

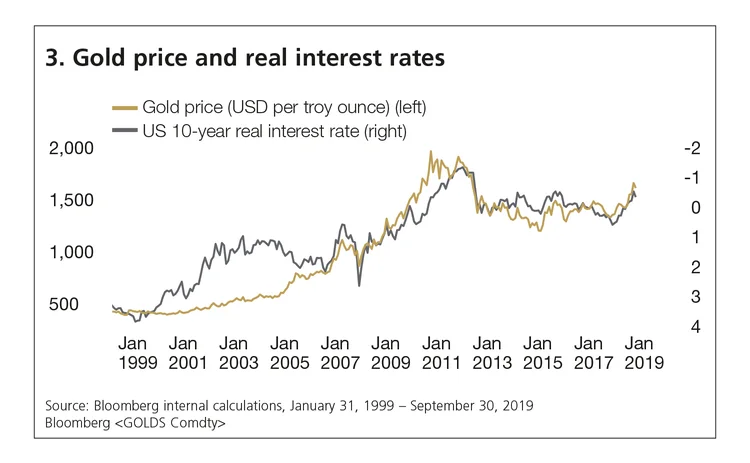

As a financial asset, gold is also subject to the direction and level of real interest rates. A key observation is that its price appears to be well supported when rates are declining or low.

The first reason for this is that falling interest rates are typically associated with recessionary conditions and higher risk aversion. As noted in the preceding section, such an environment is liable to augment demand for gold as a perceived safe-haven asset.

A second reason is that the relative difference in carrying costs between gold and government bonds diminishes when interest rates are low.

Moreover, the traditional relationship between the two might even reverse when rates on government bonds turn negative, as is currently the case for Switzerland, Japan and much of the eurozone.

A study of the historical relationship between the price of gold and the level of interest rates reinforces the contention that the two are negatively correlated. For example, inverted on the right-hand scale of figure 3 is the 10-year real rate implied by Treasury inflation-protected bonds; the price of gold is charted on the left-hand scale.

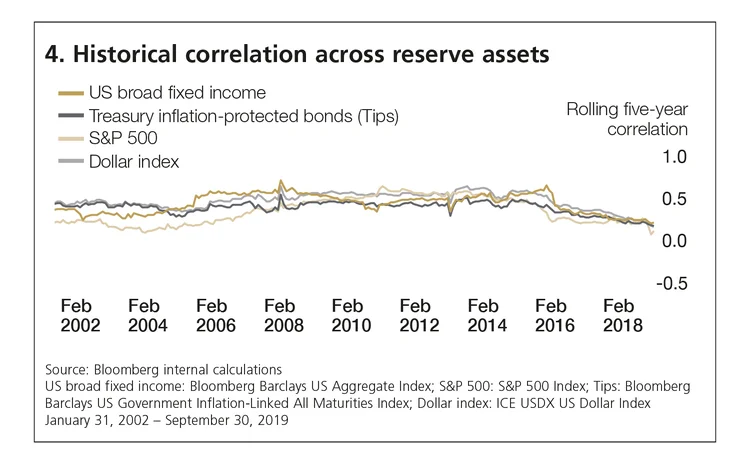

As figure 4 illustrates, there has been an analogous negative correlation between the price of gold and the value of the US dollar. This demonstrates gold’s powers of diversification when measured in terms of a trade-weighted basket of international currencies. A similar negative correlation has meant the addition of gold has also improved portfolio outcomes for central banks investing in equities. Gold’s diversification effect for a broad fixed income portfolio has been less conspicuous.

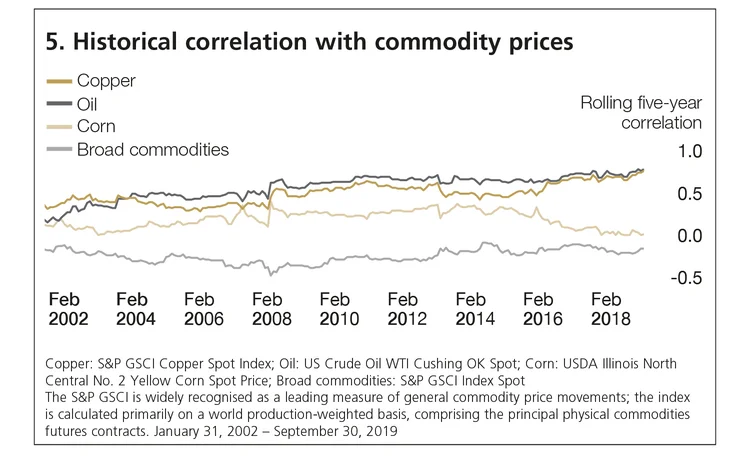

Uniquely, as illustrated in figure 5, the correlation between gold and other commodities – whether metals or agricultural goods – has tended to be positive during the past two decades. This may be especially salient for countries dependent on commodity exports, as excessive exposure to gold could invite ‘doubling up’ on the economic and financial risks within a reserves portfolio.

Innovation and de-dollarisation

As noted in All that glitters, the advent of gold ETFs has, to some degree, changed how investors of all kinds think about this asset class as a whole. But how might further financial innovation affect market dynamics and, by extension, central banks’ attitudes towards gold?

Cryptocurrencies have been suggested as a new reserve asset – one that could potentially supplant gold. As if to underline this possibility, some leading cryptocurrencies have adopted the language of mining to describe how they function.

Like gold, cryptocurrencies do not represent national liabilities. This means they are invulnerable to sovereign risk – whether from geopolitics, inflation or devaluation. They are, though, subject to hacking, a problem exacerbated both by a deliberately anonymous structure and an inherent lack of centralisation and oversight.

These fundamental traits make it unlikely that central banks would hold international reserves in cryptocurrencies. The prospect of a nation’s ‘digital wallet’ suddenly vanishing, with no dependable method of subsequently identifying the source of the incident, seems unconscionable. It is more likely that cryptocurrencies could play a bigger role in domestic monetary and financial systems, which differ from paper currency in form rather than substance.

Meanwhile, away from the sphere of fintech, other would-be reserve currencies jostle for position to little effect. Foremost among these are the yuan, the euro and the pound. All face serious difficulties – most notably lower levels of daily liquidity – in mounting a meaningful challenge to the dollar. The accumulation of gold stocks since 2008 may in part reflect diversification away from the greenback in a world that, as in 1973, affords precious few serious rivals in the safe-haven stakes.

There is also the issue of the dollar’s weaponisation and the riposte of ‘de-dollarisation’. Countries the US has targeted through sanctions and tariffs have taken aggressive actions to de-dollarise, shrinking their holdings of US securities and turning instead to gold and to other currencies. Russia, China and Turkey were responsible for 70% of central bank net gold purchases from 2016 to 2019, and many of the other nations that have added to their own gold stocks during the past few years are either economically integrated or politically allied with one of these.

The road ahead – paved with gold?

We have seen how several factors have contributed to gold’s comeback as an international reserve asset. The recent quest to lessen exposure to the dollar can trace its roots to the global financial crisis, since which time it has been further bolstered by geopolitical tensions and – certainly during the past four years – the US’s use of dollar sanctions.

In tandem, macroeconomic considerations have clearly encouraged the unfolding shift. The persistence of low growth, low inflation and, accordingly, ultra-low or even negative interest rates has been vital in solidifying gold’s rediscovered appeal.

Combine all of these elements and it is easily recognised that, as stated at the outset of this article, it is ultimately a need to diversify that has led central banks back to gold. While those in emerging markets have been in the vanguard to date, 62% of respondents in our own analysis of central banks across all regions expect gold reserves to increase in the coming months.

This is unsurprising, given that the global political and economic environment should maintain support for both the price of gold and the demand for diversification. The threat of higher trade and investment barriers and the intensification of technological and geostrategic rivalries among great powers are unlikely to end anytime soon, irrespective of who occupies the White House; ditto accommodative monetary policy.

In addition, central banks and governments will undoubtedly continue their debate around the international financial system’s excessive reliance on a single currency. This should further spur the search for alternatives to the dollar, with gold the most obvious fallback – at least for the time being.

It should be stressed, in conclusion, that we do not foresee an eventual return to an international or, indeed, domestic system centred on either gold or a single currency. The size of individual financial systems in major economies and the patent requirement for discretionary monetary policies precludes such a scenario. What is much more likely to emerge, we believe, is a more diversified global system – one in which gold, contrary to earlier assumptions of its demise, should continue to fulfil an important role as a safe-haven asset of choice.

This feature forms part of the Central Banking focus report, Gold for central banking 2020

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Instruments providing exposure to commodities are generally considered to be high risk, which means there is a greater risk of large fluctuations in the value of the instrument.

Important information

This article is for Central Banking only and is not for consumer use.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Issued by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com