Key survey data and comments reinforce the main findings in Invesco’s central bank reserve management white paper on the revival of gold as a reserve asset.

The joint Central Banking-Invesco gold survey, conducted in August and September 2020, provides interesting reading about how central banks see the role of gold in official international reserves in a low-yield, low-growth, low-inflation world where many central banks have high reserves, far in excess of likely needs for traditional uses such as foreign exchange intervention. The survey’s findings reinforce those of Invesco’s white paper, Central bank foreign currency reserves management – Revival of gold as a reserve asset, and point to evolving views and use of reserves.

The rise of gold in reserve portfolios

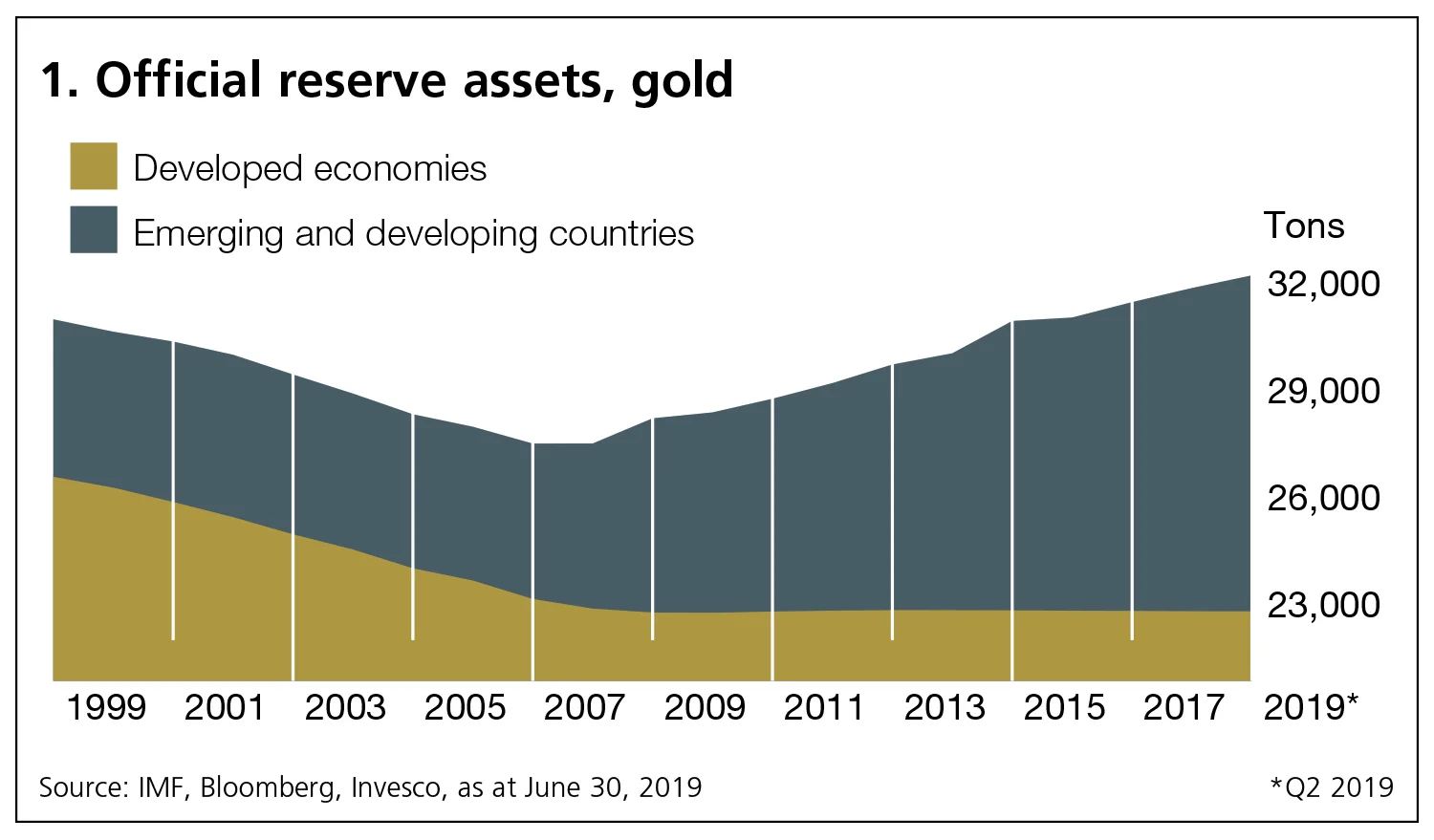

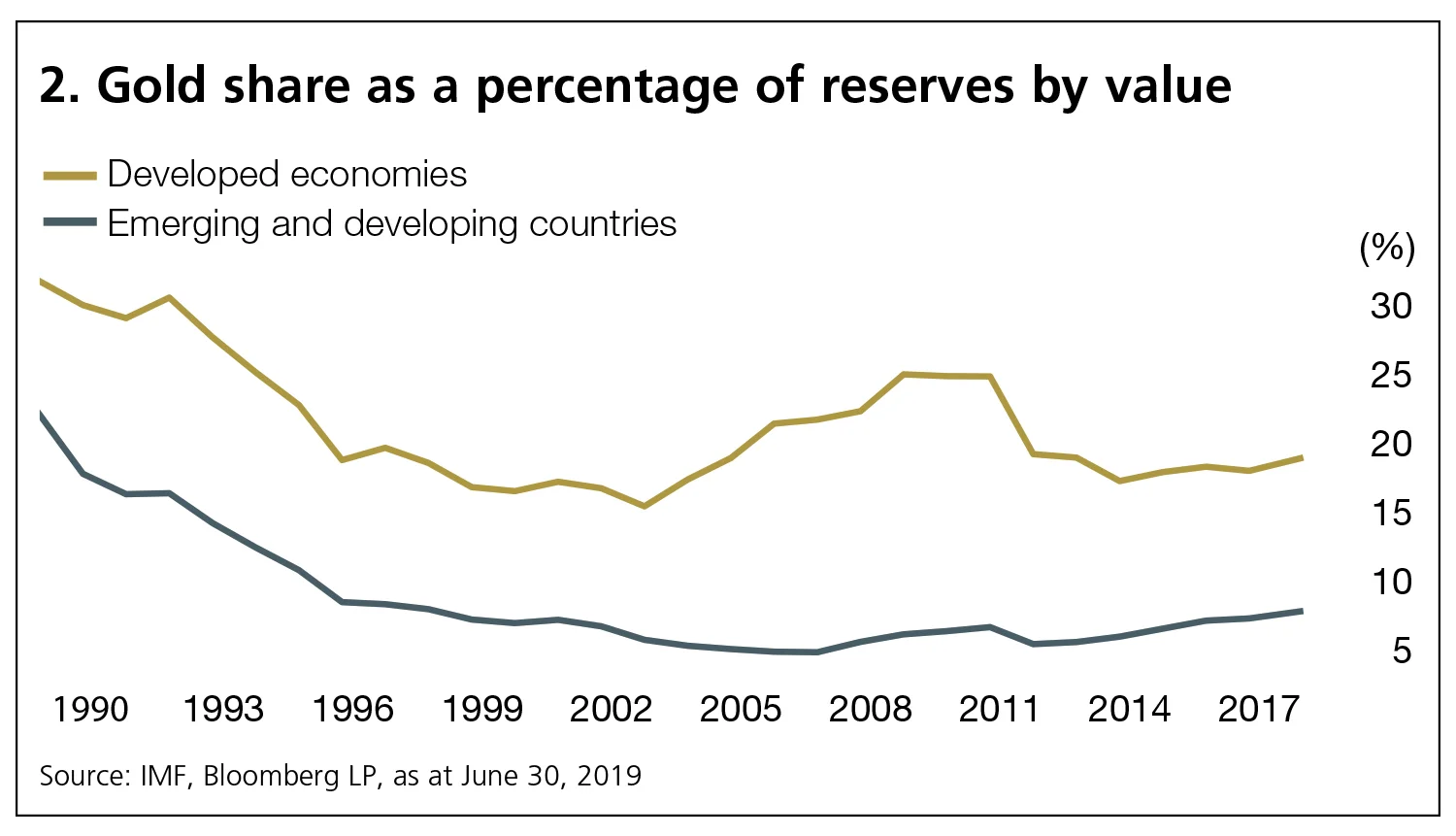

The use of gold in official international reserve portfolios has continued to rise, even after the recent price surge. Most central banks plan to maintain or further increase gold allocations; few plan to cut back. A minority of central banks are more favourably disposed to gold as a result of Covid-19 though, for the majority, the pandemic and lockdowns have not changed their views towards or allocation of gold. Around one-third of respondents to the survey have a specific portfolio weight target for gold. Price sensitivity and valuation concerns are far from common; only one central bank within this survey group expressed direct concern that the gold price was too high (see figures 1 and 2).

The trend towards divesting gold by developed market central banks stopped with the onset of the global financial crisis in 2007–08 followed by the eurozone crisis of 2010–12. Around the same time, emerging market central banks switched from an almost studied indifference, to becoming major gold buyers, led by China, Russia, Turkey and India.

The perceived benefit of diversification

Diversification remains the most important perceived benefit, reflecting the high concentration of US dollar exposure, primarily in US Treasury, mortgage and high-quality corporate debt.

The desire for diversification is expected to continue to propel interest in gold as well as other fiat-currency alternatives to the dollar and Treasuries, including China and the eurozone. However, the greater depth in scale, breadth in terms of assets, and liquidity in terms of free float relative to the outstanding stock all suggest there is no full substitute for the dollar. We would therefore expect continued demand for diversification at the margin, to the extent that central bank reserves continue to increase, but would not expect any large or sharp portfolio rebalancing away from the US dollar as the main reserve currency or US reserve assets.

The increasing allure of gold applies as much to private investors worldwide as it does to official investors, including central banks. The increasing use by private and individual investors of gold exchange-traded funds (ETFs) – as well as paper-certificated and, perhaps to a lesser extent, physical gold – suggests gold’s diversification benefits might be reduced over time, as ownership broadens out.

Furthermore, positive scenarios should also be factored in. When and if growth, inflation or both rise far enough, monetary policy would probably be tightened, and yield curves would normalise through higher yields and a steeper slope. The result could conceivably be losses on both risky and ‘risk-free’ assets – as occurred during the 2013 ‘taper tantrum’ – as market valuations adjust to less loose monetary and financial conditions, higher discount rates due to rising inflation, expectations and higher real yields.

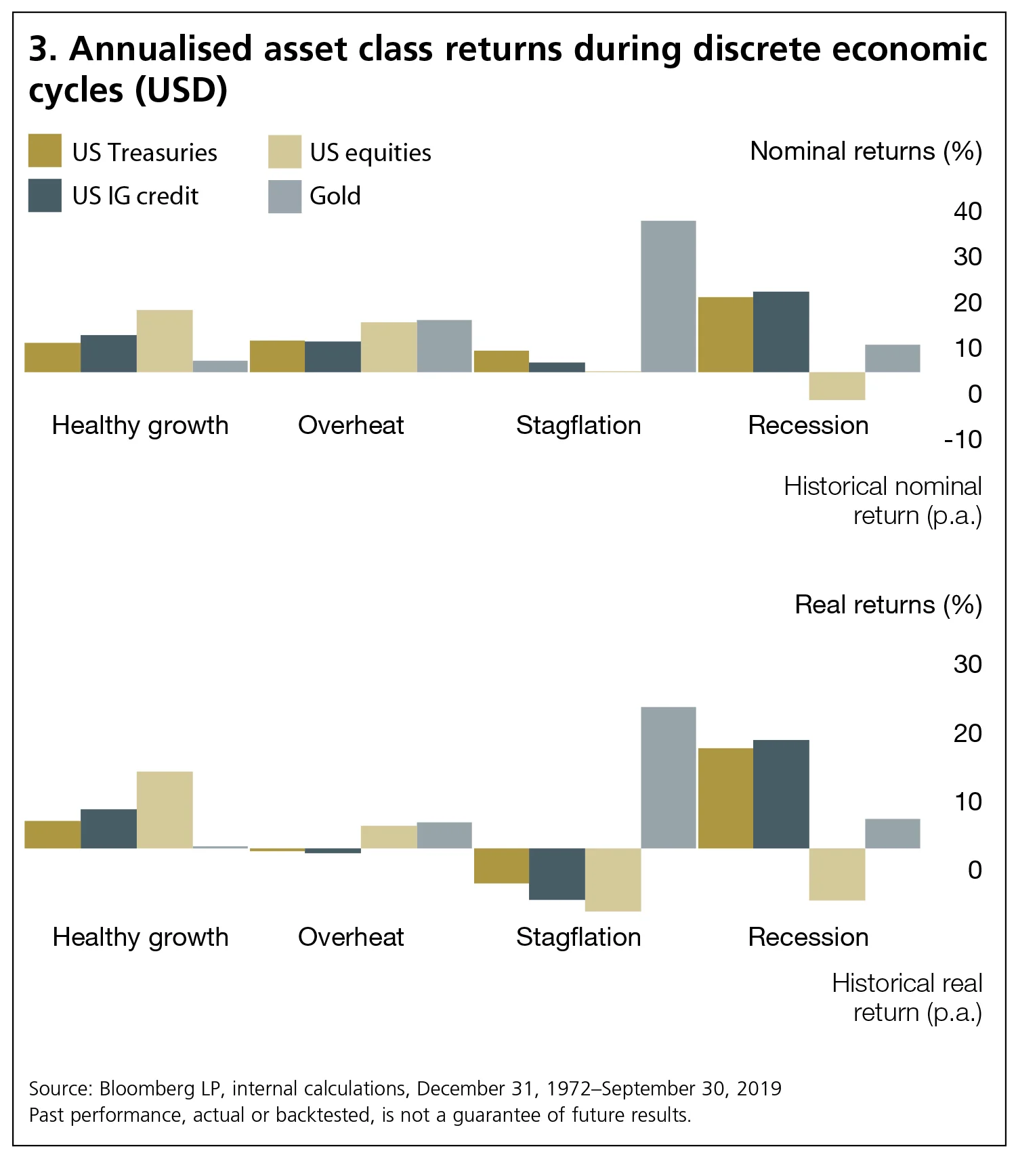

Factors such as these could limit the degree of diversification demand for gold by central banks, though we believe such a highly reflationary or inflationary outcome is unlikely in the foreseeable future. Gold has delivered positive real and nominal returns in all macroeconomic (macro) regimes in the modern era. This performance is expected to sustain private and official investor interest in gold for the foreseeable future, even if it continues to behave more like traditional asset classes with widening ownership. Gold has been relatively volatile with relatively lower returns than other asset classes over longer lookback periods, but we would expect the diversification benefits set out in figure 3 to be more important for central banks.

Uncertainty increases allure

Geopolitical, geo-economic and financial uncertainty all increase the allure of gold even as the opportunity cost of holding gold has fallen. In today’s low-growth/inflation, zero/negative policy rate and low/negative bond-yield world, alternative reserve assets yield much less than before the major financial crises of the past 15 years and the current pandemic. This historically low-interest rate environment means that the cost of holding gold is unprecedentedly low. Financing the cost of storing physical gold has been directly reduced by low interest rates; and the opportunity cost of foregone interest on alternative reserve assets is lower than recorded in modern times. More than 40% of respondents to the survey cited low interest rates as supporting gold allocations.

The combination of uncertainties is expected to support the demand for gold, which has tended to deliver positive returns in every macro regime. The challenges – as significant as in past macro regime changes – extend to domestic macroeconomic challenges, marked by pressures on fiscal policy around redistribution and taxation, as well as monetary policy and central bank independence; geo-economics, marked by barriers in trade, investment, finance and technology; and geopolitics, marked by border disputes, disagreements over territorial waters and freedom of navigation, as well as ideological, legal or constitutional differences.

Covid-19-driven domestic macroeconomic policy challenges arguably threaten both low growth and low inflation, or even deflation, as well as high inflation. In the short term, the severe hit to demand, employment and to household income in many countries precipitated by the Covid-19 pandemic, lockdowns and simultaneous surges in both private and public debt could add up to a classical debt deflation trap, which is being fought by extraordinary monetary loosening. However, many policy-makers, academics and investors are equally concerned about the risk of high inflation and financial repression, given the rapid money creation and unprecedented fiscal support on top of supply shocks created by the lockdowns, as well as supply chain disruptions brought about by rising trade and investment barriers or outright geopolitical tensions.

A third concern about higher taxes on capital, wealth and income generated from assets (as opposed to labour income) also lurks in the mind of the markets and many investors, and needs to be factored in by reserve managers as well as other investors, though it did not figure in this survey. This is because high inflation, especially with financial repression, would be a choice central banks can avoid – after all, central banks have proven much more effective at getting high inflation back down by tightening monetary policy than they have at getting inflation up to target by easing policy, especially at or near the effective lower bound for policy interest rates. Furthermore, central banks have contributed to financial repression in the past.1

Finally, high inflation is highly regressive and hence a source of inequality, affecting those on low incomes that cannot protect themselves against inflation – namely, the same segments of income distribution that have not benefited from the repeated increases in asset prices in the era of ultra-loose monetary policy; and that arguably have been hindered or left behind by globalisation, technological progress and hit hardest by Covid-19 itself, as well the unemployment effects of the lockdowns. Taxes on capital and corporate income are therefore a distinct possibility as a way of helping to balance budgets once economic recovery is well entrenched.

Gold’s historic positive return performance in highly inflationary, disinflationary/deflationary and ‘stagflationary’ (low growth and high inflation) macro regimes suggests these uncertainties will maintain a significant role for gold in both private and official investor portfolios. Equally, the challenges in the international system are likely to continue to spur demand for gold as an international currency and as an asset that is no-one’s liability as a ‘reserve currency without a country’.

Reserve diversification and reserve asset yields

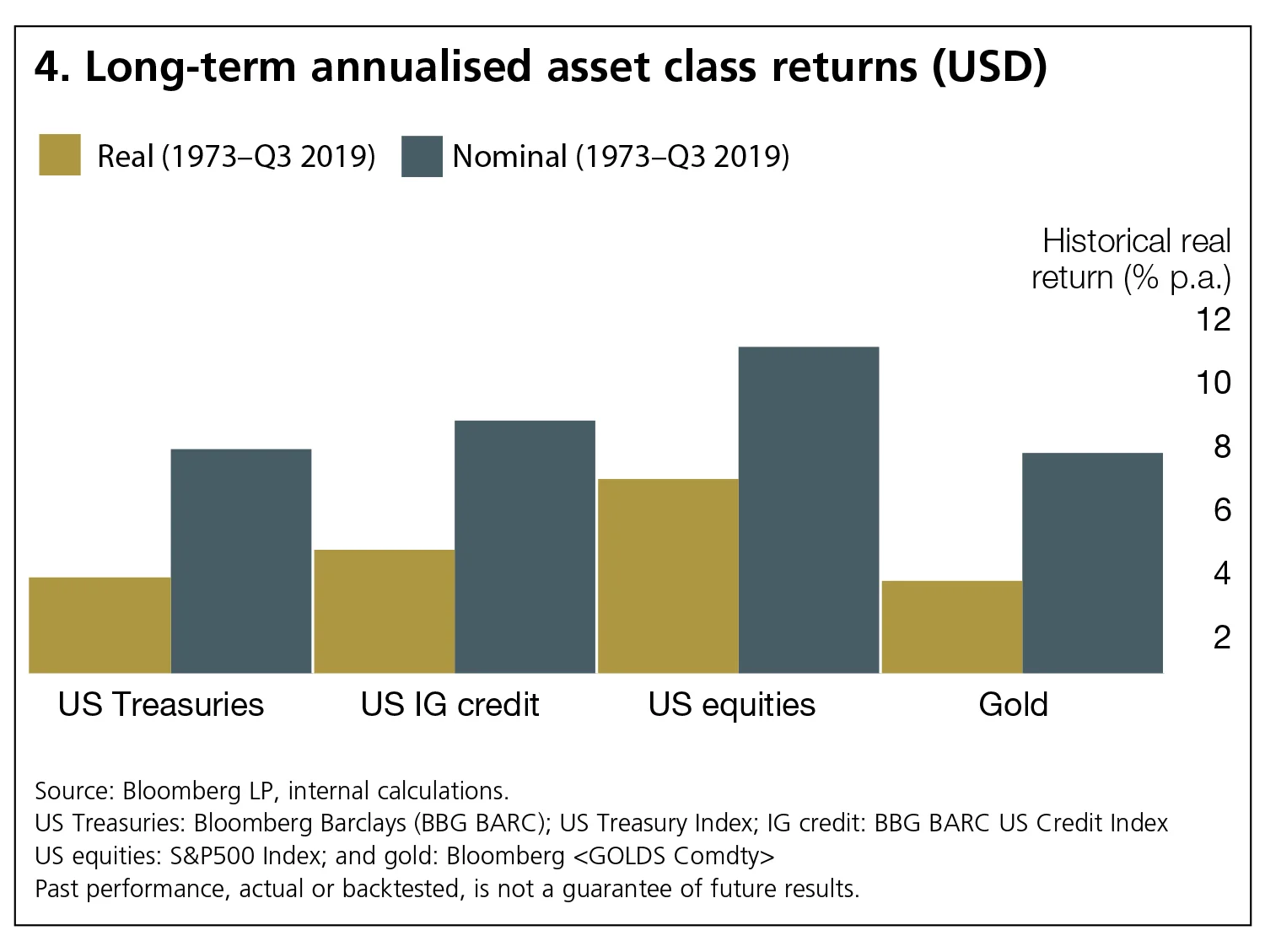

The costs and benefits of reserve diversification and reserve asset yields would seem to be associated with central bank reserve asset profit and loss, and, indirectly, quasi-fiscal costs. The balance between diversification and cost for holding reserves seems to split the reserve manager community by the level of per capita national income. Central banks of countries with high per capita incomes emphasised portfolio risk (and hence a focus on diversification), whereas middle-income countries tended to cite low global interest rates (and, hence, opportunity cost) (see figure 4).

Conclusion

Vehicles for gold transactions and holdings are evolving slowly. The Gold reserves in central banks – 2020 survey corroborates our other findings, and those elsewhere, that:

- Most central banks still prefer to buy and sell gold in the global cash market, rather than using domestic gold or derivatives markets.

- Overseas gold holdings with other central banks remains the preferred holding strategy, used by 80% of respondents. Some central banks have been repatriating physical gold, in some cases because of geopolitical risks, though this is far from commonplace. Indeed, there was unanimity that the court ruling supporting the Bank of England in holding the Central Bank of Venezuela’s gold had no bearing on decisions about where or how to hold their gold.

- Interest in gold ETFs is on the rise, but most central banks remain in an exploratory mode, with many reporting liquidity considerations as an important factor, and some indicating concern about whether a gold ETF was as ‘safe’ as gold itself is perceived to be. We would expect central banks’ use of ETFs to increase over time, not least because fears that ETFs might offer artificial or illusory liquidity in excess of the liquidity of underlying assets. They are widely seen to have been reduced by the relatively smooth operational performance of ETFs during the height of the Covid-19 financial crunch in March 2020 – even as the ‘dash for cash’ led to a short but sharp selloff in reserve assets such as Treasuries, Bunds and gilts. We believe ETFs may also be useful for some central banks as a less politically sensitive way to buy and sell gold, without the direct political symbolism of ‘selling the crown jewels’ or national ‘family silver’ that is sometimes associated with selling gold reserves.

This feature forms part of the Central Banking focus report, Gold for central banking 2020

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Instruments providing exposure to commodities are generally considered to be high risk, which means there is a greater risk of large fluctuations in the value of the instrument.

Important information

This article is for Central Banking only and is not for consumer use.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Issued by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

Notes

1. Financial repression for these purposes consists of indirect taxation of financial wealth and income through regulation or capital controls that hold yields or interest income below inflation for extended periods, as occurred in many western countries after World War II. Financial repression has also been common in many emerging market countries, even after the Bretton Woods era, when exchange rates remained fixed and capital controls were kept in place, unlike most developed countries.

Sponsored content

More from sponsor

Has Covid-19 made gold shine brighter?

The price of gold has skyrocketed this year, but central banks have not flocked to invest as they have done in the past, write Rachael King and Victor Mendez‑Barreira.

Gold reserves in central banks – 2020 survey results

Reserve managers share their views on future gold holdings, target allocations, purchasing and storage approaches, the use of ETFs, and the impact of Covid-19, in the results of a new joint Central Banking-Invesco survey. By Nick Carver and Robert Pringle

Covid-19 to accelerate asset diversification and boost gold

Crisis has accelerated long-term pre-crisis trends stemming from global financial crisis

Diversification makes gold shine brighter – panellists

Negative sovereign yields boost gold’s attractiveness among reserve managers

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com