This article was paid for by a contributing third party.

Time for resilience

Events that impact markets have made it crucial to build resilient portfolios that are aware of downside risks. BlackRock explores the importance of protection in downturn scenarios for reserve managers.

Central banks are constantly adapting their frameworks for foreign exchange reserve management to reflect changing market environments, lessons learned from turbulent episodes and evolving constraints and preferences. Most recently, sustainability considerations have begun to be recognised in central banks’ objective functions. This sustained evolution has made it impossible to set permanent, defined asset classes and static models as the basis for optimal central bank reserve portfolios.

BlackRock believes the fundamental paradigm for optimal reserve management has remained broadly unchanged for years, namely to achieve ‘safety, liquidity and return’. To do this in practice, central bank reserve managers must consciously and deliberately balance volatility and liquidity constraints against realistic income objectives.

This feature explores BlackRock’s latest recommended enhancements to the portfolio construction process – in particular, by taking into account uncertainty around return assumptions and levels of conviction. It also examines how BlackRock’s model reserve portfolios with different preferences along the volatility/liquidity/return trade-off curve – constructed under this modern paradigm – have performed against their objectives. We find that they have performed according to expectations irrespectively through different market environments. We also highlight the role of a handful of asset classes: mortgage-backed securities (MBS), gold and Chinese bonds.

Resilience must be considered from the outset: in BlackRock’s experience, portfolios that forgo some of the upside potential on average to ‘insure’ against downside often lead to more balanced outcomes.

Building resilient reserve portfolios

Uncertainty persists increasingly, both within and outside of financial markets in a late-cycle environment, and navigating such conditions demands greater thoroughness in the investment process. BlackRock believes allowing for more than one way the world can evolve is an important step, yet this is often overlooked in traditional portfolio optimisation methods.

Such methods have been overreliant on point estimates for returns; point estimates assume unrealistic accuracy and fail to capture varying convictions – especially when used in a mean-variance framework. This is akin to having one foot in boiling water and the other in freezing water and feeling fine ‘on average’. In practice, there is inherent uncertainty around forward-looking estimates that is better captured as a range of possible outcomes around a central estimate. Investors’ convictions in return expectations also vary through time and across assets. BlackRock’s aim is to quantify varying levels of confidence in its forecasts to understand the size of the range of outcomes. This is challenging, as the true underlying expected returns are not directly observable; however, it is very important for building optimal portfolios. By producing forecasts that have a range of outcomes, reserve managers should be able to better incorporate this uncertainty. The size of the range around each asset class can be tailored to represent the level of conviction and skill in one’s forecasting ability.

The problem of point forecasts propagates when they are used in a mean-variance optimisation to identify a portfolio that maximises expected return relative to risk. The resulting portfolio is optimal in terms of risk-adjusted return, but only in the specific market scenario described by that specific set of point forecasts. In other words, only when those capital market assumptions are realised – or future returns are known – might the portfolio be truly optimal. In a scenario that is even marginally different, the prescribed portfolio could be wildly different.

To create more relevant solutions, reserve managers should seek approaches that defend against these common pitfalls. Building uncertainty aversion into the portfolio construction process is perhaps the most important tenet for improvement.

In this exercise, BlackRock also considers alternative risk measures particularly relevant to the central bank reserve management community, including capital value-at-risk (VaR) measures and one‑year maximum portfolio drawdowns. While these are superior to mean variance approaches and more aligned with the objectives of official institutions, they still rely on point estimates. BlackRock’s latest framework looks to capture specific reserve portfolio objectives into the optimisation process directly, utilising the entire return forecast distribution, instead of point forecasts and incorporating a resilient portfolio construction algorithm.

Historical performance

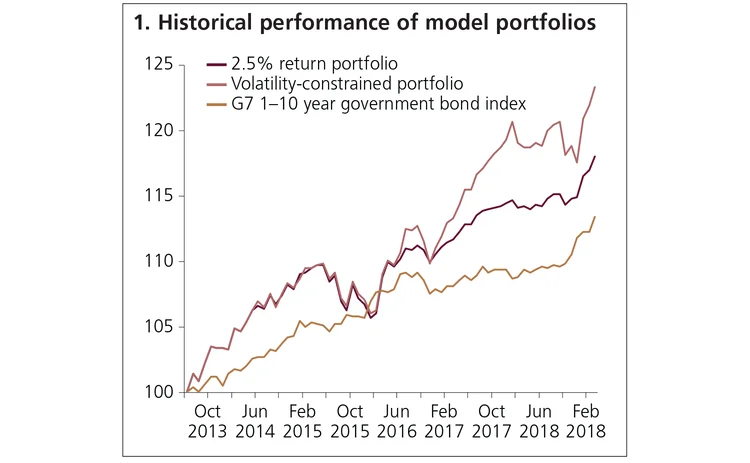

Many challenges arose for investors in 2018 across the investment universe. A market rebound in early 2019 in ‘Goldilocks’ conditions has helped risk assets claw back most of last year’s losses. This volatility is evident in the performance of the model portfolios (see figure 1).

That said, BlackRock’s volatility-constrained portfolio continued to outperform the government bond reference benchmark throughout these market movements. In fact, performance over the year to the end of March 2019 has exceeded the benchmark by 0.2%. The 2.5% target return portfolio slightly underperformed by 0.3%, but over a multiyear horizon, has beaten the benchmark by 0.7% on an annualised basis.

2019 model portfolios

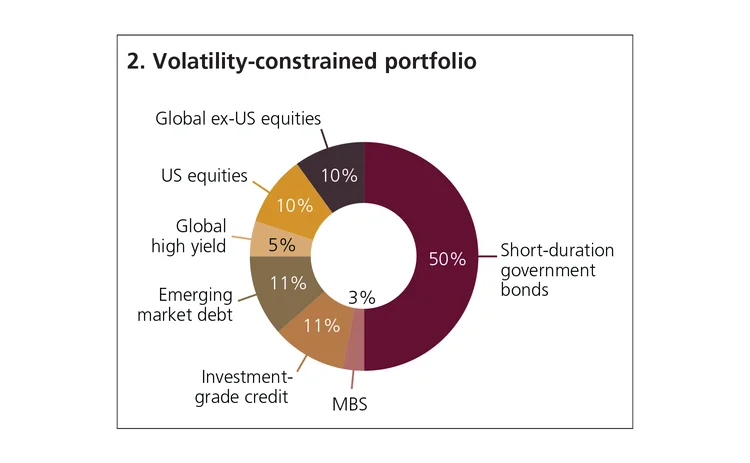

Consistent with BlackRock’s exercises in past years, this year the team continues to model two portfolios with 50% liquidity floors – one targets a 2.5% return and the other looks to maximise return with a volatility constraint of 4.6%. If the target is defined as achieving 2.5% return in the investment horizon immediately ahead, this can be achieved by owning cash equivalents. However, for a higher, risk-adjusted return, the volatility-constrained model portfolio should be considered.

The portfolio depicted in figure 2 represents BlackRock’s strategic asset allocation for the volatility-constrained portfolio for 2019. This portfolio has been created with an explicit focus on building resilience – with expected one-year maximum drawdown of 1.6%, compared to 0.8% for the G7 reference benchmark. While the maximum drawdown is higher than the benchmark, this is a measured and necessary increase for an opportunity to achieve higher returns. It is worth noting that the portfolio risk is reduced to 4.2%, compared to the 4.6% volatility cap imposed. Looking at risk through drawdown and conditional VaR are better aligned with reserve manager objectives.

Renminbi

The increased adoption of renminbi as a reserve currency by central banks globally is attributable primarily to China’s efforts to internationalise its currency and open up its capital account. These efforts received a boost from the International Monetary Fund (IMF) when renminbi was added to its special drawing rights basket in 2016, granting renminbi de facto reserve currency status.

According to model-based estimates by IMF researchers, the renminbi’s share in foreign exchange reserves of developing countries (excluding China) could eventually reach as high as 35%, from just under 2% across the board today.

From BlackRock’s perspective, renminbi’s appeal as an investment asset for reserve portfolio is likely to grow. As the third-largest bond market with $12 trillion – and growing rapidly – China’s onshore bond market has less than 3% foreign ownership. China government bonds and policy financial bonds have now joined the Bloomberg Barclays Global Aggregate Bond Index and will have an increasing weight. These inclusions are part of a broader trend for Chinese onshore markets to be integrated into global capital markets in the coming years. BlackRock’s simulations, using data from HSBC, show passive flows alone could total nearly $300 billion across the Bloomberg Barclays Global Aggregate Bond Index, JP Morgan’s Emerging Markets Government Bond Index and various World Government Bond Indexes. The inclusion of onshore bonds to major bond indexes is poised to rapidly change the structure of global bond indexes. The steady removal of investment restrictions and opening of the domestic market to foreign investors – along with increased liquidity that can be expected – will change the portfolio allocation for many, including reserve managers.

The portfolio this year continues to make important allocations beyond traditional reserve portfolio asset classes. Allocating to assets such as equities, emerging market debt and credit offers diversification benefits as well as higher potential returns. The expected return of the portfolio is 4.0% in average market conditions, and 2.6% conditional on being in the bottom half of all possible outcomes, using BlackRock’s Capital Market Assumptions. Comparing these metrics against the expected outcomes for the G7 reference benchmark, BlackRock forecasts the volatility-constrained model portfolio should outperform the benchmark by 1.5% in normal market conditions, and by 1% in the bottom half of all outcomes. By being explicitly concerned about the downside in the portfolio construction process, reserve managers can better manage against the shocks and concerns relevant to reserve portfolios.

Of course, there are factors that inform the decision-making process of central bank reserve managers other than investment returns and market risks – which themselves are multifaceted. This feature explores examples where some risks could be more tolerable while others are avoided at all costs.

Mortgage-backed securities and credit

The asset class of agency mortgage-backed securities (MBS) has traditionally been favoured by central banks, owing to its high credit quality and liquidity profile, as well as its deep market and return diversification features. This said, observations about MBS in our model portfolios show different tendencies. We conducted some additional analytics to investigate why.

While agency MBS has negligible credit risk and offers the potential for yield pick-up, the latter is not possible without some risk. Agency MBS have prepayment risks, which may provide some diversification benefits to a portfolio dominated by any combination of duration, credit and economic risk. However, the similar volatility profile to the short duration bonds already held within the volatility constrained model portfolio appears to crowd out the preference for MBS. On the other hand, looser definitions of what constitutes ‘liquidity requirements’ in the model portfolio resulted in a reduced allocation towards short-term Treasuries in favour of agency MBS.

BlackRock believes agency MBS exhibit strong merits for reserve portfolios – especially when taking into account the prioritisation of risks in reserve managers’ decision-making processes not captured by the modelling exercise. For example, central banks typically ascribe a lower reputational risk to losing money on AAA rated securities than losing the same amount of money on, for example, credit or equities. BlackRock’s model portfolio allocates 3% minimum to the asset class.

Yield-enhancing diversification is also the main rationale behind central banks owning credit. Interestingly, an important recent trend in reserve manager credit exposures is to employ index approaches across a broader credit-quality spectrum rather than individual names above higher credit rating minimums. Indexes provide less name concentration and greater yield potential than, for example, restricting to A rated minimum credits.

From BlackRock’s experience working with more than 80 official institutions on bespoke asset, risk management and advisory assignments, the majority of institutions have a clear hierarchy of risks to avoid – with risk from default often top of the list. As central banks diversify their reserves away from government bonds, the possibility of default or large equity drawdowns is especially unpopular, particularly considering associated reputational concerns. To quote one reserve manager: “For legitimate reputational reasons, central banks can be highly sensitive to credit risk incurred in reserve portfolios – well beyond the financial loss that may result.”

Gold

For largely historical reasons, most central banks have an allocation to gold. According to research by the World Gold Council, gold now accounts for around 10% of total reserves globally, at nearly 34,000 tonnes and counting. This figure is much higher than most optimisation models would suggest. In BlackRock’s portfolio optimisation exercises where combinations are largely driven by the models’ preferences between risk measures – such as volatility – and return, gold typically does not feature prominently. BlackRock’s 2013 paper1 explored the concept of ‘safety’ and referenced six separate risk categories highlighted in an International Monetary Fund global financial stability report. While we observed that gold would perform relatively well against specified credit, inflationary and idiosyncratic risks, it performed less well for liquidity, market and currency risks (versus the US dollar). The exercise was repeated, setting a constraint of at least 5% allocation to gold. Unsurprisingly, it was found that portfolios could generate a higher expected return at similar Sharpe ratios without gold.

Central banks invest in gold for different reasons. Reserve asset allocation decisions are often based on rationales beyond what can be reasonably modelled mathematically. As such, BlackRock excludes gold from its optimisation universe in this exercise.

1. Peter Fisher and Terrence Keeley, In search of a new official investment paradigm: Rethinking safety, liquidity and return, June 2013

Conclusion

Since 2013, BlackRock has constructed annual model portfolios using the same paradigm. The firm has created combinations of reserve assets that deliberately balance risk and income objectives, with two specific constraints: liquidity floors and volatility ceilings. The experience was gratifying – BlackRock’s minimum 2.5% yield portfolio and higher return/volatility portfolio both performed exactly as anticipated. They did so across varying market regimes and credit, rate and risk cycles, demonstrating how specific goals involving safety, liquidity and return could be practically sought and achieved.

But optimal portfolio exercises always involve some evaluation of plausible return expectations for a range of viable asset classes. Today, headlines remind the world of events that could materially impact markets – including climate risk, recession fears, geopolitical tensions and uncertain trade outcomes. As such, it is more important than ever to build portfolios that are aware of downside risks and are resilient in more variable market regimes. Resilience means sacrificing some excess return on average in exchange for protection in downturn scenarios. However, excess return is a price worth paying – especially for reserve managers.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com